Ultimate List of New Year’s Money Resolutions for 2024

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Each year money always tops the list of New Year’s Resolutions.

As the clock strikes midnight, people turn on the switch to break bad habits and start making new resolutions to change.

According to Statista, here are the most common New Year’s Resolutions:

- Eat healthier

- Get more exercise

- Save (more) money

- Focus on self-care

- Read more

- Make new friends

- Learn a new skill

- Get a (new) job

- Take up a new hobby

- And the “I don’t plan to make New Year’s resolutions”

Personally, I think New Year’s is a great time to examine what worked and what didn’t work in the previous year.

One reason why… Do you want to continue on the same path or not?

If you do, then you need to know what worked and what didn’t work.

If you don’t, then you need to figure out what didn’t work and change it ASAP.

A digital planner is one of my favorite tools to help me stay on track with what I want to achieve in the upcoming year.

Smart money at any age just doesn’t happen overnight.

If someone interviewed you right now, what would you tell them that your money related New Year’s Resolution would be?

Do you have the grit and grind to reach it?

Here are Money Bliss, we have plenty of resources to help you succeed. So, sit down and relax and keep on reading. And make sure to sign up for our emails.

Without further ado, here is an ultimate list of New Year’s Money Resolutions.

Find motivation. Inspiration to achieve your money goals.

To turn your New Year’s Resolution into a habit, check out this post.

List of New Year’s Money Resolutions:

1. Save money.

2. Pay off debt.

3. Be prepared for unexpected expenses.

4. Create a Cents Plan (AKA Budget).

5. Learn the steps to financial freedom.

6. Pay off credit cards in full each month.

7. Participate in one of our famous money saving challenges.

8. Make more money with a side hustle or gig.

9. Admit you need to look at your financial situation.

10. Start making money by investing.

11. Make more than the average 60000 a year salary.

12. Learn more about your relationship with money. Check out this program – Money Bootcamp.

13. Choose debt free living habits.

14. Teach your kids about money.

15. Start saving now for Christmas gifts.

16. Hold a spending freeze challenge!

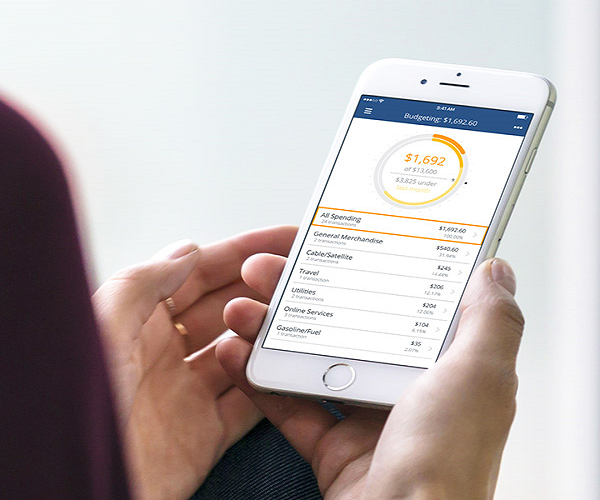

17. Use a budgeting app to track your spending.

18. Start living a frugal lifestyle.

19. Participate in the fun 100 envelope challenge to save $5050.

20. Explore time freedom.

21. Save an emergency fund.

22. Double check your receipt that you were charged appropriately. Use this resource to help.

23. Start giving money.

24. Figure out how to organize your life and create a simpler life.

25. Trim down your basic expenses.

26. Use FUN money (AKA pocket money) to stop fighting about money.

27. Start a 30 day challenge – choose from over 65 ideas.

28. Learn the advantages of budgeting.

29. Understand how to live below your means and love life!

30. Use these tips to pay off debt faster.

31. Start a Roth IRA.

32. Learn how much do I make per year.

33. Maximize your Health Saving Account (HSA) Contributions.

34. Understand the importance of sinking funds.

35. Learn how to use cash envelope system.

36. Save more money by increasing your saving percentage.

37. Live off one income.

38. Use credit cards rewards for FUN spending (if and only if paid off each month).

39. Sell stuff and clutter from around your house.

40. Save for a down payment on a house.

42. Review investments in 401k accounts. This resource makes it easy and it is free to use! Here is another free resource to easily track your investments.

