How to Budget Your Money With Percentages – Cents Plan Formula

Inside: Learn how to budget your money with percentages. The Cents Plan Formula is simple, easy, and flexible. Start managing your money your way.

There are many thoughts on how to spend your money, how much to save, what qualifies as mandatory vs. discretionary expenses…the list can go on and on.

That makes it hard to figure out what should my budget percentages be.

When using percentage based budgeting, you are allocating a percentage of a budget for this category or that category.

Also, did you know it is one of many budgeting methods?

The most common budgeting method is the 50/20/30 budget rule. But, it is it outdated and doesn’t align with the bigger picture in today’s society. You need an updated budget formula to work in today’s society.

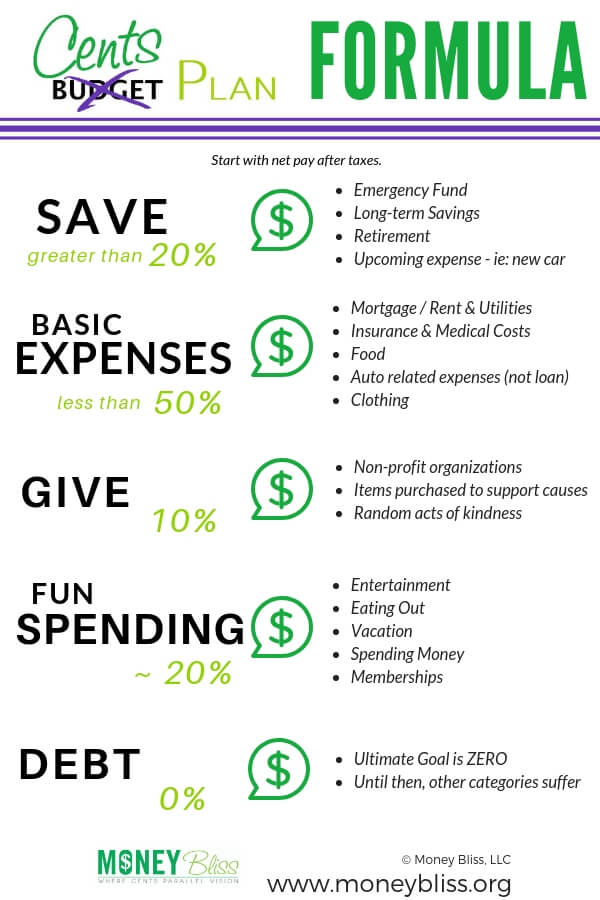

Quick Overview of Cents Plan Formula

At Money Bliss, we prefer to base percentage based budgeting off of the Cents Plan Formula. It is a guide to help ease your budgeting decisions.

The Cents Plan Formula is developed to be simple, easy, and flexible.

Understand how to budget your money with percentages. Ultimately, you decide Where Cents Parallel Vision.

The Cents Plan Formula makes up 5 budgeting categories:

- Save

- Basic Expenses like fixed expenses

- Give

- Fun Spending – or flexible expenses

- Debt

So, we are going to take the 50/20/30 budget rule one step further and create the 20-50-10-20-0 budget rule.

We’ll explain more and why it is a better budget formula.

The end goal is to learn to budget money better.

Key Aspect to Budgeting

The purpose of a budget is to help you reach your money goals and life dreams.

When starting out on your money journey, I highly recommend reading the Money Bliss Steps for Financial Freedom.

Creating a budget is the first step to becoming organized as you work through the steps for financial freedom.

Remember, the Cents Plan Formula is meant to be flexible.

As you work through the Money Bliss Steps, you will find times when there is less or more money for each category. That is completely normal. Plus it helps with long-term success with a budget.

Overall, the Cents Plan Formula helps to determine what percentage of your income should go to what.

Breakdown of the Cents Plan Formula:

One of the hardest things when learning how to budget money better is figuring out what is a good budget breakdown.

To help make things easier, we developed the Cents Plan Formula. It is a guideline on what percentage of your income should go to what.

The Cents Plan Formula consists of five categories – save, give, basic expenses, fun spending, and debt.

20-50-10-20-0 budget rule with some greater than and less than signs thrown in.

Plain and simple. Easy to follow.

This guide will help you to understand how to budget money with percentages.

That is the best way to ensure success with budgeting over the long term when you use spend save give percentages.

Save

Save is listed first for a reason.

To save, pay yourself first.

Set aside a certain percentage every month. Store up money to be spent at a future time. Learn more on how to save money with these simple and easy tips.

Recommended Save Percentage – 20%

Types of items to save for:

- Emergency fund

- Rainy day fund (or 3-6 months of expenses)

- Retirement savings

Save for goal-oriented items, such as:

- Car

- Wedding

- Vacation

- College

- Baby

- Home Improvement

- Must Needed Bank Accounts

Saving is very important in the Money Bliss Steps to Financial Freedom. Specifically, saving occurs in 7 of the 10 steps.

In the traditional 50/20/30 budget rule, this is the same amount allocated to saving. However, it becomes flat whereas with the Cents Plan Formula, you want to continue increasing your saving percentage.

