Your 52 Week Money Saving Challenge + Free Printable

Inside: Pick from the different 52 Week Money Saving Challenges. $1000, $2000, $5000, or $10000? Plus join our mailing list for your free printable.

Saving money is key to long-term financial success! This is what you want to learn, so you are in the right place.

The reality is most people don’t save.

Why?

Simple, it is way more fun to spend money than save money.

Most people can’t cover an emergency expense. Retire at a “typical” retirement age. Or pay in cash for a vacation. While these statistics are sad, it doesn’t have to be your reality. You can be different! (Plus being different with saving money is awesome.)

Real world truth of adulting… Saving is a must!

Since everyone is at a different point in their money journey, Money Bliss decided to lay out a few different 52 Week Saving Challenges.

This is your one year saving plan!

Then, you can decide which one fits your personal financial situation the best!

How much money do you save in the 52 week challenge?

Well, it depends on which of the various 52 week money saving challenges you decide on.

There are plenty so you can find success with your first challenge and keep coming back the next year.

Saving money will open up opportunities.

Did you know?

That saving is crucial for the Money Bliss Steps to Financial Freedom.

Learn how many of the steps include some type of savings component. Plus it is a great guide to follow to help you live the life you want to live and successfully cross off those money goals.

Now, let’s figure out how much should I be saving every week with this weekly savings plan. Let’s do this in 2023!

Why a Money Saving Challenge is Important?

Simply put…a money challenge will help you start saving money.

Everyone is up for a challenge.

They want to prove to themselves that they can accomplish the challenge.

Plus, it is great to hold a money saving challenge within your own community. The people you are around the most often will help keep you accountable plus the success rate is higher.

Because we all have different goals and visions, we are going to lay out 5 various money saving challenges.

Depending on the money saving challenge you pick, this amount will be saved at the end of 52 weeks:

