How to Save $10,000 in a Year: Simple Guide for Saving Money

Inside: Making money is one thing, but saving it is another. Learn how to save 10000 in a year using the following steps. Plus download your free printable!

The number of people who do not save money is growing at a rapid pace. The economy has changed and many families are struggling to make ends meet, even with two incomes.

That is why saving $10,000 in one year can seem like an impossible goal for some people.

You can save $10,000 in a year.

This has been proven over and over here at Money Bliss.

This has happened because my readers dedicated themselves to one of our money savings challenges.

A lot of people are interested in saving more money right now, but not everyone can afford to save a lot of money. You do not need a ton of income to be successful, you just need to dedicate yourself to new habits of saving.

The thing is – money doesn’t grow on trees, and I wouldn’t recommend waiting for one either if you want your savings plan to be successful.

Are you ready to be the next Money Bliss success story to save 10000 dollars in a year?

If so, then you are in the right place. Let’s create your 10000 saving plan.

How to Save $10000 in One Year

It’s not as difficult to save $10,000 in one year as you may think. All it takes is a few small changes, creating a plan, and some careful budgeting.

The first step is to start saving money.

This can be done by paying yourself first. Decide on the amount you want to save each pay period. Then, you prioritize your savings before all of your expenses and money runs out

Next, you have to decide where to save your money.

- Will you put the money into an online savings account where the temptation goes away?

- Or invest in your future with a Roth IRA and/or 401k?

- Where can you grow your savings over time?

Do not underestimate the power of your employer match contribution. If they offer this option for retirement savings or another type of investment account like Roth IRA or 401K, take advantage by contributing the maximum your plan allows each pay period.

Finally, you have to make sure you are living below your means with your increased saving rate.

These are all the fine details to make sure you learn how to save $10,000 in one year with cutting expenses.

Don’t forget to set up automatic transfers for all of your savings so they’ll be taken care of even when you don’t do it!

Shortly, you will find savings tips to help you save $10,000. The exact steps you need to do to save your first $10K or whether you want to do it again.

Breakdown How to Save 10000 Dollars in a Year:

But, first how much do you have to save to hit that 10K milestone in a year?

To save $10,000 in one year, you must set aside an average of $833.33 per month for 12 months.

Don’t quit reading now and walk away! You are reading this post for a reason. So, you will reach your saving challenge goal.

Let’s break that monthly number down into bit-size chunks.

| Daily: | $27.40 |

| Weekly: | $192.31 |

| Bi-Weekly: | $384.62 |

| Monthly: | $833.33 |

| Bi-Monthly: | $416.67 |

| Quarterly: | $2,500.00 |

Places to Save $10K in a Year

Your goal for the year is to save $10,000.

First, decide where you want to put this dollar bump in savings.

Everyone is at a stage in their financial journey, so what you choose will be completely different than someone else.

Here are some ideas:

- Emergency Fund

- Roth IRA (current contribution limits)

- Retirement through work with 401k or other profit-sharing plan (current contribution limits)

- Health Savings Account

- Rainy Day Fund

- Education

- Vacation Fund

- Downpayment for House

- New-to-you Car

- What’s Next Fund: In our house, we know something big is going to need to be replaced, so we plan a lump sum of money for that purpose every 5 years.

- Money for Side Hustle

Also, you may likely divide up your $10K savings into more than one bucket!

What are the ways you plan on saving $10,000?

Tips to help you Save $10000

According to the Federal Reserve, only half of Americans have retirement accounts.1

This means that most people will retire broke. Yikes!

The only way to achieve a comfortable lifestyle is by saving, investing, and planning for your future.

You can save $10,000 in one year if you make a goal and try your best. It will take some effort as it is not easy to do so, but the rewards are worth it.

If there’s anything that we know for certain about living life well, then this is: “you must be willing to work hard.”

So, what are some practical steps that you can take to save money? Let’s start with the first one.

1. Mindset

The purpose of this personal challenge is to help you save $10,000 in one year.

To save $10,000, you probably cannot continue doing what you are already doing when it comes to saving money.

You need to change your money mindset and your money habits.

There are a few key steps you need to take in order to save money. The first step is to have a proper mindset towards your savings – figure out where all of your money is going, then figure out whether or to what degree you’re living as you can afford it.

