110+ Personal Budget Categories for a Fail-Proof Budget

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

The success of any budget lies in planning the personal expenses.

While that may seem simple…

It’s can be…

But then, that is when most people give up on a budget.

Most people gave up on a budget because they forget about certain expenses and didn’t know what to do next. Early on in my budgeting life, I struggled a lot. So, don’t fret if that is you too!

Figuring out how your spending correlates to various budget categories can drive some people bonkers while others thrive with the complexity and details.

This list of all the personal finance categories shouldn’t be overwhelming at all.

It is a guide on what could possible be needed in your budget.

There are too many advantages of budgeting not to find a budget to work for you.

Unexpected expenses pop up not because they were unexpected, but those expenses weren’t planned for in the budget categories.

List everything one by one…Just to make sure you have covered everything.

Setting Up a Budget for the First Time

When setting up a budget for the first time, the task can seem daunting.

Think back to being a kid… did you jump on that bike and take off like a pro? More than likely, probably not. It took some practice. A few falls. Getting back on the bike and trying again. Patience when all of the neighborhood kids are spinning past you (and fast too). It took practice to get in your groove of riding a bike. This can be correlated to your budget.

Just like riding a bike for the first time, creating a budget for the first time will take patience, time, and practice.

It won’t work the first time. Guaranteed. There will be tweaks and changes until it works for you like a well-oiled machine.

The key for success is making a budget and learning to stick to it as well.

Must Reads on Creating a Budget:

- How to Budget Money and Still Enjoy Life

- 9 Surprising Advantages of Budgeting your Money

- How to Make a Budget in 7 Simple Steps

- The Best Methods of Budgeting You Need to Know

- Do You Know the Ideal Household Budget Percentages?

- Full List of Budgeting Apps on the Market

110+ Personal Budget Categories

What categories should I include in a budget?

The reason the list is exhaustively long is simple. Everyone’s life is different. We all prioritize spending, saving, and giving differently. So, there needs to be a lot of personal budget categories to fit your needs and wants.

To make the process simpler, we are going to break down all of the budget line items into the big categories. Then, it becomes more helpful to make sure all of the expenses in that particular area are cover. Easier to start making a budget that will work for you.

Therefore, all of the budget categories are laid out in bigger categories and then, broken down into smaller line items.

As always, I recommend to figure out your give and save categories first. Then, budget the basic needs. The rest is fun spending (AKA discretionary spending) unless you are trying to get out of debt.

Here is the personal budget categories list to get you off on the right track.

In case you are interested, please refer to the average vs ideal household budget percentages.

Income

Too often, income is not considered as a personal budget category. Yet, it is truly important!

The types of income are needed to base any type of budget from.

- Salary or Wages

- Salary or Wages (spouse)

- Social Security

- Pension / Retirement

- Investment Income / Dividends

- Alimony / Child Support

- Real Estate Rental Income

- Side Hustle Moola

With income and budgeting, rely on what is actually guaranteed and true actual money received. If you have an hourly wage or variable income, stick with your worst case scenario.

It is better to budget for the necessities and leave the extra for fun spending!

Just a Quick Note on Child Support and Alimony – Don’t rely on those as sources of income unless there is a solid (1 year +) of receiving the money. While in a perfect world, those payments would be timely. That is not always the case. Instead, earmark certain categories in your budget that will be funded when child support or alimony is received.

Giving

Money that is set aside to bless others.

Your give money can take many forms… traditional donations, supplying a teacher with their Amazon wish list (#clearthelists), buying the person behind you their order, helping a neighbor… Truly, the list can go on and on.

Another one of my favorite ways to give is through Kiva. Starting out as a small business is tough let alone trying in a developing country without the same resources. These are “loans” and you can lend as little as $25 to create opportunity for people around the world.

Giving Categories

- Charitable Donations

- Bless Others Money

- Give Back Program

It is okay to be generous with your money. Plus there is joy in giving!

Savings

Savings is the make it or break it for any financial plan. Don’t think of saving as money unable to use.

The key is money unable to use NOW that will LATER be utilized in a greater capacity.

You aren’t withholding money from yourself. You are just temporarily setting it aside. Plus this is the #1 way to stay debt free!