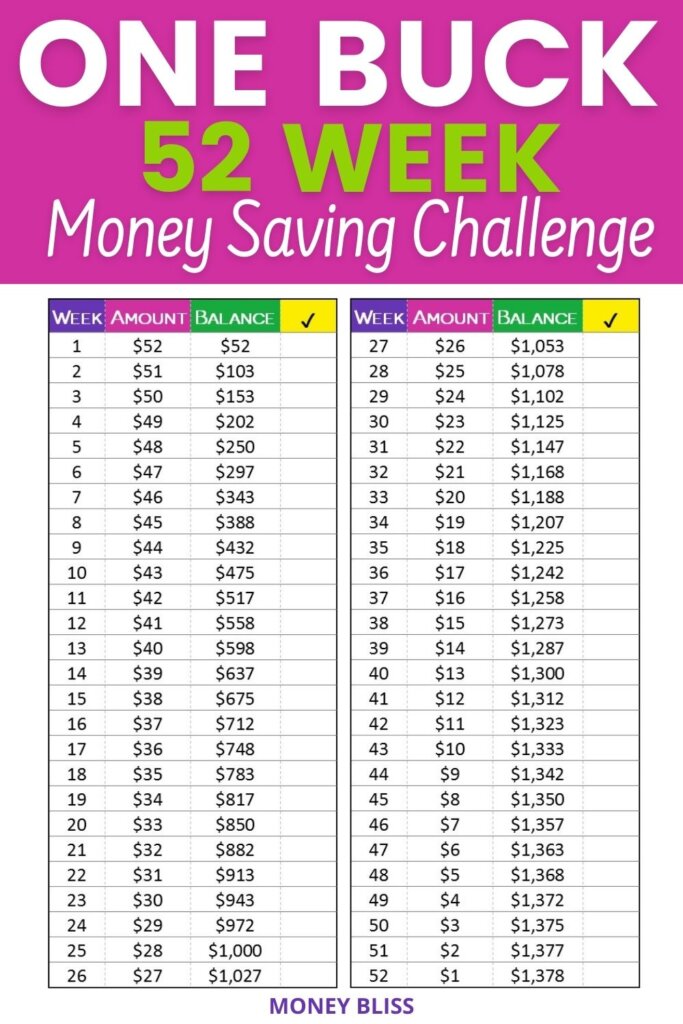

- $1,378

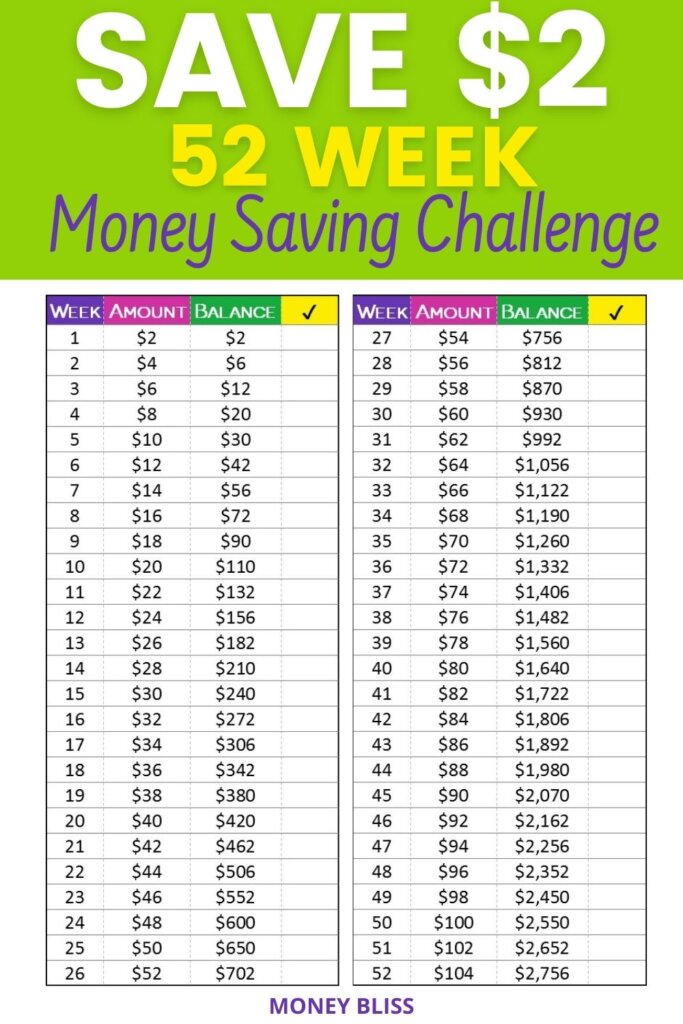

- $2,756

- $5,000

- $10,000

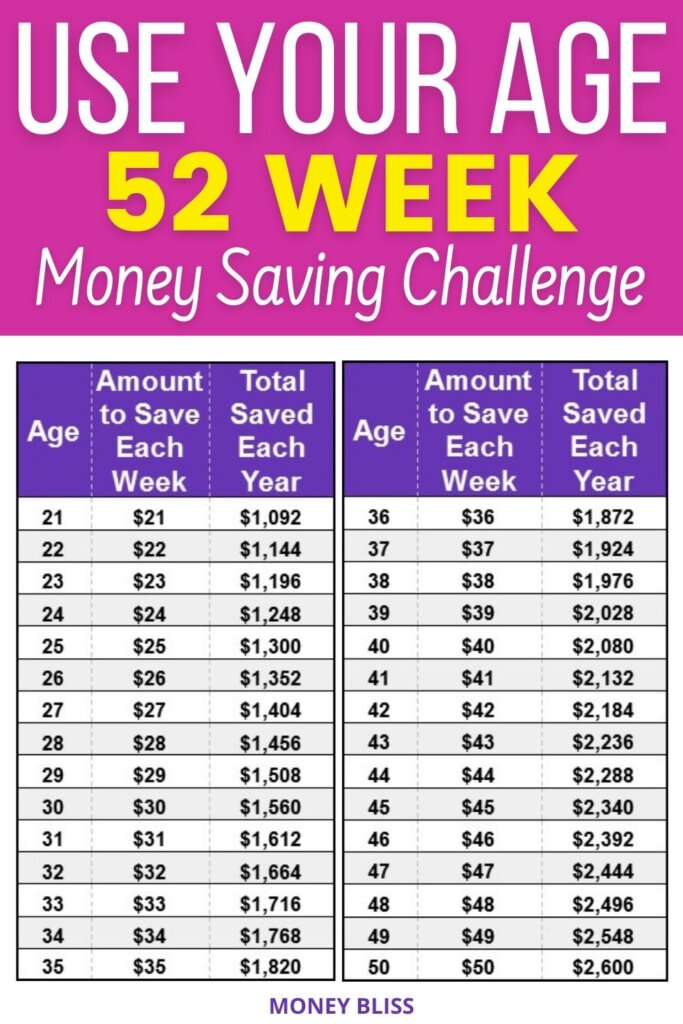

- Your Current Age * 52 = Amount Saved

Other Saving Challenges:

