How to Make a Budget in 7 Simple Steps

Inside: Learn how to budget for beginners with this step-by-step guide. Plus download your free budget printable. This budgeting thing will work – I promise.

Making a budget is the first step to financial freedom. However, it is the step when most people give up because, well, it is too hard to figure out.

Don’t give up.

We have plenty of resources at Money Bliss to help you out.

There are so many ways people get paid: daily, weekly, bi-weekly, twice a month, or monthly. In one household, you may be paid at different times of the month, which just complicates things one step further.

Later in the post, we will discuss in detail how to make a budget. Plus you won’t pull out your hair doing it!

Too many times people get caught up in what to put in a personal budget and what not to include in the budget. One of the biggest mistakes is forgetting a category, and then, being short on money for the month.

This post is perfect for understanding how should a beginner budget as well as someone who struggles sticking to a budget plan.

In detail, you will learn everything you need to know on how to create a budget. A personal budget that will work for you and your household.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Budget Basics

A personal or household budget outlines the expected income and expenses for a defined period.

Too often the word budget has a negative connotation, but in reality, you are making a spending plan based on your personal goals. Here is a full list of all the advantages of budgeting, so you truly understand the benefits of a budget.

In the grand scheme, a personal budget is a guide to see how you are staying on track towards your money goals.

By using a budget, you can see if you are over budget or under budget for the month.

It is a litmus test of how you actually spent money compared to your plan for money.

What is the first step in making a budget? These are the three basic things that need to be decided in order to create a budget.

- Timeframe – Are you going to budget by paycheck or by month?

- Level of Detail – How specific do you want the budget to be?

- Tracking – How do you plan to spend and track your money?

Keep reading because we discuss more of these in detail.

While having a budget is fine and dandy, the key to success with a budget is it actually working for you.

Decide Time Frame to Budget

Regardless of when you get paid, figure out how you plan to budget. Will you budget each paycheck? Will you budget once per month? Weekly?

That decision is completely up to you.

If you plan to budget monthly, then you look at all of the monthly expenses as a whole.

If you plan to budget by paycheck, then you must decide what bills to pay during the paycheck cycle.

Need to budget on a bi-weekly basis, then do the same method as budgeting by paycheck and determine which bills will be paid when.

Don’t freak out and give up now. This is laying the groundwork for a strong foundation with money.

Figure out what will work for you and your household. What works for your friend may not work for you. This is important for long-term success.

Tight vs. Loose Budget

What is the level of detail in your budget?

Some people track everything down to the penny and want to know how and where their spending is going. They use all the budget categories found in our Cents Plan. That is called the tight budget.

Other people want to get ahead financially but have zero desire to track every nickel. They use fewer, bigger categories and lump expenses together. That is called a loose budget.

Honestly, both methods of budgeting work.

In the end, what will work best for your personality?

At Money Bliss, we recommend starting out using detailed and accurate information when creating a budget. Then, as you become more comfortable using a budget and saving money, you can loosen the detailed budget categories to higher-level categories. Grab our budget worksheets.

Method of Payment

This is typically an overlooked step when setting up a budget.

There are one of three options.

- Cash.

- Debit card.

- Credit card.

- Okay…maybe four. Auto drafts straight from your checking account to pay bills. For instance, the mortgage payment is set up to pull money from checking on the 1st.

For this step, we are talking about how to pay for things on a daily basis. Groceries? Gas? Eating out? Clothing?

What payment types will work for you to stay within budget?

Do you tend to go over budget consistently? Then, maybe using cash envelope system is essential for your success.

how to budget with credit cards

If you like to use credit card rewards for extra money. That is 100% okay, if and only if, you can pay off the balance in full every month.

By using a credit card, it takes more discipline to track your purchases and stay within budget.

Pro Tip on Credit Cards: This is where credit cards tend to bite when budgeting (and reaching financial freedom). You spend money this month and then pay for your spending the following month. That needs to stop. It is a cycle that won’t get you ahead with your finances. (seriously true)

Change all of your credit cards to close at the end of the month (27th or 28th). When the billing cycle closes, pay it in the same month. Rather than the 21-25 days later on their determined due date.

