10 Smart Financial Goals That You Need

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Financial success doesn’t happen just in January. It happens every single day of the year with every single decision you make.

The time is now to take your New Year’s resolutions and make them into smart financial goals.

Financial goals will help keep you on track.

There are two ways to look at goals. You can either set them, or you can ignore even making finance goals. A lot of people don’t like to set financial goals because they feel like they are setting themselves up for failure. (And that is a money mindset that needs to be broken!)

However, by setting smart financial goals, you are more likely to make progress on the things that matter to you most, and that at the end of the day is the most important.

Too many times we see that people are stressed about money and their finances. They prefer to ignore their money situation and dig their head into the sand. You can quickly see that will only make the situation worse, and progress will NEVER be made.

Today, we are going to examine smart financial goals, give a few examples of goals to start with today, and then let you think BIG on long term financial goals.

Let’s dig in and change your financial future…

What is a Financial Goal?

A financial goal is writing down what you want to accomplish with your money.

It can be big, it can be small.

The size and scope of the money objective does not matter.

The most important part is that you are making a decision, ahead of time about what you want to do with your money.

Everybody has different goals.

Comparing yourself to others is worthless. Each person is on their own financial journey. The only comparison that needs to happen is what is going on with you and your situation.

What are the 5 smart goals?

First, you need to make your goals with this template in mind.

S – Specific

An overarching vision for your life is fabulous and will help you to keep on track of what you want to achieve. However, when it comes to making smart financial goals, they need to be specific.

You must clearly identify or define your goal. Be specific.

M – Measurable

With your goal, you must consider how you plan to measure it. Thankfully, this one is easy to quantify with personal finances.

You can gauge progress with dollar amounts or percentages.

If you are paying off debt or starting your journey to saving money, then using dollar amounts makes sense. If you are striving towards financial freedom, then you are looking at savings percentages or metrics to increase your net worth.

A – Attainable

With the smart goal format, we are quick to back off our goals because we don’t think we can achieve them. Don’t sell yourself short.

It is better to reach 80% of your goal than to walk away from it completely because you are 80% closer today than before you set your goal.

Go for a stretch financial goal; you will probably surprise yourself with what you can accomplish.

R – Realistic

Think about your financial goal logically. In a levelheaded voice, ask yourself if you are capable of reaching this goal today.

You have to be realistic in the season you are in and what your next financial step is. With the smart goal template, this is the point when you break up your goals into smaller pieces to set reasonable goals.

State your goal in a positive statement.

T – Time-Bound

The last part of the 5 smart goals is probably the most forgotten. Yet, it is the most important to actually reach your goals.

If you don’t believe me, then read the 12 Week Year by Brian Moran and he will convince you that changing your perspective on time planning will vastly improve your results.

Keep your financial goals with a timeframe of under 3 months.

Loftier financial goals that are long-term – that is great! You just need to break them down further into mini-milestones to reach your long term goal.

SMART Goal Example:

A great smart financial goal example would be these statements….

- Starting today, I will save $96 each week for the next 52 weeks by transferring money when I get paid.

- I will pay off an extra $3000 of student loan debt six months from today.

- This year, I will increase my saving percentage to 15% by paying myself first and living off the rest.

These are just a few examples. We will provide more in a little bit.

How To set Smart Financial Goals?

Financial goals will help you make faster progress than you thought possible.

You just must be willing to make changes, be realistic about what you can accomplish, and keep a positive mindset.

Let’s dig in on how to set smart financial goals. This is exactly how you achieve financial goals.

1. Know Where You Stand Financially

That means knowing two important factors. First, what Money Bliss Step to Financial Freedom you are on, and second, what is your net worth.

Those are two benchmarks that will help you to determine what your next financial goal should be.

Without knowing where you stand, you won’t be able to track your progress. This free tool will help you determine where you stand financially.

2. Define Your Vision

What is the overarching theme for your life? Think long term 10+ years from now.

