Use the Cash Envelope System & Find Success

Inside: Learn everything on how to start a cash envelope system. This envelope method of budgeting is simple to manage money. Use the helpful cash envelope categories list.

The cash envelope system can be a game changer for anyone struggling with money.

It is the best way to only spend what you can actually afford. IN CASH!

For many people, they can’t imagine ever spending money any other way than using the cash envelope system.

While it is a game changer, you must learn how to use the cash envelope system correctly. If not, you are in the same game as before. It won’t be able to work properly and you won’t see the greatest benefits of using cash.

Moving over to a cash envelope system is the simplest tool to start budgeting. Over time, it will help you to stop living paycheck to paycheck and start saving more money.

Don’t worry… we are going to cover how do you start the cash envelope system. It will be explained in detail throughout this post.

Like the idea, but don’t use cash? Learn how to do this with the cashless envelope system as well.

What is the Cash Envelope System?

Let’s explain this method of using cash envelopes for budgeting.

The method of cash has been around for a really long time (remember credit cards, debit cards, and even checks are relatively a new concept). It is how money has been handled for thousands of years.

It is the most basic, simplest, and rudimentary way of managing money.

Because of how the online world of managing money, it is harder for us to grasp using the cash envelope method. There are so many questions on how to budget with cash in our digital society.

The bottom line… It is possible to budget using cash envelopes. In addition, it helps with breaking many bad spending habits, overcoming debt, and starting your path to financial freedom.

Even if you don’t use a money management system binder, I highly recommend having all of your bills, budget, and notes in one place. Learn how to organize your personal finances.

However, the cash envelope method has been made famous by Dave Ramsey. He has helped many people overcome their debt and start living below their means. For that, he gets a high five!

Why Does the Cash Envelope System Work?

The cash envelope system is a great way to jump into budgeting for the first time. You get to see how and where you are physically spending your money. Online transactions are harder to track and more difficult to feel the pain of spending money.

The main goal (regardless of how you manage money) is to spend less than you bring in. That is the primary advantage of using cash envelopes.

Other benefits of the cash envelope method include:

- Actually see in real cash your spending habits.

- Difficult to overspend.

- Provides discipline.

- Accountability system.

- Keeps you on track.

By using this type of system, you can reach your money goals faster and see real progress sooner.

You don’t need anything fancy to start. It doesn’t take money upfront to begin. You can start right now.

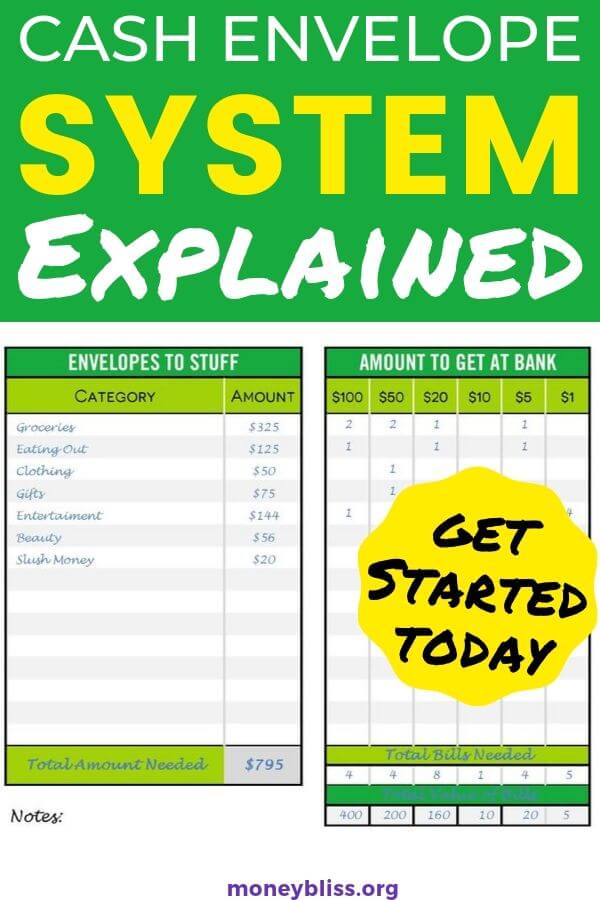

Cash Envelope System Categories

These are the main cash envelope categories that you need to use cash for:

- Groceries

- Eating Out

- Clothing

- Gas

- Gifts

- Entertainment

- Haircuts / Beauty / Personal Care

- Pocket Money or Slush Money

Obviously, this is a completely personal preference. Some people use way more cash envelopes. Others a few minimal categories. The choice is thoroughly yours. And you will probably adapt your categories over time.

