Complete Guide to Sinking Funds Examples & Categories

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Sinking funds are a type of saving account that is designed to help with budgeting. They work by setting up an account to accumulate cash over time, which is then used for the expenses. They can help with everything from monthly utility bills to vacations.

Basically, sinking funds are money set aside for a specific purpose.

By using a sinking fund, the avoidance of having a money emergency goes away.

Typically, these mini-saving accounts are expenses that randomly pop up or expenses that are paid on a quarterly or yearly basis.

So, what are sinking fund examples?

Need new tires? Taken care of with car service reserve.

Want to take a vacation? Taken care of with vacation fund.

Need to go to the vet? Taken care of with pet needs savings.

Then, you can leave your emergency budget – just for an unexpected, out-of-the-blue, knock-over-expense.

Using these sinking fund categories will completely change your finances and help you to stay debt free.

What Are Sinking Funds?

The sinking funds definition is money set aside for a specific purpose.

In other words, paying yourself first to make a purchase rather than using a form of debt.

What are examples of sinking funds?

The most common type is an emergency fund. Money is set aside just for emergencies.

There can be many types of sinking fund categories.

Another example would be a vacation fund. For obvious reasons, those types of funds are just more fun to save for and plan vacations.

On the flip side, the car maintenance fund is a different example. And well, just dreaded to save for and to use it – let’s be honest.

The type of sinking fund categories all depend on your stage of life, your path to wealth, and what you desire in life.

Just remember, a sinking fund will help you to stay debt free!

Before you keep reading understand how sinking funds and the Money Bliss Steps to Financial Freedom will change your financial future forever.

Later in this article, you will find a full list of sinking fund examples.

Is it smart to have a sinking fund?

Yes! A sinking fund is an account that you create to save cash for a specific goal. It is easy to set one up and does not take long to start saving money.

Sinking funds are an effective way of saving money because you earmark money specifically for something that you want to buy or own.

This can help you avoid using credit cards or taking out loans when you want to make a big purchase.

A sinking fund is a great way to ensure that you are always prepared for the unexpected. You don’t have to worry about anything happening financially because you have already saved up for it. Sinking funds come in different categories, so you can choose the one that best suits your needs.

Sinking fund vs. Traditional savings account

Sinking fund accounts are set up for a particular purpose and are to be used only when the need arises. Typically, it starts out with a small amount of money (often $10), and as the funds are depleted, they are replaced by new deposits.

Sinking funds are specific and can be used for a car, vacation, Christmas. For example, you could set up one sinking fund to pay off your debt in two years while others can be for medical bills or travel expenses. Be deliberate with the use of sinking funds so that they do not get depleted too quickly

A savings account, on the other hand, starts with a larger amount of money at the beginning and this amount does not change.

A savings account is any type of savings that can serve anyone’s needs, but it has no specific limitations or conditions on how they should use them.

Sinking fund vs. emergency fund

A sinking fund is a safety net that you set up to accumulate funds for future needs that are known and specific. It differs from an emergency fund, which is meant to serve as temporary relief for current financial emergencies.

An emergency fund is generally a separate fund used as a reserve for unplanned expenses such as car repairs, medical bills, or unexpected home repairs.

The emergency fund is any reserve that can be drawn on in times of financial need.

Importance of Sinking Funds

By utilizing sinking funds, the living paycheck to paycheck cycle is broken. It is a way to ease stress. You are able to say ahead on bills and unexpected needs.

Thus, being easier to sleep at night.

The key to sinking funds is not to cross cash between accounts. That means the home repair sinking fund can’t be used to pay the kid’s travel competitive soccer registration.

Don’t be tempted.

If not, there is no point to a sinking fund.

By utilizing one of the sinking fund examples, then the emergency expense does not pop up here and there.

It is easy to set up sinking funds when you learn how to make a budget.

Each month the same amount of money is allocated to the sinking funds. Take out the roller coaster effect of making ends meet.

Resources to help you succeed:

- Money Blocks: Fastest Way to Remove Abundance Blocks

- How to be Smart with Money: Get Rich Faster And Build Wealth

- Fun Money: The Ultimate Guide to Make Your Budget Have A Fun Time

How Many Sinking Funds to Use?

That is completely up to you. Some people want a few sinking funds. Others want over 50 sinking funds. Decide what is best for you.

What can you manage? What areas do you need to sock extra cash away?

We have a complete sinking funds list below.

At the minimal amount, I recommend at least five sinking funds, which we will cover shortly. These sinking funds would be held in separate bank accounts so that way you don’t intermix the money.

Specifically, This is the Number of Separate Bank Accounts You Need.

Shortly, we will get to the most common types of sinking funds.

When to Start Sinking Funds?

In the Money Bliss Steps to Financial Freedom, the first two steps focus on getting personal finances organized and establishing an emergency fund.

Wait to start any sinking funds until those steps are complete.

In Money Bliss Step 3, begin a few basic need-based sinking funds. Sinking fund examples would be car repairs or home repairs. Those items would knock you off basics and eat up your emergency fund and cause more debt in your life.