This will stop the temptation to overspend what is left in the checking account. Plus it is easier to budget since you are budgeting and paying for the items in the same month.

Sit down and decide how you plan to spend money.

Remember, by taking the time to figure out how things are paid for two things happen. First, it helps many of the arguments over money.

Second, it helps your success rate with using a budget.

Enjoy guilt-free spending and effortless saving with a friendly, flexible method for managing your finances.

How to Make a Budget

Okay, now to the nitty-gritty of how to create a budget.

Here are the simple steps to do a budget. As we have mentioned many times, a budget shouldn’t complicate things. Budgeting makes you save more money because you are making a plan for your money.

These are the simple ways to budget money.

1. Organize your Financial House

Time to start gathering up all of your statements and bills. Any and everything related to your income or expenses. Don’t leave anything out.

In the Money Bliss Steps to Financial Freedom, this is step #1 – get your financial house in order.

This is laying the foundation to be successful with money. Step by step. Layer by layer.

The more information you can pull together, the better. Then, you won’t be thrown off by any surprises (AKA forgotten unexpected expenses).

Also, to cover the budget basics decide:

- Timeframe – Are you going to budget by paycheck or by month?

- Categories to Use – How specific do you want the budget to be?

- Tracking – How do you plan to spend and track your money?

Learn how to organize your personal finances first.

2. Determine Your Goals

This is my favorite part of the budgeting process! A time to uncover your life’s vision and determine achievable goals.

This is the whole reason to budget. Period.

What are your goals? How do those goals relate to money?

Too many times, we go through life spending money here and there and not really knowing where it goes. By the end of the month, there is no money left over for what you want to spend your money on.

Doesn’t that sound backward?

Creating a personal budget is about aligning your spending with your goals.

Here at Money Bliss, we refer to it as:

Where Cents Parallel Vision

As you are going through this process of how to make a budget, it is time to line up your cents (both dollars as well as head sense) and make sure they are running parallel to your vision.

If you have never created these before, here is a great resource on setting money goals.

With our money bootcamp, you can walk step by step through this process.

3. Write Down Income Sources

A personal budget is based on what you make each month or paycheck. You can use net income (taxes already taken out) or the amount on your check.

For the advanced budget, you can include taxes. Then, you can determine if you need to adjust your withholding based on the size of your tax return.

When making a budget, it is best to always use guaranteed income. Not overtime or bonuses.

Extra income is what we call little swings. Download our printable from our resource library to understand how to budget for these types of situations.

If your income is 100% variable income or commission, then check out My Ultimate Money Blueprint to develop a budget plan that works in the long term.

Record all sources of guaranteed income to make a budget.

Make sure you understand the types of income sources to put into your budget.

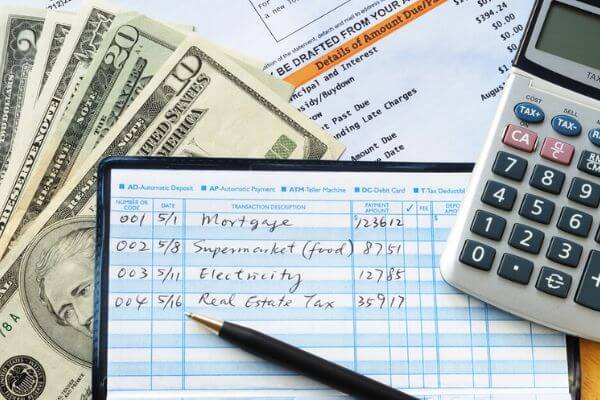

4. List all Expenses

Make a list. All the expenses – both every month and those annual expenses.

For this step, you can look back at bank statements, credit card statements, or even of them may give you an annual spending report.

To truly understand all of the categories and know that you are not forgetting an expense – download our Cents Plan (AKA budget).

