Can You Have Multiple Roth IRAs? 3 Things You Need to Know

Inside: Are you considering opening multiple Roth IRA accounts? You need to know if you can have multiple Roth IRAs. Here is what you need to know before making the decision.

While managing multiple Roth IRAs can create confusion, especially with tracking contributions across different custodians and potentially violating the five-year rule, I have found a method to use them to my benefit.

By having multiple Roth IRAs, I am able to diversify my investments as each Roth IRA account has a specific purpose.

However, you must know the rules about having multiple IRAs.

For the average investor, having multiple Roth IRAs may seem like a potential strategy to diversify your investments and attain financial independence, but it often leads to more confusion than benefit. Therefore, simplifying your finances by having a single Roth IRA might be a more feasible approach to reaching financial independence.

However, readers at Money Bliss know there is always a reason if I am strategic about why I do something.

So, let’s go through everything you need to know about having multiple Roth IRAs and if it is worth it for you.

What is a Roth IRA?

A Roth IRA stands as a type of retirement account with distinct tax benefits. The Internal Revenue Service (IRS) manages specific rules on who can open a Roth IRA, along with the contribution limits and withdrawal policies. 1

When your contributions in this retirement account and their interest earnings grow, they do so tax-free. 2

“Roth IRAs give you the flexibility to increase retirement savings tax-free. Thus, helping you to reach financial independence quicker.”

Kristy @ Money Bliss

Can You Have Multiple Roth IRAs?

Absolutely! You can certainly have more than one Roth IRA.

Different from some other types of retirement accounts, no restrictions apply to how many Roth IRAs you can manage.

From the IRS perspective, regardless of how many different IRA custodians you choose to utilize, your contributions are treated as one Roth IRA. You must still follow the guidelines on contribution amounts on your Roth IRA and traditional IRA. 3

This could potentially lead to tracking or contribution errors, or even unintentional violations of the Roth IRA’s 5-year rule, which can result in penalties. Furthermore, managing multiple accounts can also lead to an accidental overweighting of one investment strategy due to faulty fund allocation.

Why would a person want more than one Roth IRAs?

Several reasons could motivate an individual to manage multiple Roth IRAs:

- Saving for various objectives. Investors might manage different IRAs for distinct purposes—one for retirement income, another as a cushion for emergencies.

- Diversification of investment portfolio. Multiple Roth IRAs facilitate varied levels of risk adoption across different types of investments.

- Raising insurance protection. With multiple Roth IRAs spread across separate institutions, each account can avail of $250,000 FDIC insurance protection. 4

- Simplifying inheritance. Dealing with inheritance matters gets easier upon having distinct Roth IRAs, as assets can be split and handed down according to wishes.

Personally, I choose to have multiple Roth IRAs because I actively trade options contracts in one while the other is for long-term holdings.

Is it smart to have multiple Roth IRAs?

This is a highly personal decision as it depends on individuals and their unique circumstances.

Multiple Roth IRAs can offer remarkable benefits. However, keep in mind that more accounts may mean more fees and added complexity when managing your retirement savings.

You must consider your financial goals, risk tolerance, and time horizon is crucial before opting for multiple IRAs.

Many people end up with multiple IRAs when they decide to rollover a 401k from a previous employer.

Benefits of Opening Multiple Roth IRAs

You will have to decide if these benefits of multiple Roth IRAs are worth it for you:

- Diversified investments. By having multiple accounts, it allows you to vary your investment strategy by account.

- Conversion Flexibility. Managing the tax implications of converting traditional IRAs or employer-linked retirement accounts to Roth IRAs gets easier.

- Varying Savings Objectives. Different Roth IRAs can be maintained for different purposes such as retirement income, house maintenance or rainy day funds.

- Elevated Insurance Protection. If one Roth IRA is reaching the FDIC insurance limit, a second account with a different institution ensures additional protection.4

Drawbacks of multiple Roth IRA accounts

While having multiple Roth IRAs has broader benefits, it comes with some shortcomings:

- Complex Management. Managing several Roth IRAs requires frequent monitoring and coordination.