After any debt is paid off, then you can begin fully funding a rainy day fund (always known as 3-6 months of expenses). That is the point you can start as many sinking funds as your heart desires.

So, basically, you need to make sure you are building a strong foundation with finances first.

How to Create a Sinking Fund

In order to create a sinking fund, you must make sure that you are not spending more than your income. Also, it is helpful that you have no debt.

A sinking fund is a category of the budget that will only grow if you have money left over. It’s important to note, however, that it won’t work without being in your budget because it relies on cash flow.

If you are trying to save for retirement or other long-term investments, this can be helpful as an easy way to funnel savings into their intended purpose while staying within the bounds of your finances.

Step #1 – How Much in Each Sinking Fund Category

The first step is to decide how much money will need in each category yearly.

It’s important to name the budget item before starting on any part of this process so you know what goal your money will go towards.

Step #2- How Much to Save Monthly

Now, you need to determine how much money you need each month to save in order to reach your sinking fund goal.

Typically, you would take the full cost needed and divide it by the number of months until you need it.

Once you have established sinking funds, you can divide it up equally into twelve months.

Step #3 – Where to Keep Sinking Funds

You need to decide if you are going to use cash envelopes, a spreadsheet, or an app to track your sinking funds.

There is no wrong or right answer only what will work for you.

Then, in order to create a sinking fund, the funds need to be transferred into this type of savings account each month.

Step #4 – Replenish Used Funds

The purpose of sinking funds is to have money available when needed. As such, you will constantly need to refill your sinking fund buckets.

Hopefully, you are putting money into each bucket every month and you won’t be caught off guard without anything.

How Much Should be in A Sinking Fund?

Well, that depends.

Honestly, I hate that answer, too. But, everyone’s financial journey is unique just to them.

For instance, a car replacement fund would max between $15,000-30,0000 pending on the car preference.

On the flip side, a clothing fund of $500 should suffice.

Sinking funds create choices. Choices open up financial freedom.

Is there some magical sinking fund formula?

No. It is all a personal choice. Here is a good start to learning the ideal household percentages vs. your actual numbers. That can help you determine if you are saving more or less than average on certain sinking fund examples.

Quarterly or Yearly Sinking Funds

For those sinking funds that are yearly or quarterly, it is much easier to decide how much to save. These are sinking fund categories that aren’t the same amount each month. It varies by month, quarter or year.

Sinking fund examples would be:

- Car registration or insurance

- Sewer bills

- Kid’s activities

- Property tax bill

How the sinking funds formula works

The sinking fund formula is a way to determine the amount you need to set aside each month to fund your sinking account.

Thankfully, it is very simple math to do:

(Sinking Fund Amount / number of months until due) = monthly amount

(monthly amount * number of months until due) = Sinking Fund Amount

Many sinking fund formulas use an interest rate, but for personal finances that is more complicated than what you need. So, we keep it simple.

Sinking Funds Formula Examples

Here are some simple examples to help you understand the sinking fund formula in action!

Example #1:

Your annual car insurance premium is $1400 and is due every 12 months.

$1400 / 12 = $117

As such, you need to set aside $117 each month to pay the insurance premium in full.

Example #2:

Another example would be for kid activities. Throughout the year, you typically spend $4,000, but the payments aren’t monthly and happen for each sports season.

$4000 / 12 = $334

So, each month, you would need to set aside $334 to cover kid’s activities.

Example #3:

You want to set aside $50 each month for Christmas gifts and the holidays are 8 months away.

$50 * 8 = $400

When you start buying Christmas presents, you will have $400 saved in your Christmas sinking fund.

Key Note: If your bill is due before the 12 months, then you need to modify how much you set aside. For example, if your car insurance is due in 8 months. Then you would take $1400 divided by 8 and need to set aside $175 each month to pay the insurance premium in full. ($1,400 / 8 = $175)

Just remember this is saved by you for a future decision.

how to organize sinking funds Money?

A couple of different options to choose from depending on your preference.

Those include a separate saving account or a cash envelope. If you utilize primarily cash, I highly recommend a hiding place like this or this.

It is okay to have multiple savings accounts for sinking funds. Yes! We do!

Why? Because it is easier to know how much money is allocated to what fund.

A terrific option is a high interest online savings account. The key is to set it up and don’t delay.

Once an account balance is higher than $10,000, look into an investment account for the excess. Yes, there is a risk, but there is also a possibility of higher returns.

Understand: The Best Methods of Budgeting You Need to Know

List of Sinking Funds Categories & Examples:

- Car Service / Repair

- Auto Registration

- Home Maintenance / Repair

- Medical Expenses

- Education Expenses

- Replace Furniture & Electronics

- Christmas

- Gifts

- FUN

- Vacation / Travel

- Kid’s Activities

- School Tuition

- Pet Needs

- Clothing

- Baby / stork fund

- Property Taxes

- Misc Utilities (sewer, trash)

- Association Dues

- Babysitting Money

- Just Because Money

- Giving

- Income Tax

The list for examples could go on and on.

The Oh No Fund!

This is the last sinking fund example we are going to talk about today. It is the Everything-Lumped-Together-And-Hope-Nothing-Happens-Fund.