Key Note: As debt is eliminated, the saving percentage typically rises to the recommended amount. Once Money Bliss step 6 starts, the save category will be greater than the recommended 20%.

Interested in FIRE? Learn more here.

Basic Expenses

The basic expenses in our life. Some people call it mandatory expenses.

Either way, it is the basic needs we need to survive – shelter, food, clothing, and a mode of transportation.

Basic expenses = bare necessity.

Examples of Basic Expenses:

- Mortgage / Rent

- Utilities

- Gas

- Clothing

- Medical co-pays

- Insurance

- Groceries

- Auto repair

- Child care

Recommended Basic Expenses Percentage – 50%

Remember, we are focusing on the bare necessities!

The goal with basic expenses is to stay under 50% of take home pay. Then, cash is freed up to be used in other categories. This is the same as the 50/20/30 budget rule.

These expenses DO NOT qualify as Basic Expenses:

- Starbucks

- Cable bill

- Eating out

- Housecleaner

- Hair salon

- Home Improvement

- Gifts

- Dry cleaning

Spending more than 50% on basic expenses would stretch your money situation and stress you out.

With basic expenses, the goal is to push these expenses lower!

Thus, a raise in salary does not justify a higher mortgage or a fancier car. Keep basic expenses well under 50% to attain Money Bliss faster.

Be wary of lifestyle creep when a paycheck increase happens.

Key Note: If you can lower basic expenses to 25% of your budget, then 25% of your money can go to other things – like savings, investing, travel, giving, or whatever you would like.

Give

Giving is generous.

It is a random act of kindness.

Decide where and when you want to give your money. There is a joy behind giving!

And remember, you might as well give some now because you can’t bury your money later.

Recommended Give Percentage – 10%

Giving happens in many ways…with your time, your money, or your talents.

It is your choice on how you choose to give and how much to give.

Give money is set aside for random acts of kindness or planned giving. The big debate on giving…Do you give 10% before or after taxes? Don’t get stuck in the details – just give. Learn more about how to start giving money when you never have.

This isn’t covered in the 50/20/30 budget rule at all. Blessing others could possibly come from your discretionary spending. But, it isn’t defined as it is in the Cents Plan Formula.

Key Note: Many people are overwhelmed with the idea of giving when they are straddled in debt. Start small with one percent of your income. As debt is paid off and your personal finance situation improves, keep increasing the giving percentage.

Fun Spending

Fun spending (AKA discretionary spending) is exactly what it is labeled – fun spending!

This is the space in our life that feeds our hearts. It is why we work hard to have fun spending money in our lives.

Spend your money where your heart desires.

Examples of Fun Spending:

- Entertainment

- Eating out

- Memberships

- Kid activities

- Gifts

- Date nights

- Hair Salon

- Vacation

- Latest iPhone or other technology gadget

- Anything FUN!

- And my personal favorite…Slush money – spending money you can spend any way you want without any questions.

Recommended Fun Spending Percentage – 20%

Fun spending is when you live life to the fullest.

Are you struggling with discretionary spending? Overspending each month? Then, learn how to stop spending money now.

During Money Bliss Steps 1-5, fun spending is typically well below the 20% threshold. However, if you choose to increase fun spending percentage during that time; then, realize it will take much longer to finish Money Bliss Steps 1-5.

Past Money Bliss Step 6, it is recommended to increase the percentages for fun spending and saving at the same rate.

One of the best ways is to try a service like Trim to cut down your discretionary expenses.

In the 50/20/30 budget rule, discretionary spending is set at 30% which is so much more than the 20% in the Cents Plan Formula. However, when money is tight and debt is present in your money situation, allocating that much money to fun spending is not a smart money move and you need a shoestring budget.

The flexibility with the Cents Plan Formula is the fun spending money can increase when your other category expenses are lowered. Something to remember to keep you motivated!

Key Note: Plus the best part, once you have eliminated debt, lowered your basic expenses, then increase the fun spending percentage with the Cents Plan Formula. This is the reason you worked so hard to pay off debt and build a strong foundation with money.

Debt

Yes, debt is part of the Cents Plan Formula.

The goal is ZERO debt.

Debt is the cash flow killer in your budget. With debt, it is impossible to do many of the above categories. Most debt (outside of a mortgage) is just overspending on items that we could not afford in the first place.

Recommended Debt Percentage – 0%

Don’t fret…it is possible to get out of debt!

It takes a dedicated plan.

Check out this post on Five Steps to Pay Off Debt (and move on with life). Also, are you making one of these debt mistakes?

The key to staying out of debt is to save in advance! Up your saving percentage for that big purchase and pay cash. Then, the chunk of debt eating up your percentages can be allocated to other categories!

Not sure which method to use – debt snowball or debt avalanche?

Unfortunately, debt is not even mentioned in the 50/20/30 budget rule. However, most households struggle with debt at an overwhelming rate.

Key Note: Don’t get overwhelmed if debt takes up a huge portion of your income. You can and will overcome it.

How to budget your money with percentages?

The Cents Plan Formula is developed to be flexible.

Allowing for changes as you go through various seasons in your life and on your money journey through the Money Bliss Steps for Financial Freedom.

