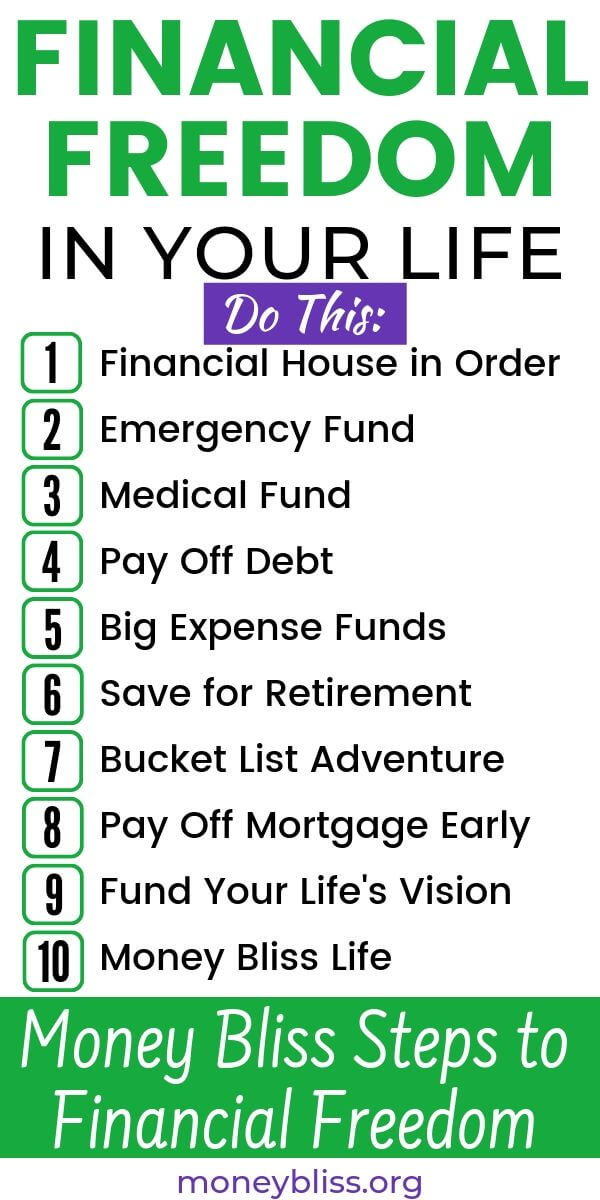

10 Money Bliss Steps to Financial Freedom

Inside: The Money Bliss Steps to Financial Freedom are in order for a reason. They are a path, a guide, to help you reach financial freedom. They work. You can become the next millionaire. Start today.

Have you ever wondered how you get financial freedom in 5 years?

It all starts with a plan and a desire for something more in life. Also, you will need a little bit of dedication and persistence along the way.

Here, I have developed our own Money Bliss system to help you achieve financial freedom.

These steps are laid out for you to enjoy a life of Money Bliss. This is a path, a guide, to help you enjoy financial freedom.

The Money Bliss Steps are in order for a reason. They work. This is how you become a millionaire with no money. I did it. You can too.

Hint: Don’t skip around because you are just delaying reaching financial independence. Plus the stress isn’t worth it.

Background on the Money Bliss Steps to Financial Freedom

Everywhere you turn, there is information out there on how to manage your money. However, most of it is conflicting and difficult to navigate especially if you’re not naturally a numbers person.

So, what are you left to do?

Continue on your current path? Or figure your own way and hope it works?

While most of the advice is good and valid, for me personally, there was one thing glaringly wrong. (Yes, we learned this after many, many mistakes.) No progress will be made if you attack everything at once. It is a recipe for disaster. However, most of the financial gurus say to buy a house, pay off debt, save for retirement, and start a 529 plan all at the same time.

The typical financial advice has you walking on thin ice.

You are trying to get ahead on a slippery slope. There is no foundation to stand and build on toward financial independence. The cycle of paycheck and paycheck is vicious. No milestones to actually cross on your money journey.

Do you hear the ice breaking?

The clock ticks until the ice will completely break from underneath you and you find yourself stuck in a financial mess.

In order to achieve a financial freedom life, a strong solid foundation is necessary.

Thus, enter the Money Bliss Steps to Financial Freedom.

The financial freedom plan. The financial freedom steps. A guide was developed on how to get financial freedom based on what I did.

After failing with the “typical financial advice,” I decided to go against all recommendations and pay off our $53,000 of debt. Many people thought we were nutso and that is fine with me. Once we paid off debt, I found ourselves able to finally make progress with our finances. We had a solid emergency fund and medical fund in place, so we could handle the unexpected things or multiple surgeries when maxing out our medical deductible.