1 – Mandatory Expenses:

The basic fixed expenses to live is a mandatory expense.

Basic needs include shelter, food, clothing, and transportation.

Bottom line is the mandatory expenses you need to survive the day in and out.

For instance: bus fare to get to and from work would be a mandatory expense. Financing a brand new SUV is not a mandatory expense.

Discretionary Expenses:

These are all of the fun extra expenses. Typically, these are your variable expenses.

In the grand scheme, you can totally live without them, but you may not be thrilled about it.

For instance, picking up your morning coffee through a drive-through (instead of getting free coffee at work) or grabbing a pizza on the way home from work (instead of making dinner) are discretionary expenses.

In this step, you want to figure out how much you are spending.

You may want to start with a shoestring budget.

5. Set up a Budget or Spending Plan

Typically, most people think this is the only step in how to make a budget. But, in actuality, it should be one of the last steps.

A budget should be made around your money goals and visions.

Keep that in mind, while working through your budget.

Now, that you pulled together everything to figure out your income and current spending, it is time to combine that with your money goals and visions.

Your first attempt at a budget will more than likely be difficult. Nine times out of ten there is overspending and decisions to be made on cutting expenses. That is okay.

Keep working through the budget.

The goal is to set up a fail-proof budget. Will a traditional budget, a percentage-based budget, a zero-based budget, sinking fund budgeting, or backward budgeting work for you? Plus there is a method of budgeting for people who hate to budget.

You need to find a budgeting method or spending plan that works for you to find success.

The key to creating a budget is to make it work for you.

Bonus Tip – Schedule a recurring meeting to discuss your budget and how you stand.

6. Track your Progress

This step makes or breaks your budget.

Remember, the purpose of a budget?

To track your budget, it is important to decide if you want to track a tight or loose budget. Regardless of your choice, you must know if you are over budget or under budget each month.

The easiest way to track your spending is with cash. When it is gone, it is gone. Pick up the cash envelopes to help you stay on track.

If you want to use credit cards for those great rewards, then it will take more diligence to track. Some options to help you include:

- YNAB

- Simplifi

- Tiller Money

- Quicken – read my Quicken Review.

This step needs to be done at a minimum of monthly or paycheck basis.

This is the next critical step when people give up on a budget. You have to find a tracking method that works for you.

Pro Tip: When beginning a budget, more time is needed to track expenses and make sure your spending is aligned with your money goals. Just remember, the first three months are the toughest to stick to a budget.

7. Make Adjustments As Needed

The last step in creating a budget is actually maintaining your budget.

As life goes on, things will need to be tweaked here and there.

Another way to put it is maintenance budget mode.

For instance, if the insurance bill is higher or the kids are growing, then those categories need to be increased. That means another category must be decreased.

My favorite type of budget adjustment is a pay increase!!

Just note, that a rise in pay doesn’t equate to a rise in your standard of living. I know – I should like the bummer of bad news. Put that pay increase towards debt, savings percentage, or even share the love with an increased giving percentage.

Budget Printable

Download your free budget printable to help you get started today!

Follow These Steps to Making a Budget

Your first budget won’t work. So, don’t get down on yourself and give up.

You will need time to refine what you are working on. You need to stay focused on these steps. It is possible to be successful.

If you are still lost in My Ultimate Money Blueprint, we spend a detailed amount of learning on everything you need to consider when budgeting. Very extensive compared to what you have read. This is perfect to start winning with money today.

Remember, you must organize your personal finances and know your money goals. That is the foundation for creating a successful budget.

In the end, be realistic with your budget.

With these 7 simple steps on how to make a budget, you are ready to make a budget and stick to it.

Grab your budget worksheets and get started now!

Check out this to improve your budgeting on a low income.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

Your tips about how to make a budget are awesome! You break them down into easy steps that even beginners could understand! Thank you so much for sharing your thoughts on how to make a budget.

Glad you found the tips helpful!