Avoid the Trap of Lifestyle Creep and Reach Financial Freedom

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Lifestyle creep is a real thing!

Plus it easy for it to slowly creep into your lives without even realizing it.

Seriously…lifestyle creep can sweep in and take over without a blink of an eye. It is simple, gradual spending that seems “normal” until it has completely knocked you off course.

Lifestyle creep is overspending at its finest moment.

You just got a pay raise to celebrate, so you go out to a fancy dinner. Then, you decide that you can now afford that fancy dinner, so you make it a regular thing. Since you have money leftover each month, you are thinking to move into that bigger house or nicer apartment closer to work. Maybe it is time for a new car?

Seriously, lifestyle creep is dangerous territory.

The dangerous territory that we almost fell victim to last year. We have been debating for a long time whether to buy a new house with more square footage (specifically a usable basement and a fourth bedroom) with a bigger yard. We could afford it according to all the calculators (lifestyle inflation speaking – not financial freedom).

Once we placed an offer on a new house, we quickly realized the trap we were getting ourselves into. Swooped up by lifestyle creep in the United States.

In order to make this happen, we would have to sacrifice on our savings percentage and other things we enjoy like travelling.

Thankfully, our offer wasn’t accepted and we didn’t fall victim to lifestyle inflation. But, it is an easy trap to get yourself into. And a huge eye opening experience for me as a money / personal finance blogger.

After our experience, I want to dive into lifestyle creep, the dangers of lifestyle inflation, and how you can avoid it. Then, you can stay far away from the traps of lifestyle inflation and reach financial freedom.

You have to arm yourself with knowledge because you can slip into the trap just like we almost did.

Learn how do I stop my life creep. You want to hear this…

Lifestyle Creep Definition

Lifestyle creep or lifestyle inflation is when your spending increases as your income rises.

This is something that happens over an extended period of time, so it is harder for you to notice.

It can be so gradual and sneaks into your life without much regard.

A rise in income equates to an increase in spending.

This happened for many people when the most recent tax changes happened. People found themselves with more money in each paycheck, but when taxes were due that their tax refund was smaller than expected.

Signs of Lifestyle Creep to Avoid Lifestyle Inflation

There are many warning signs to falling victim to the lifestyle creep. Also, many of this is hidden and difficult to uncover because it happens gradually over time.

Increase of Debt

The more you spend, the more chance you have to get into debt. This is especially true for people who have struggled with credit card debt in the past.

Debt can snowball back at a rate that you are left with an uncontrolled credit card and starting over on how to get out of debt.

This is something I have seen over and over again. Pay off debt only to find themselves in a deeper pile of debt. Lifestyle creep is partially to blame.

An increase in income means you are able to buy more on credit, which can quickly lead to more debt.

Unable to Become Financial Independent

This is huge!

Becoming financially independent means you are able to rely on yourself to make ends meet and have flexibility in your choices because you have cash on hand.

If you fall victim to lifestyle creep, then you don’t have the ability to make the same choices as someone who is financially independent and doesn’t rely on a paycheck to make ends meet.

If you never want to reach financial freedom, then go right ahead and fall victim to lifestyle creep. However, if you desire more out of life and want to reach your money goals, then be careful to avoid the lifestyle inflation trap.

This was the main reason we stopped our house buying process. We wanted more out of life than just a bigger mortgage payment.

Not Saving Enough

This one is the biggest dangers of lifestyle creep.

As Americans we don’t save. Period. Don’t save for an emergency fund. Not enough savings for retirement. We live in the here and now. Living in the moment and not saving for the future.

When a rise in income happens, a rise in saving percentage should occur at the same time.

However, an increase in income typically leads to an increase in spending. Thus, the lifestyle creep at its full potential.

how to avoid lifestyle Creep

It is possible to steer clear of the lifestyle creep. It is something we have managed to do (even in a high cost of living area).

You have to be willing to make conscious decisions about how and where you are spending money.

As well as knowing how lifestyle inflation can derail you without even realizing it.

Be Content

Here is the contentment thing again. We must find contentment with what we have and then we can avoid the lifestyle creep.

For us, when we explored buying a bigger home, we came to the realization that we were content and happy in our current house. The big part of our decision was we couldn’t reach financial freedom as fast with a higher mortgage payment and increased maintenance costs. Also, after reading this book, I quickly realized by getting rid of the extra stuff in our house would make our current space feel bigger (even the kids agreed how much bigger our space was).

Finding contentment is a challenge when comparison traps are everywhere and keeping up with Kardashian’s happens.

To avoid lifestyle inflation, then you have hard decisions to make on whether or not you are content with your current lifestyle.

There is no need to increase expenses if not needed.

Make a Plan

In order to conquer lifestyle creep from happening set your money goals and be active in managing your money.

Ahead of time, make a plan for how you plan to handle a rise in income.

For example, you are currently making $55,000 a year and getting a pay raise to $70,000. A difference of $15,000 of cash in your pocket. This is a 27% increase in your income (or savings). That is a significant change!

Make a plan for your new income beforehand.

Decide when you get a pay increase what you plan to do with the money. Where is going to go? What plan do you have for it?

Keep your Expenses the Same

Did you know that you didn’t have to spend every single penny in your bank account?

This may be a new concept to you and that is okay. Keep your expenses the same and save the remaining amount.

To avoid lifestyle creep, then don’t rise your expenses to your new income level. Pocket the difference in your savings account.

Financial independence is easier to reach when you continuously increase your savings percentage.