We built a strong foundation with our money.

That is the key to financial freedom.

Take the money steps to financial freedom to start your journey to a solid money foundation and reach financial freedom.

Definition of Financial Freedom

What does financial freedom mean to anyone? How does that differ from financial independence?

First of all, if you achieve either financial independence or financial freedom, then you are ahead of most of American society. So, give yourself credit. It takes perseverance and persistence to reach your money goals. So, you have to keep trucking along.

Financial Freedom:

The financial ability to act or spend without hindrance or restraint.

When you reach financial freedom, you are not a slave to money. You have unrestricted access to the money you need in life.

That is Money Bliss Step #10; when you reach Money Bliss life.

Financial Independence:

Money is not the first factor in making your life decisions. You are independent because you are building a strong financial foundation.

For instance, a job loss or sudden loss of money would not throw you into financial ruin without the ability to pay bills.

Financial independence means money doesn’t control and influence decisions.

Financial independence begins once Money Bliss Step #5 is complete and continues to grow until you reach financial freedom in Step #10.

While financial freedom and financial independence are very similar; they vary in the extent of free spending of money.

Money Bliss Steps to Financial Freedom

Remember, these steps are in order to build a strong foundation of money.

Think of it as climbing a mountain…even though you want to jump to the top, you can’t. The only way up is step by step. Your money journey is the same way.

A strong foundation will lead to financial freedom fast.

For most people, the steps to financial freedom breakdown into three phases:

- Baby Steps / Pay Off Debt – Phase One – Steps #1-4

- Rainy Day Fund / Saving for Retirement – Phase Two – Steps #5-7

- Pay Off Mortgage / Build Wealth – Phase Three – Steps #8-10

While each step is just as important as the other, these phases are the biggest phase of the transition on your money journey to financial freedom.

Phase One of Money Bliss Steps to Financial Freedom

1. Financial House in Order (Create your Cents Plan)

The first step to living a life of Money Bliss is to get your financial house in order. This step isn’t meant to be daunting at all. At this point, look at your financial picture as a whole. The 1,000 foot view!

You must know:

- Where you are spending your money

- How many accounts do you have?

- How many credit cards are open?

- Any outstanding debt unpaid?

- How do you want to live your life with money?

The next step is to create your Cents Plan (what we call a budget around here).

To live a life of Money Bliss, it is necessary to live within your means. Don’t play the “Keep up with the Joneses’ Game.” Remember, most people use debt to finance their lives. But, it does not have to be that way! You can pay in full on the purchase (and many times get a discount). Plus save hundreds of dollars in interest!

More Budgeting Help…

IMPORTANT

Another important part of getting your financial house in order is to make sure you are properly insured.

The first piece is life insurance. A basic guideline with life insurance is to have enough coverage to pay off your home plus living expenses for surviving, immediate family members. If you are single with no dependents, a small life insurance policy to cover funeral expenses and travel costs for the family is enough.

However, it is important to review all insurance policies – auto, home, renter’s, umbrella, identity theft – to make sure you are properly covered.

Completing the first step puts you on the Money Bliss Steps to Financial Freedom.

Remember to focus on each step individually. It is impossible to work through all of the steps at once.

2. Emergency Fund

An emergency fund is so important because life will throw curve balls. The question is not if an emergency expense will arise, but a matter of when it will happen. So, be prepared! Start an emergency fund.

The minimum emergency fund should be $1,000. Maybe even $2000+ with the higher inflation.

Yes, setting aside a minimum of $1,000 just for emergencies. However, a better threshold of how much to save for an emergency fund is 2% of the annual salary. The best place for an emergency fund is a savings account associated with a checking account. You need to be able to access the money quickly and not wait a couple of days.

Remember, this account is for REAL emergencies – not to cover overspending.

The only exception to the $1,000 minimum are high schoolers and college students; a $500 emergency fund should suffice.

Fifty percent (50%) of Americans cannot cover a $400 emergency expense out of savings, according to a recent study.1 Most noteworthy, when looking across income levels, the same statistic hardly varied. By saving money, you are considered an oddity in America. Rather, I prefer to be different and fiscally responsible while prepared for any situation.

When building the emergency fund, Money Bliss recommends building the emergency fund fast!

Methods to Build Emergency Fund Fast:

- Sell anything possible to reach the minimum threshold.

- Pick up extra hours or a side hustle to establish an emergency fund.

- If a Health Savings Account (HSA) is utilized, stop contributions for now.

- Temporarily stop contributions to an employer retirement plan for now until this step is completed.