Here, at Money Bliss, we like to refer to it as your Dream Big Vision.

This will be the starting point for all of your smart financial goals.

What is the one thing that you want most? This doesn’t have to correlate to money. It can be a LIFE goal.

You must first define your vision to clearly make smart financial goals. Think of it as building blocks. You will progress faster with be stable by building your goals one step at a time versus trying to jump over a few key steps and sinking fast.

Also, make sure you do not have a money block holding you back.

3. Create a Plan

Once you know your Dream Big Vision, you have to create action steps along the way to help you reach it.

That is where the Money Bliss Steps to Financial Freedom will help you define the big financial moves to make along your journey.

Then you can take your personal situation (where you stand financially) and your persona vision to create a plan. Many times your personal finance plan will have many short term and long term financial goals along the way.

Smart Financial Goals Examples

What are some good smart goals? These are the top financial goals we truly believe everyone must accomplish.

Everyone is on their OWN journey.

Here is a list of money goal examples that can be further defined by your situation.

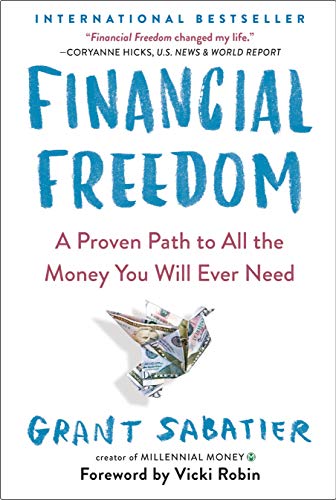

1. Be a constant learner

The first smart financial goal is to be a constant learner. With money management and personal finance, there is so much to learn! We all complain that we weren’t taught how to manage money in schools.

Yet, this is a life-long skill.

Add one or two of these finance books to your booklist. Many of us strive to read books monthly that will enrich our lives.

Recently, I made the decision to want to learn more about investing. While there are a ton of investing books out there (and I have read many of them), I wanted to dig deeper into the investing world. So, I signed up for this course and found a wonderful trading community.

Also, since tax laws are constantly changing, it is wise to stay current on news events and find ways to improve your personal finance situation.

Example #1 – I will read one personal finance book each quarter.

2. Pay Yourself First

This is one of the best long term success factors with money. Yet, it is the hardest for us to grasp.

You must pay yourself first … meaning you save money today for another purpose later.

This is one of the best ways to not be knocked over by unforeseen circumstances and to stay out of debt.

Early on, you must fully fund an emergency fund.

Then, look at saving for rainy day fund, downpayment on a house, or retirement. This is one of the best money management tips you don’t want to skip.

Example #2 – I will set up automatic withdrawals of 10% of my paycheck to move into a savings account and $200 to Roth IRA when I get paid.

3. Multiple streams of income

One conversation I would love to have with my grandpa is about working for one company for 34 years and retiring with a pension. In today’s world, this is a foreign concept and side hustles are the norm. What would our previous generations say?

Now, you need multiple streams of income.

If you say your job is stable and you’re fine. You are….until you’re not.

That is why you need to be proactive in creating multiple types of income. The quick response is picking up a side hustle. Another would be investing in the stock market. Possibly flipping second-hand items. Maybe picking up a second job.

There are many ways to make money fast. But, you need to start building multiple streams of income before you actually need the extra cash.

Example #3 – I am going to sign up with Neighbor to lend out the space I don’t use to create extra income.

4. Get out of Debt and Live debt free

You can’t move forward when you have debt hanging over your head and holding you back.

Progress is impossible when you are living with and trying to pay off debt.

The faster you can pay off debt, the better off you are. Then, you need to stay debt free.

This is one of the best smart financial goal examples!

Example #4 – I will pay off the total balance of my student loans before I turn 30.

5. Spend less Than You Earn

This is a simple example. Yet, it is more difficult to achieve with the amount of easy access to credit in our society.

This is an ongoing mandate to live by.