- Increased fees. Many IRA accounts come with fees. Even low fees across multiple accounts can add up.

- Unequal Investment Allocation. Spreading investments across multiple IRAs makes monitoring performance difficult.

- More Paperwork. More accounts mean more paperwork, which could be time-consuming.

The Motley Fool is dedicated to helping the world invest — better.

They help millions of people attain financial freedom through their site, podcasts, and premium investing services.

Unfolding the Complexities of Multiple Roth IRAs

With multiple Roth IRAs, complexities unfold around the management and tracking of these accounts. The investments need to be monitored on a regular basis to maintain strategic alignment with retirement goals.

It’s necessary to regularly check for fees and investment performance.

Balancing the portfolio of multiple IRAs plays a vital role, as the percentage of each investment differs between accounts. This could make it challenging to form a streamlined portfolio until you have sufficient experience.

Nevertheless, this is an easier question to answer than is now a good time to buy stocks.

Understanding the rules with multiple Roth IRAs

Understanding the regulations with multiple Roth Individual Retirement Accounts (IRAs) is essential when planning for a stable retirement.

With a comprehensive overview of the laws governing multiple Roth IRAs, one can strategically leverage these tax-advantaged accounts for optimal retirement savings.

No more confusion or lack of knowledge on how many Roth IRAs they can legally own, this section provides clarifications on these essential rules.

Does having multiple Roth IRAs mean you can contribute more total money each year?

The short answer is no.

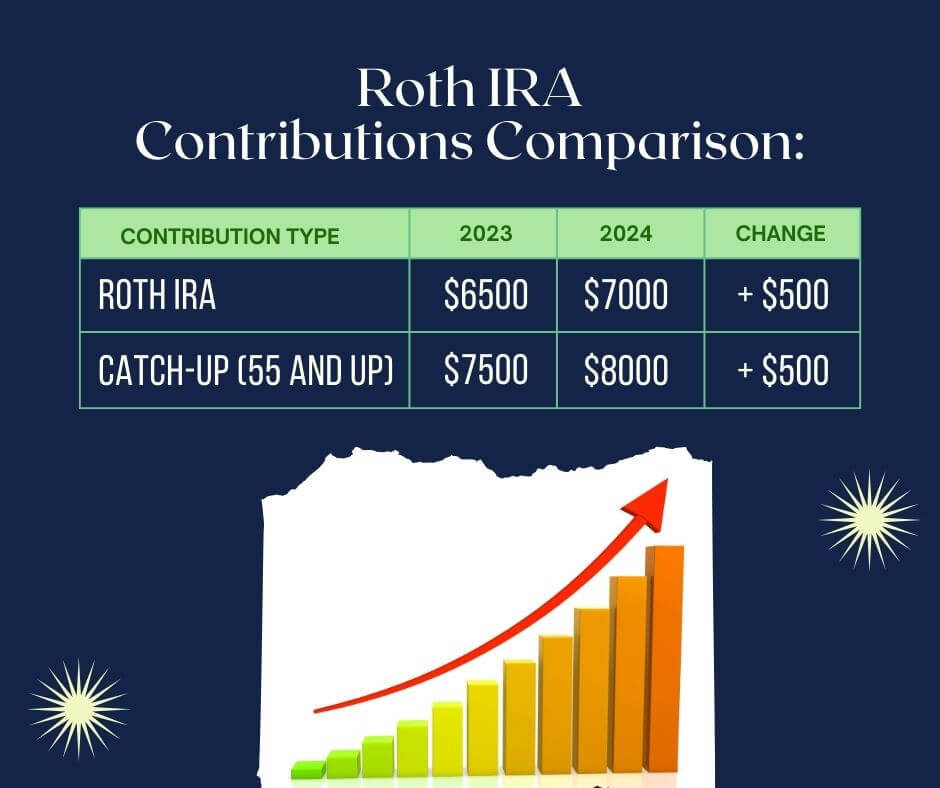

Regardless of how many Roth IRAs you have, your total annual contributions combining all accounts can’t surpass the IRS-placed limits.