- 20 Simple Money Saving Challenge to Save More This Year

- Ultimate Guide to a Successful No Spend Challenge

- These Monthly Money Saving Challenges You Need to Try

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Hailed for its competitive APY rates and digital ease of use, GOBankingRates named CIT as one of the Best Online Banks for 2022.

Earn one of the nation's top rates.

- Daily compounding interest.

- No account opening or maintenance fees.

- Your deposits are FDIC insured.

- Deposit checks remotely.

- Make transfers with the CIT Bank mobile app.

How to Complete 52 Week Money Challenge:

Most money challenges start in January because people tend to make resolutions at that time. However, you can start whenever you want to. There is no right or wrong time to start saving money.

In all honesty, it is best just to start saving! And do it now! (Set up your account here.)

If you are a resolution type of person, then check out the Ultimate List of New Year’s Money Resolutions!

However, to be successful at the end of 52 weeks, you need to find a method of saving that works for you.

Remember, the 52 week money challenge is about creating new habits of saving money.

This is how you can save money every week for a year.

A weekly saving planner can help you stay on track!

1. In Order

Save money each week for a year by just following one of our helpful templates.

Check off week by week!

This method is all about momentum! Get the ball rolling and slowly increase your saving amount.

This is the most common method because we tend to follow a pattern and don’t want to deviate from our plan. This type of challenge is perfect for the logical person who wants to make it simple.

2. Reverse Order / Backwards

Many 52 week money saving challenges have you saving the most amount of money around the holidays.

**Just to note…we specifically created our challenges to save the least amount around November & December (if you start in January).

For instance, the sticky spot with the regular 52 week saving challenge is you have to save $45-52 a week around the holidays. That is tough for any household.

The reverse 52 week money saving challenge is often great because you get the heavy lifting done early in the challenge while your drive is still running high.

If you want to work backward, that will work as well!

Also, in the beginning, it is a great way to get rid of old stuff and make some money. Or pick up a gig economy job!

3. Hacked Method

This type of challenge is for those who want to save but on their terms!

The end goal at 52 weeks is to cross off all dollar amounts that need to be saved.

If you get a bonus or tax refund or more money is saved than you thought you could save, then cross off the higher amounts to be saved throughout the year

Easy to save money! A savings calendar will help you to stay on track!

Key Tip: You don’t have to start any of the money saving challenges the first week of January! Pick a date and start saving! It is never too late to start to save money!

Saving Money Resources:

1 – Traditional 52 Week Money Saving Challenge

The premise behind the 52 week money challenge is simple.

Start with a $1. Each week, add another $1.

At the end of 52 weeks, you have saved $1,378.

And let’s be honest, trying to find a dollar here or there when starting out is easy. With these saving money challenges, you prove to yourself that you are capable of saving money. That is huge for your money mindset and reaching your financial goals when you are making $15 an hour.

This is a great money challenge to be done in reverse to kickstart your savings (or for an emergency fund)!

Prefer to save the same amount each week? $27 a week it is. $1000/52 = $27

Below you will find the dollar a week savings chart.

The 50 envelope challenge is perfect too! Save $1275!

2 – Two Buck 52-Week Savings Challenge

Much like the $1 challenge, but this one ups the ante by $1.

Start with $2 and add another $2 each week.

By the end of 52 weeks, $2,756 has been saved!

Great way to challenge yourself one step further. It is amazing how fast a measly $2 adds up over time. You can prove to yourself that you can save money on a tight budget.

For kids, the Save Age Challenge for Kids is a fantastic way to teach good money habits under your roof!

Prefer to save the same amount each week? $53 a week it is. $2756/52 = $53

3 – $5000 52-Week Challenge

The 5K challenge is about going the full distance.

By saving $5,000, it shows you that you are capable of saving money.

The challenge is great to save money for a vacation fund or contribute to a Roth IRA.