There are many financial goals you can create in the short-term to help you stay on track for the long-term.

Example #5 – I will participate in a no spend challenge for the next 30 days to identify what my spending priorities are.

6. Increase your Saving Percentage

This is one of the best ways to slowly increase your net worth and not really notice the difference.

Ultimately, you want to save at least 20% of your income. There is no limit to how much you can save.

Save more money today, then work less later.

Yes, there is a trade-off to live below your means. But, the long term impact is well worth it plus you can sleep well at night.

Example #6 – I will increase my saving percentage by 1% each month for the next 12 months. Then, I will be saving 12% of my income.

7. Let money flow through your hands

Too many times, people become so focused on their goal that they forget to let money pass through their hands. This could be with giving money to charitable organizations or paying it forward in the drive-through line.

Don’t make this overall complicated.

Just like Dave Ramsay says on giving, “If you can’t live on 100% of your money, you will still have to make changes to live on 90%.” Start small with giving and increase each year.

Example # 7 – I will research organizations that I want to donate money to. Then, pick one to contribute $100 a month for the next year.

8. Keep a Financial goal Journal

Research has shown that if you write down your goals, then you are more likely to achieve them. In fact, statistics show you are 1.4 more likely to reach your goals when you write them down (source).

So, be smart and keep track of your financial goals!

Plus it is great to look back and see the progress you have made. Each milestone that you have crossed. That is great motivation to keep trucking on your current target.

Example #8 – Buy a money journal and track my progress each month.

9. Teach others solid money management skills

Throughout your life, you will learn many valuable lessons. Most of them probably came from the school of hard knocks.

Don’t let those valuable lessons go to waste. Help others learn from your mistakes. We all made them and had to overcome them.

One sentence may positively change the trajectory of someone else’s financial path.

This may seem like an odd example of a smart financial goal. However, your journey has been pivoted by others stepping in to help or maybe be watching others fail.

We need more individuals in this world that understand proper money management. Pass on your knowledge to your kids, local school, friends, neighbors, or by volunteering.

Example #9 – Make monthly meetings with my teenager to discuss money. Discuss a success and failure I did in my past.

10. Retire on Your Terms

The final top financial goal is to retire on your terms when you want.

This looks different from one person to another. Some may want to FIRE. Others love their job and never want to leave. Some are forced to work well beyond what they want.

The key to retiring on your terms is to have enough saved up for you to continue your lifestyle without bringing in earned income.

Honestly, putting off saving for retirement is not a smart financial goal.

Example #10 – Open a Roth IRA and deposit $500 each month to reach the maximum contribution amount each year.

Setting Financial Goals Worksheet

If you want to make progress, you have to take action. If you don’t, then you watch from the sidelines and your dreams go up in smoke.

Take thirty minutes to fill out our financial goals worksheet.

Start with your overall vision. Then, break it down into small bite-sized milestones that you can accomplish. Review monthly and set new money goals once you accomplish previous ones.

Which Financial Goal Examples will you Start With?

Throughout this post, we reiterated this concept. But, it is SO important that it is worth repeating again…

This is your journey. Your journey will be different than anyone else. So, don’t spend time comparing yourself to others.

Spend time focuses on what you can accomplish.

From the top financial goals, what is your next priority?

Personal finances are a long term game. You must assemble building blocks to slowly climb one step at a time.

Comment below on what your current financial goal is.

Best Financial Books to Change Your Perspective

The Simple Path to Wealth: Your road map to financial independence and a rich, free life

This is the #1 personal finance book I recommend. It is a must-read for everyone.

Financial Freedom: A Proven Path to All the Money You Will Ever Need

This book will change your perspective on what matters in life and how changing your spending habits will help you get there.

The More of Less: Finding the Life You Want Under Everything You Own

Have you ever considered the long term impact of buying stuff? This book will have you decreasing the number of items in your life and spending less money.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

I’d love to keep a financial goal journal since most of them are just in my head. Thanks for these tips!