- For more ideas…How to Save Money Fast – Save $1,000 in a Month

>>>The most common question is why to stop retirement contributions… Very simple, it is extremely difficult to make any significant progress financially when trying to attack all of the steps. Focus on the current step – build an emergency fund. Then, make progress through the remaining steps.

An emergency fund should be established in a short amount of time. Less than 2 months would be ideal.

The maximum size of an emergency fund is $5,000. Anything beyond that amount is considered a rainy day fund (part of Money Bliss Step #5).

3. Medical Fund

In today’s society, medical costs are high in the United States. By establishing a separate medical fund, medical expenses, co-pays, and deductibles are easily managed. Thus, not causing financial ruin.

How much to set aside for a medical fund?

Enough to cover the in-network deductible, prescriptions, and average co-pays for a year. If the medical account is depleted for any reason, stop the Money Bliss steps and come back to replenish one year of medical coverage.

While working through Money Bliss steps 4 & 5, one year of medical fund coverage is sufficient. Once Money Bliss Step 6 is started, re-visit the amount in the medical fund and fully fund to the out-of-network deductible and/or yearly amount for Health Savings Account.

Note on Health Savings Accounts (HSA):

If your employer offers a Health Savings Account (HSA), take full advantage of this type of insurance. The contributions to an HSA are taken pre-tax; thus, they lower your taxable income. However, each year a maximum amount of money can be contributed; in 2024, the contribution limit is $4,150 for a single coverage (up from $3,450 in 2018) and $8,300 for a family (up from $6,900 in 2018).

Another qualification of contributing to an HSA is the health coverage must be tied to a High Deductible Health Plan (HDHP). The other tax benefits of HSA are the account grows tax-free and withdrawals are tax-free (under current tax codes). Even if employment switches, the Health Savings Account (HSA) can be moved and used for medical expenses for many years in the future.

Since HSAs have tax advantages, the Money Bliss recommendation is to always fully max out the HSA contribution limit each year.

While working through Money Bliss Step #4 & 5, you must weigh the advantages and disadvantages of fully maxing out the HSA contributions for your personal money situation. However, if credit card debt is involved, wait until starting Money Bliss #6 to max out the contributions each year.

If you don’t have access to a Health Savings Account, create your own medical savings fund. It would be a plain, savings account. It won’t have the tax advantages as the HSA; however, money is set aside to cover just medical expenses. And that alone is worth less stress!

You will learn how to manage your money, your way. Not have your money manage you.

4. Pay Off Debt

D-E-B-T is the Cash Flow Killer.

The ability to get ahead financially when in debt is impossible! The cycle of debt happens very easily in our debt-obsessed, spending freely society.

Each HOUSEHOLD has over $104,215 of debt – credit card debt, student loan debt, and auto loans, according to a recent study.2 That number does NOT include mortgage debt. That is a LOT of debt (and overwhelming stress) to be carrying on your shoulders. Debt is the Cash Flow Killer in action.

With each debt payment, there is an outflow of money plus interest. Thus, debt is withholding your cash flow hostage and decimating your Cents Plan (aka budget).

Let’s look at a simple example of the cost of debt.

- Without an emergency fund to cover an unexpected expense, the typical reaction is to charge $800 to a credit card with 18% interest.

- Now, a debt and paying only the minimum payment due. It will take you 7.5 years to pay off the debt and pay $623.13 in interest.

- Making the $800 truly cost $1,423. With each payment, additional interest piles up on the total amount due.

The fourth Money Bliss Step is to pay off debt. Period. Pay Off Debt.

Traditionally, to pay off debt a couple of different methods are used; either the debt snowball or the debt avalanche (sometimes called debt stacking). There is a lot of advice as to which is best. Here is the one key factor to live a life of Money Bliss…. You must pay off the debt and live debt free.

In Money Bliss Step 4, the type of debt we are most concerned with is credit card debt, auto loans, personal loans, and student loans. Tackling the mortgage happens further down the line of the Money Bliss steps (to be exact it is Step 8).

If credit card debt or personal loans are included in your debt total, then Money Bliss recommends stopping all contributions to retirement accounts even if matched by the employer. With auto loans or student loans, Money Bliss recommends contributing to an employer retirement plan only up to the employer’s match during Money Bliss steps 3-5.

Phase Two of Money Bliss Steps of Financial Freedom

Reaching phase two is a huge accomplishment for most people. A good majority of society is living paycheck to paycheck and loaded with debt.

So, keep on the money step towards financial independence.