This is what makes the budget formula work.

This time of fund is for people who just don’t want to keep track of a bunch of accounts, live within their means, and want simplicity.

The Oh No Fund!

It is a simplistic way to cover the next thing that is guaranteed to be replaced. It may be a car, a home repair, or home improvements. Who knows! But, your oh no fund will have you covered.

What About Retirement?

Personally, I don’t like to think of retirement as part of this. Even though, technically, it is.

This is a long term saving goal. That needs to be added to on a consistent basis. Don’t wait to start saving for retirement. Start today with just 10-15% of your income.

The same is true for college tuition. However, should parents pay for college? That brings up a whole new level of questions and thoughts.

As for Health Saving Accounts (HSAs), the same principle holds true. They needed to be treated as a long term saving account. Money that is consistently added to your HSA each and every year.

Oh, and you don’t want to learn what happens when you don’t save for retirement.

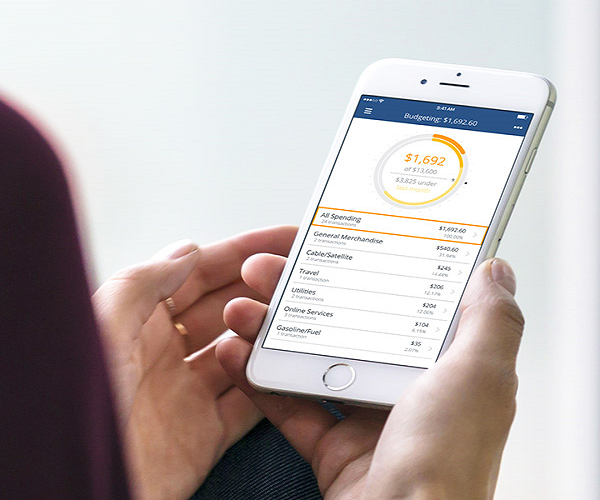

Sinking Funds Tracker

A sinking funds tracker is a way to track all of your sinking funds over time.

You can use a sinking fund worksheet PRF or a sinking funds spreadsheet.

Also, many budget apps like Simplifi will do that for you.

Sinking funds printable is a tool that lets you track your spending and saving. Also, it can calculate the amount of money left over at the end of the month based on what you have spent and saved.

Check our shop for the latest printables.

Which Sinking Fund Categories will You Use?

All in all, sinking funds will improve your budget.

Each of the sinking fund categories that you decide to use means you have set money aside for that certain purchase.

For our household personally, we use the following sinking funds:

- Giving

- Vacation

- Fun

- Property Taxes

- Kid’s Activities

- Gifts

- Auto Insurance and Registration (we lump them together)

- And don’t forget the Oh My Fund!

There is no wrong or right answer on the number of sinking fund categories. You need to do what works best for you and your budget.

Sinking funds will change your financial situation immensely.

So, start off with one or two types of sinking funds, then start adding from there.

What are your favorite sinking funds? Which are the most important in your household?

Best Budgeting Apps - The Top 10

From all of the free and paid budgeting apps, here are our top budgeting apps to check out!

Quicken Personal Finance & Money Management Software

Personal finance and money management software allows you to manage spending, create monthly budgets, track investments, retirement and more.

YNAB - You Need a Budget

Enjoy guilt-free spending and effortless saving with a friendly, flexible method for managing your finances.

Change your relationship with money!

Empower - Track Your Finances for FREE

Personal Capital is wealth management for the Internet Age. The online platform combines digital technology with highly personalized service to provide a holistic view of a unique financial picture (AKA your net worth).

Make sure to connect all of your accounts within 7 days to set up your Personal Financial dashboard.

Tiller: Your Financial Life in a Spreadsheet, Automatically

Tiller is the only tool that automatically updates Google Sheets and Microsoft Excel with your spending, transactions, and balances each day.

Start your free trial.

Qapital - Discover true money happiness

Automate your financial plan with set-and-forget money tools that fit right into your daily life.

That’s why Qapital puts your goals front and center, then helps you plan your spending, saving, and investing around them.

Simplifi

Manage your money less in 5 minutes each week. Reach your money goals with confidence! The personal finance app gives you something to look forward to.

"The easiest, most comprehensive way to both see where your money is going and plan for future expenses."

Rocket Money

Your automated financial assistant and budget tracker are designed to put you back in control of your money.

Stay on top of your spending, easily track bills, cancel unwanted subscriptions, and find ways to improve!

Pocket Smith

The best personal finance software for all walks of life.

Forge your own financial path – they provide the tools.

Click here to get 50% off the PocketSmith Premium Monthly plan for the first two months.

Bee Saving with HoneyMoney

HoneyMoney increases your awareness about your money habits. Being fully aware of your money naturally changes how you spend it.

Great way to use cash flow budgeting. Plus uses "envelopes" to budget.

Start your free trial.

Moneyspire: Have total control over your financial life

Moneyspire is user-friendly personal finance and small business accounting software that brings your entire finances together in one place.

Have total control over your financial life in one click.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.