Important Savings Budget Categories:

- Emergency Fund – Learn how to start one ASAP

- Retirement Savings – what happens if you don’t have enough saved for retirement

- Health Savings Account / Medical Deductible Fund

- Car Replacement Fund

- Home Fund (down payment or pay off mortgage)

- Vacation Fund

- Rainy Day Fund – Learn why you need 3-6 months of expenses

- Bucket List Adventure Fund

- College Fund – Should parents pay for college?

- Steps to Financial Freedom Goals #1-6 – Do you know the Money Bliss Steps to Financial Freedom

When making a budget categories list, I always prefer to list saving accounts first.

They should take first priority in any budget especially if you want less stress around money.

How Much to Save: It depends on your current financial situation. The goal is to increase your savings percentage each year. Starting out saving 20% of your income is key and will open up opportunities.

If you are unable to save 20%, then at least start with 2% and keep increasing from there.

Helpful Save Money Resources:

Debt

Ugh! The dreaded word… DEBT!

Personally, we call it the cash flow killer. You can’t get anywhere with your cash flow when debt payments are holding you back.

However, it is important to list out any debt as part of budget categories. If you are in debt, I highly recommend jumping over to our DEBT section and figure out how to get out of debt.

- Car Payment #1

- Car Payment #2

- Credit Cards #1-5

- Student Loan #1

- Student Loan #2

- Boat or RV Loan

- Medical Debt

- Money Borrowed from friends or family

- Other Debt

If you are overwhelmed in our free resource library, you can download the debt worksheets to help you start sorting all of your debt out.

True Impact of Debt… Your debt is holding you back from enjoying life. The key is to get out of debt fast and make it just a season (not a lifelong issue). The interest paid is keeping you from that vacation or changing jobs.

Get Out of Debt Resources:

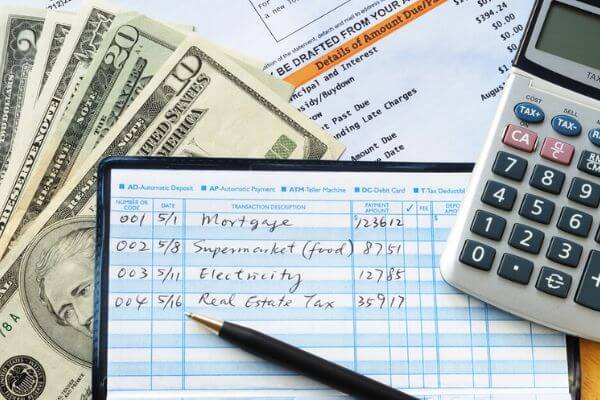

Housing

Housing accounts for the biggest percentage of most people’s budget. For good reason, shelter is a primary need. Just make sure your housing costs are what you can truly afford – not what the lenders approved you for.

Many of these housing costs are fixed for the longer term.

- Mortgage / Rent

- Property Taxes

- Home / Renter’s Insurance

- House Maintenance

- Home Improvements

- HOA

- House Services (House Cleaner, Gardener, Etc)

- Home Warranty

- Other Housing

Utilities

Personally, I like to list out utilities separate from housing because even when the house mortgage is eliminated, you still will be paying the same amount in utilities.

Also, utility costs tend to vary month to month.

- Gas & Electric

- Water

- Sewer

- Trash

- Cable

- Cell Phone

- Internet

- Other Utility

Food

Food expenses can make or break your personal budget.

Some people prefer to lump everything into one big category. However, it is necessary to break out spending at restaurants or take out. Then, you can adjust how and where you eat if you need to save money.

Your food budget is one of the easiest areas to decrease spending in.

- Groceries

- Meal Planning Services (start a free trial)

- Grocery Delivery

- Take Out / Restaurants

- Libations

Tips to Drastically Lower Your Grocery Budget:

Clothing

Typically, the clothing item would be for the basic necessities. However, you can still be fashionable when buying clothes on a budget. If clothes spending is a contentious area of discussions, then use slush money to cover the overspending someone may not agree on.