5. Big Expense Funds

Life happens. Unexpected job loss. Cross-country move. Long-term illness. The best outcome in these situations is to be financially prepared.

5A – The first big expense fund to create is a rainy day fund; a minimum of 3 months of basic expenses is needed.

However, six months is suitable for most households (comfort level). In some cases, twelve months of expenses are recommended; these situations include highly variable commission jobs or any person over the age of 55.

Once a fully funded rainy day is secured, a small step towards financial independence occurs.

The first glimmer of financial independence is that you are not a slave to money.

There is still progress to reach financial freedom. But, the money journey is moving in the right direction. #goal #financialfreedom

While funding a rainy day fund or any big expense funds in Money Bliss Step 5, contribute to an employer retirement plan only up to the employer’s match.

5B – The second part of big expense funds is to prepare for big expenses with long-term savings in advance.

Some big expense examples to save up for include a car, a down payment for a house, or a home remodel. Also, included in this section is saving for personal college expenses for yourself – not any children.

By setting aside money for big expenses, then you can stay out of debt.

Revisiting this step again to build up savings goals is completely normal. You pay in cash vs. strapped to debt. If revisiting this step, continue the current allocations on retirement savings.

6. Save for Retirement

The two biggest mistakes most people make when it comes to retirement is:

- (1) starting too late and

- (2) not saving enough.

Personally, I am guilty, too. In my 20s, my first response to saving for retirement was I would start once I got a pay raise. Yes, I did contribute some here and there. Rather, if I could do it over again, I would start saving for retirement at my first job when I was 14 and set aside at least 15% of my income. Good habits to start as young adults.

So, Money Bliss step 6 is saving for retirement.

Contribute 15% of gross income (or max out) to retirement accounts, preferably tax-advantaged accounts like Roth 401(k) or Roth IRA.

This percentage does not include an employer’s match. Think of that match like gravy or whipped cream on top. If you have a tax-deferred retirement account (traditional 401(k) or IRA), the employer match will pay the taxes on withdrawal.

If you have a choice between retirement accounts, Money Bliss recommends always choosing a Roth account. With a Roth IRA or 401(k), taxes are taken out on the contribution; however, distributions and growth are tax-free. (at least under the current tax code)

If you want to contribute more than 15-20% of your gross income towards retirement, wait until reaching Money Bliss Step 9. Remember the goal is to build a strong foundation towards financial freedom. Finish Money Bliss Steps 7 and 8 first.

7. Bucket List Adventure

What if you were to die tomorrow? Then, what is the one experience you wished you could do? What experiences do you want to feel? What is the most important thing for you?

This step is about you! A chance to live life now. Cross off a bucket list adventure.

Some examples of a bucket list adventure include: traveling, pursuing your passion, learning a new language, trying a new sport, switching professions, writing a book, and visit a country. The list can go on and on.

Money Bliss Step 7 is filling your heart with the adventure of a lifetime.

Too many stories include the words…

“We planned to travel once we retired, but my spouse passed away before we could.”

“I always wanted to work in “xyz,” but I was too scared because I felt the financial pressure to provide.”

“We wanted to move out of the city or to a foreign country, but now we don’t have the resources we hoped for.”

Personally, I heard these statements from my grandpa and my mother-in-law. Memories were never made because their loved one passed too soon. This is especially relevant in our fast-paced society. On this step to financial freedom, you set aside the net worth or FI number and enjoy life.

The first question is you are thinking, but wait, I’m not financially free from my obligations. Yes, that is true. However, you are alive!! If properly insured with life insurance, the life insurance will take care of your family’s needs, college savings, and pay off the house upon death.

One thing the life insurance CANNOT do is provide memories during your bucket list adventure.

The time to live is today. Take advantage of life and live for today.

Phase Three of Money Bliss To Financial Freedom

Aah! You have finally reached the final stretch to full financial freedom.

You are becoming independently wealthy.

8. Pay Off Mortgage Early

Almost all people believe paying off the house seems like a dream. This dream can become a reality. However, estimates show that 40% of homes are owned free and clear – no mortgage! 3

Above all, homeowners have paid off their mortgage and eliminated their biggest expense in the Cents Plan (aka budget). So, you can do it too!

Money Bliss Step 8 won’t happen overnight.

It will take time, persistence, and perseverance. For homeowners who have paid off their mortgage early, typically it took them about seven years. Therefore, celebrate the small successes as you progress in paying off your mortgage early.

By paying off a mortgage early, hence you save thousands of dollars in interest (maybe even hundreds of thousands). Plus years of paying off another debt wiped away! Consequently, you can live the life you want and move towards financial freedom fast.