For 2023, the limit stands at $6,500 if you’re under 50 or $7,500 if you’re 50 or older. 3

In 2024, the limit stands at $7000 if you’re under 50 or $8000 if you’re 50 or older. 3

Can I contribute to a Roth IRA and a Traditional IRA?

Yes, you can contribute to both a Roth IRA and a Traditional IRA.

However, the total contribution to all your IRAs cannot exceed the annual limits set by the IRS. 3

For instance, in 2023, the total contribution limit is $6,500 for individuals under 50, and $7,500 for those who are 50 or older.

You don’t want to be taxed on excess IRA contributions.

Tips for managing multiple IRAs

Managing multiple IRAs comes with its own set of challenges. But, with the right approach, you can reap substantial benefits:

- Organize Your Investments. Keep your IRAs clearly labeled for distinct goals—a critical step.

- List Your Beneficiaries Properly: You must list your beneficiaries on each Roth IRA account.

- Consolidate Accounts. If you find managing many accounts overwhelming, think about consolidating them at one institution.

- Regular Review. Evaluate your portfolio time and again to see if adjustments are needed.

- Monitor Fees. Fee accumulation can hollow out your retirement savings. Keep a close watch on them.

- Use Software to Help You. My personal favorite is Quicken Classic

For many people, they learn how to invest 10k the first time using their Roth accounts.

Learn to trade stocks with confidence.

Whether you want to:

- Retire in peace without financial anxiety

- Pay your bills without taking on a side hustle

- Quit your 9-5 and do what you love

- Or just make more than your current income....

Making $1,000 every.single.day is NOT a pie-in-the-sky goal.

It’s been done over and over again, and the 30,000 students that Teri has helped to be financially independent and fulfill their financial dreams are my witnesses…

FAQs About Having Multiple Roth IRAs

Invest spare change, invest while you bank, earn bonus investments, grow your knowledge and more.

Every purchase you make means an opportunity to invest your spare change! So coffee for $3.25 becomes a $0.75 investment in your future.

Now, How Many Roth IRAs Can I Open?

In conclusion, it is not only possible but also potentially advantageous to hold multiple Roth IRA accounts.

By diversifying your retirement savings across various Roth IRAs, you can expose your money to different asset classes and investment opportunities not all available in one account.

Learn how to invest in stocks for beginners.

Nevertheless, the decision to open multiple Roth IRAs must be driven by your personal financial circumstances, retirement objectives, risk tolerance, and expected time horizon. If the decision aligns with your financial blueprint and retirement strategy, opening multiple Roth IRAs today could be a smart move.

Given the unique tax advantages Roth IRAs offer – tax-free withdrawals during retirement – this could ensure a financially secure and tax-efficient retirement.

Honestly, I think choosing the right brokerage is harder for most people.

As always, consider seeking guidance from a trusted financial advisor to help navigate these decisions and ensure your retirement planning is optimally structured for your financial needs and goals.

Remember, the key to successful retirement planning lies in understanding all associated rules, benefits, and potential drawbacks.

Sources

- Internal Revenue Service. “Types of Retirement Plans.” https://www.irs.gov/retirement-plans/plan-sponsor/types-of-retirement-plans. Accessed October 10, 2023.

- Internal Revenue Service. “Roth IRAs.” https://www.irs.gov/retirement-plans/roth-iras. Accessed October 10, 2023.

- Internal Revenue Service. “Retirement Topics – IRA Contribution Limits.” https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits. Accessed October 10, 2023.

- FDIC. “Your Insured Deposits.” https://www.fdic.gov/resources/deposit-insurance/brochures/insured-deposits/. Accessed October 10, 2023.

- Internal Revenue Service. “Retirement Topics – IRA Contribution Limits.” https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits. Accessed October 10, 2023.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.