The reason children’s clothing is lined out separately is for two reasons. First, their costs for clothing will increase as they grow from babies to teenagers. Secondly, this is a budget category that only lasts for 18-19 years!

- Adult’s Clothing

- Children’s Clothing

- Dry Cleaning

Auto

The need for some sort of transportation is necessary. High five if you live in a community where walking, biking, and light rail are mainstream modes of transportation!

For these personal budget categories, a car loan or lease is NOT a budget category. Period. It is a debt. You owe money to the bank plus interest. So, list it out with your debts.

- Auto Fuel

- Insurance – are you getting the best rate?

- Registration

- Service / Repairs

- Commuting (Parking, Tolls)

- Uber/Lyft Money

- Other Auto Related Cost

What About My Car Loan: Your car loan is debt and needs to be treated as debt. You can save up for a car replacement fund and avoid making interest payments for the next 7 years. Owning a car that is paid in cash is an awesome feeling.

Related reading: Is a Car an Asset or Liability?

Medical

The cost of medical keeps increasing each year. Insurance companies are covering less and less. So, make sure you have a medical insurance plan.

Even if you are healthy and rarely go to the doctor… until that unexpected thing comes up.

- Health Insurance

- Medical Co-pays

- Medications – Out of Pocket

- Dentist

- Vision

Key Note… In the Money Bliss Steps to Financial Freedom, we list having your own savings account to cover any medical related expenses. This is a fantastic savings account to have. If you can get a Health Savings Account (HSA) with your health insurance, that is your best long-term investment strategy. If not, a basic online savings account will suffice.

Insurance

The primary purpose of insurance is to cover a total or partial loss while paying a smaller monthly premium.

In today’s society, many types of insurances are necessary to survive a possible financial hit.

It is hard to pay monthly premiums, but until you are able to self-insure then it is a necessity (and that is something 98% of people can’t do anyway).

- Life Insurance – get a free quote

- Long Term Care

- Umbrella Policy

- Disability Insurance

- Identity Theft

Note on Home & Auto Insurances: For homeowner, renter’s and auto insurance, all of those premiums are listed in their associated categories of home and auto, respectively. If you own one of these assets, then you would have to probably insure them. If you don’t, then you costs related to those categories are much lower.

To save money on your home and auto insurance, you can raise your deductibles to save some money if you have a fully funded emergency fund.

Education

Education is important.

This is a budgeting category than can change the outlook on your overall personal finance picture.

Learning is growing and you should never stop learning.

- Adult Life Long Learning

- Kid’s Tuition / Child Care

- School Supplies

- Books & Magazines

- Career Advancement

- College Tuition

The College Debate: One of the hottest debates is whether college is the right path for each student. In today’s society, the typical ways of learning are being shifted. So, is paying for college truly worth it. Read the answer here.

Personal Expenses

This is the hardest area to categorize many personal budget categories. But, we broke it down for you.

- Personal Care Products

- Haircuts

- Massages

- Manicure / Pedicure

- Slush Money

- Kid’s Money

Many of these personal expenses are considered FUN spending.

Lifestyle Luxuries

We have more than 90% of the world. And that materialistic stuff comes with a hefty price tag.

- Replace Furniture

- Subscription & Dues

- Computer / Laptop

- Electronics

Baby Supplies

Babies are expensive and they come with a lot of gear.

There is no need to break down baby supplies any further because the baby phase is short (even though it doesn’t seem like it when you are in the thick of it)!

- Baby Supplies

Pet Supplies

The cost of a pet can be startling especially when you first get a new pet.

- Food

- Medications

- Vet Visits

- Pet Necessities (leashes, beds, crates)

- Pet Toys

- Animal Sitting or Boarding

- Pet Walking

- Pet Insurance

It is highly recommended to have a separate sinking fund just for unknown pet expenses. A single bee sting can set you back a couple hundred dollars. #truestory

Gifts

Too many times, gifts pop up as unexpected expenses (even though the date of the holiday hasn’t changed from the year before).

Also, it is one area in which we tend to overspend money that we didn’t plan on spending.

- Birthday Gifts

- Christmas Gifts – Get Ready to Save for Christmas

- Anniversary

- Special Occasion

Free Printable Alert – To make things easier, you can grab our free worksheets so you can plan our your gift spending. No more surprises!! Hit the resource library now.