43. Understand the F.I.R.E. movement.

44. Save extra coins for a rainy day fund.

45. Decide whether or not to pay for college.

46. Make consistent income with a side business.

47. Learn the best methods of budgeting you need to know.

48. Stop going to Starbucks each day (or a couple times a day).

49. Save for college expenses. Or better yet…find scholarships.

50. Track your net worth (seeing progress is super helpful). Free resource to easily track your investments.

51. Set aside money for taxes if self-employed.

52. Super charge your savings like your grandparents did.

53. Use an app to pay off debt.

54. Use gift cards wisely.

55. See if you wasted money this year.

56. Change to eating out 1-2 times a month.

57. Find ways to make money online for beginners.

58. Start freezing meals for dinner.

59. Review insurance policies.

60. Pay your taxes on time.

61. Take one of our courses to fast track your progress.

62. Go from broke to rich with the right money mindset.

63. Learn how to double $10k quickly.

64. Vow NO MORE DEBT.

65. Trim down your grocery budget without rice & beans.

66. Millennials – learn how to invest in stocks for beginners.

67. Choose free things to do over spending money.

68. Make sure you have the 6 key bank accounts set up.

69. Give experiences instead of gifts.

70. Or at the very least find gifts for kids under 10 dollars.

71. Understand the concept of time, value, and money.

72. Take care of your financial house first.

73. Go on No-spend date nights (or kid-parent date nights).

74. Don’t be afraid to look at your money situation. Here are great courses to help you!

75. Use cash instead of credit cards.

76. Have enough money for kid’s activities when they are due.

77. Create a FUN jar.

78. Learn how to manage money and still enjoy life.

79. Understand the difference between rich vs. wealthy.

80. Become independently wealthy.

81. Learn how to live on next to nothing.

82. Stop using credit cards to fund everyday purchases you can’t afford.

83. Get tips to make ends meet even if you are broke.

84. Refinance those pesky student loans.

85. Make sure you aren’t making one of these common debt mistakes.

86. Pick up the best kitchen gadgets for healthy eating.

87. Stay on budget at Christmas.

88. Conquer your clutter once and for all.

89. Decide if a meal plan subscription will help you reach your other New Year’s resolutions.

90. Make passive income.

91. Use Cash Back Apps for extra spending money.

92. Start participating in random acts of kindness.

93. Start making money with a side hustle.

94. Spend less on material items to experience life.

95. Understand the top 10 frugal living tips with a big impact.

96. Start meal planning.

97. Pack a lunch for work rather than eating out.

98. Stop picking up fast food for a quick alternative for dinner.

99. See the reality of what happens if you don’t save for retirement.

100. Increase retirement saving to 15% of annual income.

101. Don’t buy these things at the grocery store. This is what we stopped buying to save money.

102. Make sure your wills and power of attorneys (POAs) are up to date.

103. Don’t fall into the debt trap again with these tips.

104. Compare your budget percentages to the average American.

105. Don’t fall for some of the worst financial advice.

106. Find awesome gift ideas when you’re broke.

107. Learn to make a budget in 7 steps.

108. Add these personal finance books to your reading list for 2023.

109. Start saving money each month.

110. Why investing early is so important.

111. Find happy hour specials or kids eat free nights.

112. Pick up a few thrifty tips & tricks.

113. Start saving a vacation fund.

114. Memorize the 10 Money Rules you need to know.

115. Diversify your income with these 3 income sources.

116. Entrepreneurs – Make wise business marketing decisions.

117. Learn how to score a true deal shopping on Amazon!

118. Change career paths.

119. Meet with a flat fee financial planner or at least start with a money coach.

120. Save money with one of the 52 week money saving challenges!

121. Realizing that “I don’t want to work anymore“ is okay. And make a plan for it.

122. Enjoy the fun of Trade & Travel!

123. Don’t give up!

The ultimate list of over 100 New Year’s Money Resolutions to change your life!

Bonus tip:

Did you know you are WAY more likely to reach your goals when you tell others!

Find motivation to change your life with money. Plenty of tips to get you started with financial New Year’s Resolutions!!

Which Financial New Year’s resolution do You Prefer?

We have a long list of ideas to get you started.

There are plenty of ways to go through life.

You can let money manage you? Or you can manage your money?

Which do you prefer?

Stick around. I promise you will learn a thing or two. Plus greatly improve your money journey.

I want to hear from you… What are your finanncial New Year’s Resolutions for 2022?

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.