- With savings, you prepare for the unexpected expenses, so you are able to pay cash instead of going into debt or possibly prepare for early retirement.

- By eliminating debt and minimizing your basic expenses, there is money in the Cents Plan to go towards another category of your choice.

- With giving, you can help others and provide a smile.

- Fun spending is where you live your life – filling your heart with memories.

- The last category is debt; in the Cents Plan Formula, it serves as a reminder of the slippery slope debt can cause in life. If you are debt free, make to avoid not falling back in debt trap again.

All in all, money is a part of our daily lives. Get to a point where you control money and not be controlled by money.

Learn how to budget money and still enjoy life.

With the Cents Plan Formula, it is simple and easy to formulate the spending of money.

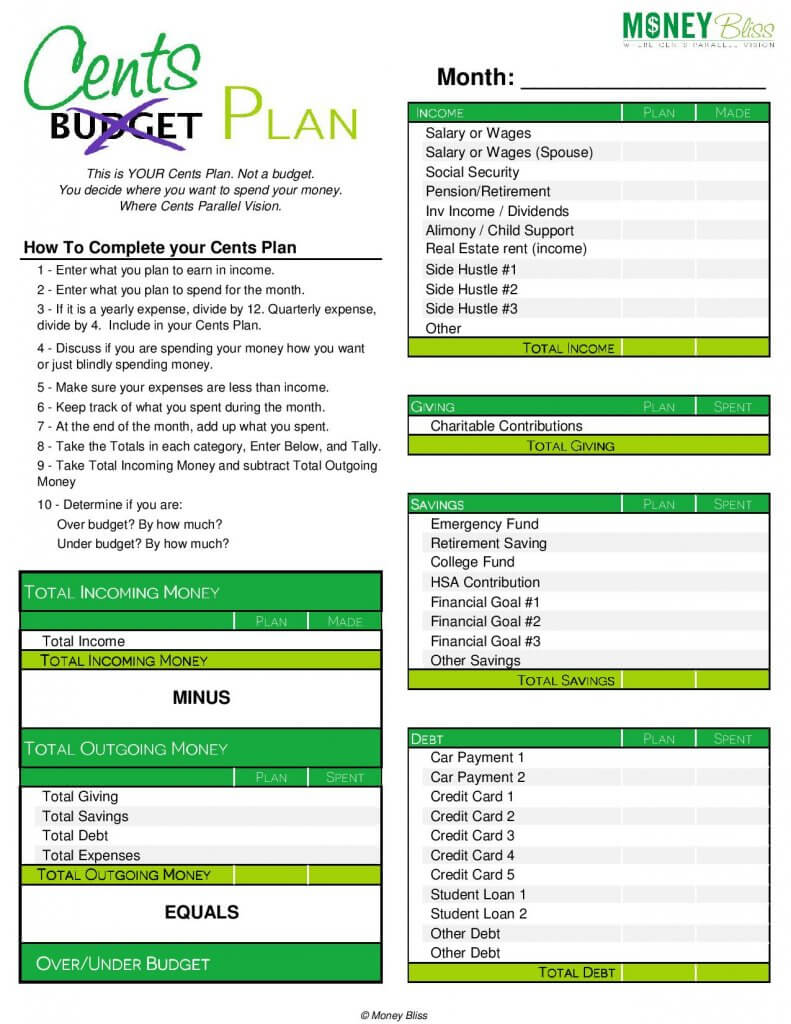

Now, take Action

what you learned about the Cents Plan Formula and turn it into the Cents Plan (AKA Budget).

This is YOUR Cents Plan. Not a budget. You decide where you want to spend your money.

Enjoy Freedom with the Cents Plan. A budget is too constricting. Learn to enjoy your life with money. Get out of debt. Save money. Live life.

Get your Cents Plan now.

Don’t forget to read the Money Bliss Steps to Financial Freedom!

This guide to financial freedom will help you enjoy money and your life.

The first step of the Money Bliss step is to get your financial house in order. Don’t delay! Get started today.

Budgeting Help:

- How to Organize your Personal Finances in 8 Simple Steps

- 110+ Personal Budget Categories for a Fail-Proof Budget

- The Top Budgeting Apps for You

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

This is something I really want to work on this year. I feel guilty spending fun money, but then I go and spend on things like fast food that really aren’t good on any level. I’d also like to up my giving at church.

Rabia – Have you signed up for the 7 day Jumpstart Your Money Bliss? It is a FREE program I offer. It will help you get on the right track. Check it out – http://www.moneybliss.org/jumpstart/

Definitely pinning this! We need to work on being smarter with our budget!

20% fun spending sounds great! i need to remember that and start doing it more! =)

Hi Ananda! I’m glad you like the fun spending! It is an important part of the equation.

I think I spend way to much on my “Fun spending” 🙂 I guess I’ll have to adjust, boohoo. Thanks for sharing 🙂

Hi Coralee! I think all of us have been guilty of too much “fun spending.” The best part of the formula when you are able to have zero debt and limit your basic expenses, then you can increase “fun spending.”

This seems like a great formula. 🙂 Thank you for sharing!

You’re welcome Tami! I hope you find it helpful!