The key is to label your cash envelopes appropriately.

Find a full list of personal budget categories.

How does the Cash Envelope System Works?

When using cash envelopes, the process you follow is similar to learning how to budget money. The main difference is you are actively putting cash into envelopes to start rather than categorization your transactions at a later date.

The envelope system really does work!

1. Make A Budget

The first step of budgeting is to make a budget.

You need to decide in advance how you plan to spend the money coming in.

The key to being successful is to budget in the same period that you get paid. If you are paid bi-weekly, then you budget bi-weekly. If you are paid monthly, then budget monthly. Budget monthly or budget each paycheck if you are paid twice a month.

That just helps to make the whole system easier to understand, which in turn will help you be successful.

2. Leave Money for Fixed Expenses

Not everything today can be paid for using cash. Many of these transactions are done online.

For any fixed expenses that are reoccurring and the same amount each month, then leave the money in your bank account. There is no need to pull those fixed expenses out and put them in cash envelopes. Some examples include mortgages, insurance, utility bills, etc.

To make sure bills are always paid on time, download our free bill payment organizer to keep you on track.

3. Fill Cash Envelopes

This is where the magic happens. Head to the bank to fill your cash envelopes and label each of them properly.

For instance, if you get paid twice a month, then you would put half of your money into the cash envelopes at each pay period. A budget binder with envelopes is helpful.

What cash envelopes to use?

The choice is completely yours. You can pick up envelopes at the dollar store. You can make your own DIY cash envelopes using a template. Another option is to purchase laminated cash envelopes. Or even upgrade to a cash envelope wallet. Cash envelopes are a very personal item and everyone prefers something different. For me, I prefer laminated cash envelopes because of their durability.

What about my rent or house payment?

This is a very good question to be successful. During the month, you may have a larger sum that you need to pay with the first paycheck. Then, fill cash envelopes for certain categories with the second paycheck.

4. Use Your Cash Wisely

This is where the cash envelope system will make it or break it. This is the hardest part and typically the time when most people give up.

Your success lies in how your spend your cash throughout the month.

In this guide, I have provided step-by-step instructions, tips along the way, and obstacles you will have to overcome. But, in the end, it is up to you.

- You have to make the decisions on how you want to spend your money.

- I have been asked time and time again to just give someone the exactly money they need to spend right then and there and not have access to the rest of their money. That isn’t possible.

- You have to be stronger and take control of your money.

Learn how much cash should I have on hand.

By actively managing your personal finances, you can change your direction forever by using cash wisely.

This is the hardest step of budgeting – sticking to your plan.

5. End of the Month

What can I do with leftover cash from cash envelopes?

If you have money leftover at the end of the month, that is awesome! You should be very proud of yourself for not overspending money.

However, you need to make sure you put that money to work.

Options for Leftover Money:

- Rollover remaining cash to the next month.

- Put the cash into an emergency fund.

- Take the leftover cash and put it towards your debt to help pay it off faster.

- Readjust your budget amounts if needed.

The best place to put any leftover money is heavily dependent on where you stand in the Money Bliss Steps to Financial Freedom.

Each person is on their own journey. Where you are today will not be where you are tomorrow if you continue sticking around Money Bliss.

So, figure out what step you are on today and that is where you need to focus your financial goals and any leftover money.

Overcome Hurdles of the Cash Envelope System Problems

These aren’t necessary downfalls or a reason not to use the cash envelope system. These are obstacles that you must know about so you can overcome them and be successful!

1. Changing Money in Envelopes

This is way to common and needs to be stopped regardless of what budgeting method you use!

This is overspending at its finest moment.

Resist the temptation to move money from another envelope to cover your wants in the moment.