Also, if you are up for a slightly greater challenge, add an additional $1500 to save the total amount to max contributions for a Roth IRA in 2023!

For most people, when they prove to themselves they are capable of saving $5000, it shows them that financial independence can become a reality. Plus, this saving money challenge helps to avoid lifestyle creep. Are you ready for the challenge?

This is exactly how to save 5000 in a year. Prefer to save the same amount each week? $97 a week it is. $5000/52 = $97

Many people prefer one of these $5k challenges instead:

- 100 Envelope Challenge – Fun $5050 Money Saving Plan

- 200 Envelope Challenge – A Spin to Save at Least $5K

4 – $10000 52 Week Money Saving Challenge

In our house, we have been known to say “Go Big or Go Home.”

This challenge is going the extra distance to save money.

Reasons to save $10,000 could be for a new-to-you car, down payment on a house, or money to go back to college. It could be money saved for retirement. Or my hubby’s favorite… F*** You money, courtesy of this wildly popular book.

By saving $10,000 in 52 weeks, you have proven to yourself that you can live below your means and you are putting an emphasis on saving and your financial future. There is no better way to build a strong money foundation than by saving 5 figures of money.

How much should I save a week for 10000? If you prefer to save the same amount each week, then $193 a week it is. 10000/52 = $193

This is exactly how can I save $10000 in 52 weeks…

- Go further into detail on How to Save 10000 in a year.

- Go extreme and learn how to save 10k in 100 days.

5 – Weekly Save Age Challenge

Money Bliss created the Save Age Challenge when a good friend said she couldn’t save money. I asked if she could save her age and her response was a resounding “Of course!”

All in all, the dollar amounts we were discussing weren’t much different.

That was the beginning of the Save Age Challenge!

For this challenge, take your age and save that number each and every week for 52 weeks.

This is a great way to continually increase the amount you save. Typically income increases over time – just like your savings percentage should increase year over year. Also, this is a great money challenge for kids, too!

Free Printable 52 Week Money Challenge

These money saving charts are crucial to help you stay on track. No need to DIY your own cute printable.

To help your saving success, we have all of these 52 week money saving challenge free printables in our resource library. You can access everything for free – just check it out.

Our way to help you!

These are free worksheets and printables to help you save money and reach financial freedom.

Make sure to download your copies today! Start your money saving challenge! Change your financial future now!

What should I do If I get behind on the Money Saving Challenge?

If you get behind, don’t quit.

Just figure out how you can catch up. Saving money is a priority now.

By paying yourself first, the opportunities become endless on how your life and decisions will be impacted.

A key to long-term success is to know the reason you are saving money. That will help your motivation in completing the 52 week money saving challenge.

Hailed for its competitive APY rates and digital ease of use, GOBankingRates named CIT as one of the Best Online Banks for 2022.

Earn one of the nation's top rates.

- Daily compounding interest.

- No account opening or maintenance fees.

- Your deposits are FDIC insured.

- Deposit checks remotely.

- Make transfers with the CIT Bank mobile app.

FAQs

Does the 52 Week Money Challenge Work?

Yes! You just have to dedicate yourself to it.

The key to any challenge is starting! Take action to move forward. At the end of 52 weeks, it doesn’t matter which method you used as long as you saved the money.

Any one year weekly saving plan will work for you!

Everyone is different! That is why one of these – In order, Reverse Method, or Hacked method – will work for you!

Make sure to sign up for our special tips on saving money with any of these 52 week saving challenges!

What 52 week savings challenge are you going to pick today?

Comment below.

Also, make sure to sign up for our money saving challenge for more money saving tips!

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

Thank you for so many options to save in a year. I like the “Save your age”challenge. Easy-peasy. We will start doing it from age 4 onwards to 45 for each member in the family. Genius way to save for college, school expenses and emergencies. Thank you.

Thanks for the marvelous posting! I certainly enjoyed reading it, you may be a great author.I will ensure that I bookmark your blog and definitely will come back in the future. I want to encourage one to continue your great work, have a nice day!

Please tell me that you’re going to keep this up! It’s so great and so important. I can’t wait to read more from you. I just really feel like you know so substantially and know how to make people listen to what you’ve to say. This blog is just also cool to be missed. Excellent stuff, seriously. Please, PLEASE keep it up!

Loved your content.

I choose the save my age.

I love reading your site.