Recreation & Entertainment (AKA Fun Money)

YEAH! The best budget categories of them all! FUN SPENDING!

Wouldn’t it be nice if we had the ability to spend more money on these fun things instead of paying our basic bills like mortgage, auto expenses and health insurance?!?! Not to burst your bubble (and mine), this is the last spot where you money can funnel into.

However, on the flip note, you can work hard to lower your basic expenses like we do, so we can afford more FUN in our lives. Here are some of my best frugal living tips.

And now to the Recreation and Entertainment budget categories.

- Gym Membership

- Hobbies

- Kid’s Activities

- Babysitter Money

- Entertainment

- Music & Technology

- Vacation

- FUN

How to Afford More Fun: It all comes down to priorities. Personally, we choose to live below our means that way we have more money available to spend on fun activities. That didn’t happen though until we paid off our debt.

Government Taxes

Gulp! Yep, taxes need to be on your personal budget categories list.

No matter how you cut it or try and shape it… taxes take a big chunk out of your budget. While most of the time, budgeting is done with our net income. It is still good to know how much taxes you pay with every paycheck.

This is especially important if you are self employed or have a side hustle. Then, you won’t be surprised by a large tax bill from Uncle Sam.

- Paycheck #1 Taxes

- Paycheck #2 Taxes

- Self Employed Taxes

- Accountant Fees

- Online tax software

Cover All of the Personal Budget Categories

There you go! We covered all of the personal budget categories.

Why is this important?

Then, you won’t be surprised by an unexpected expense because you already covered it in your budget.

The goal is a FAIL-PROOF BUDGET!

Now, it is your turn to create a personal budget list.

Have you forgotten any of these budgeting categories in your budget?

More Budget Help:

- Why You Need a Cash Flow Budget + How To Start

- How to Improve Your Finances with a Bare Bones Budget

- Budget By Paycheck: Easy Tips To Maximize Your Income

- Biweekly Budget Template: How To Create A Biweekly Budget

Best Budgeting Apps - The Top 10

From all of the free and paid budgeting apps, here are our top budgeting apps to check out!

Quicken Personal Finance & Money Management Software

Personal finance and money management software allows you to manage spending, create monthly budgets, track investments, retirement and more.

YNAB - You Need a Budget

Enjoy guilt-free spending and effortless saving with a friendly, flexible method for managing your finances.

Change your relationship with money!

Empower - Track Your Finances for FREE

Personal Capital is wealth management for the Internet Age. The online platform combines digital technology with highly personalized service to provide a holistic view of a unique financial picture (AKA your net worth).

Make sure to connect all of your accounts within 7 days to set up your Personal Financial dashboard.

Tiller: Your Financial Life in a Spreadsheet, Automatically

Tiller is the only tool that automatically updates Google Sheets and Microsoft Excel with your spending, transactions, and balances each day.

Start your free trial.

Qapital - Discover true money happiness

Automate your financial plan with set-and-forget money tools that fit right into your daily life.

That’s why Qapital puts your goals front and center, then helps you plan your spending, saving, and investing around them.

Simplifi

Manage your money less in 5 minutes each week. Reach your money goals with confidence! The personal finance app gives you something to look forward to.

"The easiest, most comprehensive way to both see where your money is going and plan for future expenses."

Rocket Money

Your automated financial assistant and budget tracker are designed to put you back in control of your money.

Stay on top of your spending, easily track bills, cancel unwanted subscriptions, and find ways to improve!

Pocket Smith

The best personal finance software for all walks of life.

Forge your own financial path – they provide the tools.

Click here to get 50% off the PocketSmith Premium Monthly plan for the first two months.

Bee Saving with HoneyMoney

HoneyMoney increases your awareness about your money habits. Being fully aware of your money naturally changes how you spend it.

Great way to use cash flow budgeting. Plus uses "envelopes" to budget.

Start your free trial.

Moneyspire: Have total control over your financial life

Moneyspire is user-friendly personal finance and small business accounting software that brings your entire finances together in one place.

Have total control over your financial life in one click.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.