The next step is you believe that you are capable of saving money. That is the bigger part of the battle for most. It is believing that are incapable of saving that much money.

If you haven’t heard of a vision board, then you must create one ASAP. And don’t forget those money affirmations.

2. Automate Savings

Automating savings is a great way to save money.

It can be done by setting up automatic transfers from your checking account or even transferring funds from your paycheck into an emergency fund that you will never touch.

This allows for more freedom in spending without having to think about if you saved your goal for that pay period.

With direct deposit, you will save money automatically and the temptation to spend drastically goes down.

If direct deposit is unavailable, you could set up an automatic transfer with your bank.

3. Focus on Saving Goal

All of your money decisions revolve around your goal of saving 10000 dollars.

That is the smart financial goal you have created for yourself. Now, that is your #1 focus.

Here is how to believe you will save $10k before you start:

- Tell yourself over and over that you will save $10K by (insert your date).

- Post reminders about your goal.

- Put a sticky note on your debit or credit cards and/or cash envelopes.

- Find an accountability partner.

- Review your habits that make saving more different.

All in all, you have to stay dedicated and commit to your saving goal.

4. Budgeting

Budgeting allows you to save money and reduce stress.

It is important to take the time and create a budget that works for your needs to minimize spending and maximize savings.

When you sit down and take a hard look at your budget, it is easier to make cuts and prioritize what needs the most attention.

In this case, your goal for the next year is to save 10000 dollars!

Don’t skip this step! You must pay yourself first to reach your 10k goal.

5. Biggest Expenses

We are talking about your biggest fixed expenses – housing, transportation, and food.

Big moves are difficult, but they produce big results. Downsizing or moving to a cheaper place is drastic, but it can save you thousands of dollars in the long run.

Other options include renting out space in your home on Airbnb, negotiating with your landlord, and taking other measures to reduce housing expenses.

Although it is now more uncommon for families to have only one car, that is a great way to save money on a depreciating asset and ongoing maintenance costs.

Refinancing a car payment or trading in your set of wheels for an affordable ride will help you keep up with the latest trends without breaking the bank. You could also save on gas by doing your own maintenance.

In order to save some money, you should start meal planning and save money on food. You can also eat out less and use coupons or cash back apps for your grocery shopping.

Buying in bulk is a great way to get cheaper prices on certain items, but it might be too much of a hassle if you’re unsure about what kind of foods work best with each other–and there’s always the possibility that they’ll go bad before their expiration date!!

6. Increase Your Income

When you increase your income, the sky is virtually your limit. There are various ways to accomplish this goal but each way comes with its own set of risks and rewards.

The best way to increase your income is by taking on a second job. Even better, negotiate or find a new job that pays more and increases your income.

The next possible way to make money is from a side hustle or an online business, such as Amazon FBA, Etsy, eBay flipper, Rover, or affiliate marketing. This will allow you to be your own boss and work from home.

Check out the best ways to make money online for beginners.

People who want to save $10,000 in a year should increase their income. To do that, you must find ways to earn more money.

Don’t forget that you always want your money to make money! This is called passive income.

It is possible to make more money on your business than you make more money in your current job or career.

7. Track Progress

It’s important to track progress with goals. This will help you see the journey and milestones of your savings.