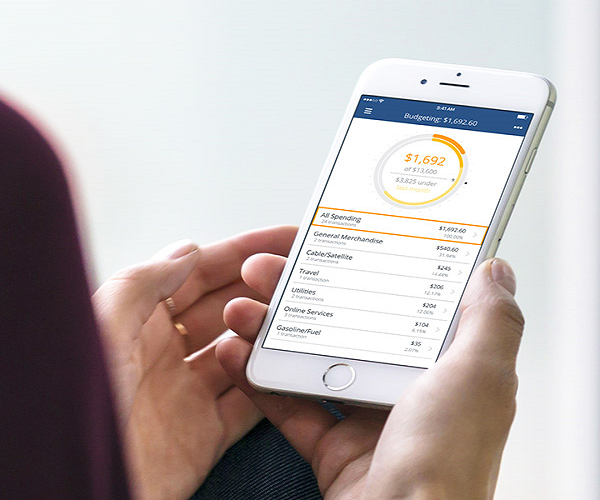

Budget

If you are regularly budgeting, then you will quickly notice a rise in spending.

However don’t get caught in the trap of overspending by a small percentage, over time that small percentage adds up and adds up fast.

A budget or using YNAB can help you notice spending trends faster than never budgeting.

You just have to be willing not to become the latest victim of the lifestyle creep.

Save A Increase of Wages

This tip is easy enough to implement.

Any increase in your paycheck is automatically saved. Then, there is no temptation to spend money and you won’t be able to become a victim of lifestyle inflation.

Ahead of time, make sure you know where you want to save your money:

- Emergency Fund

- Rainy Day Fund

- Retirement Savings

- Auto replacement fund

Those are just a few ideas to help you save any increase in wages.

Wise Spending

I get it. You finally got the a raise that you deserve and you are tired of living frugally all the time. So, you want to release the tight grip on your budget and your spending.

That is fine as long as you make smart choices on spending the money.

Don’t make big changes. Look at smaller more gradual ways to make changes in your lifestyle.

The key is to make sure you are reaching your money goals and able to retire when you want to.

Set Money Goals

One of the top ways to avoid lifestyle creep is to set money goals. You want a financial freedom lifestyle!

This is paramount!

Don’t skip this step!! It is way to easy to get caught up in the cycle of life and not pay attention to when are where you are spending money.

By setting money goals, you know what you want to do with your money. You are managing your money and not having your money manage you.

Take the time and lay the groundwork for long-term financial success.

Are You Ready to Battle Lifestyle Creep?

The dangers of lifestyle creep are real and can quickly knock you off your strong foundation.

Are you prepared to take the necessary steps to avoid lifestyle inflation in your life?

These simple steps will help you stay on track towards financial freedom and not be stuck living paycheck to paycheck your whole life.

The choices is yours.

We were close to become a victim to lifestyle creep. It took the willingness to say that we are content with what we have and we are actively choosing to pursue financial freedom. Lifestyle inflation is not for us. But, it is very tough to fight off every day.

Are you willing to take a stance against lifestyle creep?

If so, comment below and let us know!

Make sure you read the 10 Money Bliss Steps to Financial Freedom to ensure you are living the life that you desire.

Here are some millionaire habits that you need in your life!

Serious Way to Make More Money

One of the best ways to improve your personal finance situation is to increase your income. Here are a variety of side hustles that are very lucrative. With time and effort, you can start enjoying the lifestyle you want.

Learn How To Create Printables That Sell!

This is the perfect side hustle if you don’t have much time, experience, or money.

Many earn over $10,000 in a year selling printables on Etsy. Learn how to get started by watching this free workshop.

Learn the Skill to Proofread Anywhere

Are you passionate about words and reading?

If so, proofreading could be a perfect fit for you, just like it’s been for countless of readers! Learn how you can create a freelance business as a proofreader.

Check out this free workshop!

FREE VIRTUAL ASSISTANT TRAINING

If you've ever wanted to make a full-time income while working from home, you're in the right place!

This intensive training combines thousands of hours of research, years of experience in growing a virtual assistant business, and the power of a coach who has helped thousands of students launch and grow their own business from scratch.

Earn Extra Income with Bookkeeping

Bookkeeping is the most stable, reliable & simple business to own. This is how to make a realistic income -either part-time or full-time.

Find out TODAY if this is THE business you’ve been looking for.

Earn More Writing - Learn How to Make Money as a Freelance Writer

You can make money as a freelance writer. Learn techniques to find those jobs and earn the kind of money you deserve!

Plus get tips to land your first freelance writing gig!

Free Flipping Video Training Series

Learn how to buy and resell items from flea markets, thrift stores and yard sales. They will teach you how to create a profitable reselling business quickly

…no matter how much or how little experience you have.

Trade & Travel with Teri Ijeoma

Learn how to supplement your daily, weekly, or monthly income with trading so that you can live your best life! This is a lifestyle trading style you need to learn.

Honestly, this course is a must for anyone who invests. You will lose more in the market than you will spend this quality education - guaranteed.

Freight 360 University

Designed as a 101-level course on freight brokerage, you’ll learn the basics of freight brokering in this online course.

This course is designed for freight brokers in any setting, regardless of their employment status.

If you want to start your brokerage, we’ll show you exactly how to do it. If you are an agent or employee of a brokerage, we’ll take you through sales and operations modules designed to help you source more leads and move more freight.

Empowered Business Lab

The Empowered Business Lab teaches you how to sell your digital products naturally with strategies that just make sense.

Monica helps thousands find momentum and create revenue streams in their businesses.

Be Inspired by One Gentleman's Trading Journey

After taking a second job as a driver for Amazon to make ends meet, this former teacher pivoted to be a successful stock trader.

Leaving behind the stress of teaching, now he sets his own schedule and makes more money than he ever imagined. He grew his account from $500 to $38000 in 8 months.

Check out this interview.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.