Also, the swirling rumors about removing the mortgage deduction on personal tax returns or changing the current tax code came true. So, the deduction for interest on mortgages may become non-existent if claiming the standard deduction. 4

Learn how to manage your money, your way. Not have your money manage you with the Money Bliss Steps to Financial Freedom.

9. Fund Your Life’s Vision

Money Bliss is all about Where Cents Parallel Vision.

To reach that place, where Life + Money = Enjoyment.

Yes, experiencing this place happens around Phase Two (Money Bliss steps 5-7). It is on a smaller scale. However, once the mortgage is paid off in Step 8, the bliss and peace are heightened. The hard work towards financial freedom is starting to pay off.

This is the step where you can implement those long-term visions.

During Money Bliss Step 9, the goal is to build wealth, so you can live and fully fund your life’s visions.

Life’s Vision Ideas…

“I could change jobs and finally be happy in a career field I truly enjoy.”

“We are able to setup the non-profit we always dreamed about.”

“We are able to pay for our kids college without sacrificing our retirement.”

“I plan to retire when I want.”

Money Bliss 9 is fully funding yourself and the life you want to live. That magic number where your assets can sustain your current lifestyle. Determining at what age “early” retirement is an option.

- First, maxing out retirement accounts is of the utmost importance. The contribution limits are constantly changing, so check here for the latest info.

- Depending on your age, you need to balance how soon before “retirement” you will need access to your money. For one simple reason, retirement accounts can’t be used without penalties until 59 1/2.

- So, spread the retirement savings into a brokerage account or mutual fund account. These types of accounts do not have the same tax advantages. However, diversification is key.

Other options to build wealth include rental properties, investing in a business, or developing passive income.

When to Pay for College

If you want to pay for your children’s college, this is where you would start saving for their college expenses. You can pay for college without loans, too.

This is completely backward of most financial experts since most recommend starting at infancy with a 529 plan.

However, many of us managed to pay for our schooling and survived. Maybe not thrive financially due to student loans, but many lessons of hard work were learned.

By waiting to fund college expenses, you can become financially free first, and then, help out your children with college.

Continue to earn income until you believe your assets are fully funded for your Money Bliss Life. Remember, there are no debt obligations to hold you back…

10. Money Bliss Life

Money Bliss = Where Cents Parallel Vision.

This is the point in life where financial obligations do not dominate your life and your decisions. You can live financially free! Live the life you want!

There are no payments to be made or debt to be the slave under.

The last Money Bliss Step is taking a HUGE breath of air and realizing all of the struggles, the determination, and the sacrifices made over the years were well worth it.

With Money Bliss Step 10, retirement is not an age – it is the ability to self-finance your life adventures.

The true definition of financial freedom is the ability to act or spend without hindrance or restraint. Just remember to make smart choices with money.

During this step, building wealth happens fast if you choose to continue earning income. Remember, there are no debt obligations.

Money is a blessing for you as well as the impact on others through giving.

The Money Bliss Steps to Financial Freedom.

All 10 steps to financial freedom will completely change your life!

The impact will be direct and you will transform your money situation for many years to come. Will financial freedom happen fast?

This is a journey! To complete all the steps and live a life in Money Bliss, it will take time, dedication, and sacrifice.

As a result, you can live with financial freedom.

Step by step you are impacting your life as well as your family legacy. Especially if you start to manifest these money affirmations daily.

You are capable of making significant progress. Just start with one step at a time.

Don’t worry about what is ahead of you. Stay focused on the current step in your journey.

Learn how to manage your money, your way. Not have your money managed you with the Money Bliss Steps to Financial Freedom.

Understand the Cents Plan Formula…

Source

- Consumer Financial Protection Bureau. “Emergency Savings and Financial Security.” https://files.consumerfinance.gov/f/documents/cfpb_mem_emergency-savings-financial-security_report_2022-3.pdf. Accessed February 27, 2024.

- Fool.com. “Average American Household Debt in 2023: Facts and Figures.” https://www.fool.com/the-ascent/research/average-household-debt/. Accessed February 27, 2024.

- Bloomberg. “The Share of Americans Who Are Mortgage-Free Is at an All-Time High.” https://www.bloomberg.com/news/articles/2023-11-17/amid-high-mortgage-rates-higher-share-of-americans-outright-own-homes. Accessed February 27, 2024.

- Tax Foundation. “The Home Mortgage Interest Deduction.” https://taxfoundation.org/research/all/federal/home-mortgage-interest-deduction/. Accessed February 27, 2024.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

This is great advice for younger people. So what would you tell people who are retired, can they still become a millionaire for older adults