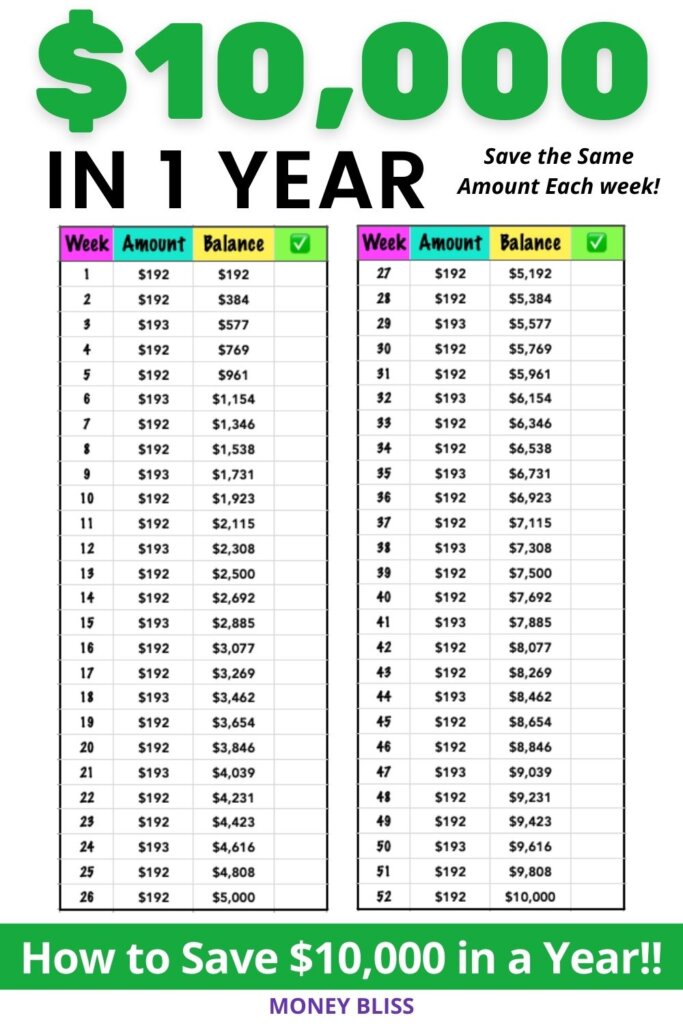

To track progress, download our free $10000 printable and check off boxes as you hit milestones.

Before you can reach $10,000 in savings, you must first reach smaller amounts such as $500, $1,000, or $5,000.

8. Celebrate Milestones

You can decide what to reward yourself with, but it’s important to celebrate each win by rewarding yourself somehow.

Plan your milestones and rewards in advance.

That way you have the motivation to keep going and know that you can afford your milestone.

Some examples:

- $500 = Ice cream treat out

- $1000 = Take out from your favorite place

- $2500 = Something you want, but haven’t wanted to splurge.

- $5000 = Halfway point! Celebrate with dinner out.

- $7500 = Plan an experience gift like ziplining or rock climbing.

- $10000 = A hotel night and dinner to celebrate with your significant other or friends.

Now, come out with your own milestones and rewards that match your lifestyle and desires.

Bonus Tip – Get Out of Debt

Saving money becomes way easier once you have paid off all debts (excluding mortgage).

This can be accomplished by prioritizing your loans, paying down the highest-interest loan, and then moving on to the next one.

Once you’re free from debts, it’s time for some simple adjustments in your spending habits that will help save thousands over a year.

Debt will always hold you back on your financial journey until you enjoy a debt free life!

How to save $10000 fast

So, you want to save $10,000 in a year?

Many of the methods listed above will help you save $10,000. But, let’s add ways to get your results faster!

You can do it!

At first glance, this might seem like an impossible task but with these tips and tricks, it’s not too hard to set your budget up so that you’ll be able to afford everything from a vacation abroad in your future.

The key is finding ways around spending money on things such as coffee, clothes, and other small luxuries so you can save the most money.

Here is a list of ways to save $10,000 in one year:

- Cut your spending on coffee by 90%

- Eliminate cable TV from your life for a month

- Stop using taxis or public transportation when possible

- Avoiding credit card debt.

- Living with roommates instead of buying a house.

- Get rid of all unnecessary subscriptions

- Stop buying coffee at Starbucks or other coffee shops

- Don’t buy anything with coupons unless it’s something you really need

- Stop eating out

- Cook your own food at home

- Figure out what you spend the most on in a month and cut back by 20%

- Sell any unused items you have in your home

- Spend $5 per meal. Frugal meals are good!

- Creates grocery list to limit eating out

- Live like a thrifty person

- Try a no spend challenge

- Compare what is happening with your savings goals

- Eliminate fees

- Be careful with your money. Stop buying things that you don’t need and start living more simply. Do you really need that new iPhone?

- Think about purchases over $25, specifically whether or not it’s worth it

- Save for a set purchase instead of buying things as you go

- Limit all impulse buys

- For more ideas, check out our 200+ Frugal Living Tips.

There are some faster methods above that will get the job done quicker than just saving for 12 months.