If there is no money left in the envelope, then you can’t go or need to put something back. You went through the process of how to make a budget, so stick to it.

Don’t move money from one envelope category to another.

2. Paying Bills Online

Obviously, the cash envelope works for when you pay for everything in cash and in person. This isn’t how our world works and many of the transactions take place online.

The key it still subtracting your online purchases from your cash envelope.

For instance, you buy $35 of clothes online and pay with your card. Then, you must physically deduct $35 from your clothing envelope and put in back into your checking account. To make it simpler, you can have one envelope dedicated to this purpose and deposit the money on a recurring basis.

If this is a recurring bill, then don’t put that money in your cash envelope. Leave it in your bank account and note it as a category expense. You can use our cash envelope tracker for this purpose.

3. Running Out of Money

Looking to find an empty envelope is never fun. You need to get creative on how to handle this situation.

Don’t be tempted to move money from another envelope.

If you notice a cash envelope getting low, then you need to go on a spending freeze or stretch the remaining money left.

For instance, if your grocery money is empty, then do everything you can to stretch the food you have remaining out home. Look into the freezer or pantry to figure out what to make. It is easy to google or go on Pinterest and put your two random ingredients with recipe. You might end up with a family favorite.

The primary purpose of the cash envelope system is for you to stick to your budget, manage your money, and not overspend money.

4. Cash Isn’t Going to Change your Spending Habits

Pure and honest truth here… cash will not change your spending habits. They will just become more obvious when staring into an empty envelope.

Sticking to a budget can be a challenge. I will admit that. But, the benefits of a budget heavily outweigh any negatives.

If you have a low income or living on a budget is hard with all of your debt payments, finding a budget that works for your situation will be tricky (yet, not impossible). Then, the next obstacle is staying on budget each month.

A spending freeze is always helpful to help overcome spending habits. Maybe look at a simpler life or a frugal lifestyle.

5. Weaknesses Exposed

This is where the rubber meets the pavement. When using cash, it will quickly expose your weaknesses (aka overspending).

This will only be an obstacle if you don’t deal with your weaknesses. Once you get to the root cause of your weaknesses, then you can overcome them and be vigilant of them if they creep back into your life.

And to be completely honest, this is the hardest area to deal with in budgeting. Just like when decluttering the home, the personal keepsakes are the hardest to deal with. For both situation, emotions are strong and helping to guide your decisions – both good and bad.

Deal with your weaknesses in order to avoid money mistakes that can snowball to an uncontrollable point.

6. Multiple People Needing Access

This is a tough area for many households Maybe one partner isn’t on board with using cash. Maybe dividing up the cash is proving to be difficult.

Just like with anything, this to can be overcome. You need to find a system to work for you and this will need to refined overtime.

Two Options:

- Each party takes money out of the joint category envelope before they leave the house.

- You divide up your cash into your own cash envelopes for each category.

The first option is the simplest one, but it takes the most planning and thinking ahead of time. You must know that you need money to get gas or go out to lunch. Also, you need to make sure that any leftover cash makes it back into that envelope when you get back home.

The second option provides more flexibility, but takes time to figure out how much each party needs. Another benefit is one person’s envelope may be empty, but the other person hasn’t touched theirs yet. So, still money to get groceries for the month.

For example, you both need gas money. So, you each get gas money for your own envelope. Do you divide it 50-50? Or does one person drive more than the other, so they get a greater percentage? This is something the needs to be refined over time.

Ready to Start Budgeting with the Cash Envelope System

The advantages of the cash envelope system are great!

Many, many people use the cash envelope system and refuse to use any other method for managing their money.

It is an awesome way to get your spending under control and learn how to budget.

Just like with anything, it takes time to get a handle on how the cash envelope system will work for you and in your household. Don’t give up after the first mistake. Keep going. You can overcome this.

It takes time to develop new habits and in the case, your new habits can get you out of debt and on your path to financial freedom.

Find the best cash envelopes or the best cash envelope wallets for you!

Now, are you guilty of any of these money mistakes?

Like the idea, but don’t use cash? Learn how to do this with the cashless envelope system as well.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.