Saving money isn’t as hard as you think it is. All it takes is some creativity and a little bit of willpower.

How to Save $10000 in a Year with Envelopes

Envelopes are a great way to save money. They allow you to collect interest on the cash you have saved in your account. Envelopes make it easy for people without much financial knowledge to save.

Since you are saving such a large amount of money, it is best to use an online budgeting app that works well with the envelope method.

To save money, you need to know how much you have saved with the 10k in 100 days challenge.

Tracking your progress is a good way of doing this and can be done by using envelopes with the amount inside that corresponds to what total savings count towards each goal.

Download Your 10000 Dollars Printable

Saving up $10,000 can be difficult and it’s not easy to know what to do. The tricky part is learning how to sustain those savings for the long run.

To help you show you how to save on a consistent basis, you can download one of our free $10000 printables.

When you sign up, you will have access to these free money saving challenge printables!

How to Save 10000 in 6 Months

Okay, you are determined to speed up your $10k savings!

That is awesome!

All you have to do is double how much you are saving each pay period.

To save $10,000 in 6 months, you must set aside an average of $1,666.67 per month for 6 months.

| Daily: | $54.65 |

| Weekly: | $384.62 |

| Bi-Weekly: | $769.23 |

| Monthly: | $1,666.67 |

| Bi-Monthly: | $833.33 |

| Quarterly: | $5,000.00 |

How to Save $10000 in 3 Months

Saving $10,000 in 3 months is a difficult task but not impossible. Here are some suggestions:

-Start saving money as soon as you can and work your way up to $10,000.

-House hacking is a must. Buy a house and rent out the rooms for extra income. Live with parents. Another great option is house sit and be paid for your housing!

-Rent out your car (or sell it) in order to save on gas costs.

If your goal is to aggressively save $10000 in three months, then you must drastically reduce all expenses.

To save $10,000 in three months, you must set aside an average of $3,33.33 per month for three months or in a period of 90 days.

| Daily: | $111.11 |

| Weekly: | $833.33 |

| Bi-Weekly: | $1,666.67 |

| Monthly: | $3,333.33 |

| Bi-Monthly: | $1,666.67 |

| Quarterly: | $10,000.00 |

How to Save $10000 in 2 Years

Saving 10000 dollars in a year is a little more aggressive than you believe possible. That is completely okay.

It does not matter how long it takes you to save $10000 as long as you complete the saving money challenge!

To save $10,000 in two years, you should start by saving at least 10% of your income every month. Then you can invest that money into index funds or other investment options to maximize your wealth.

To save $10,000 in 2 years you must set aside an average of $416.67 per month for two years or $5000 per year.

| Daily: | $13.70 |

| Weekly: | $96.15 |

| Bi-Weekly: | $192.31 |

| Monthly: | $416.67 |

| Bi-Monthly: | $208.33 |

| Quarterly: | $1,250.00 |

Are you Ready to Save 10000 Dollars?

A money saving challenge is a competition with the goal of finding ways to save money.

The best way to save money is through baby steps.

To start, you can take a look at your current financial situation and identify the areas of opportunity for savings. For example, if you’re struggling with debt or have an expensive monthly budget, then it’s time to find ways to reduce spending in these areas.

Once you’ve identified some opportunities for savings and created a plan accordingly, make sure that your progress doesn’t slow down by using tools like automatic saving plans and paperless billing.

Money saved in the long run will be worth it and you should participate in any of our money saving challenges.

The key point about saving money is not having too many goals as it will make it difficult to prioritize which ones are more important than others when trying to save more.

This is a simple guide for saving money, and it’s designed to help you save $10,000 in a year. Next up, is learning how to save 20000 in a year.

We have included tips on how to save money, but more importantly, change your finances for the long term.

Related Money Saving Challenges:

- Your 52 Week Money Saving Challenge + Free Printable

- 100 Envelope Challenge – Fun $5050 Money Saving Plan

- Save 5000 in a Year with this Easy $5,000 Savings Challenge

Source

- Federal Reserve. “Changes in U.S. Family Finances from 2019 to 2022.” https://www.federalreserve.gov/publications/october-2023-changes-in-us-family-finances-from-2019-to-2022.htm. Accessed January 22, 2024.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.