Best Finance Books: The Top 10 Must-Read Books To Improve Your Finances

Inside: These best finance books are a great way to learn new strategies and tools to improve your financial situation. Check out 10 must-read finance books.

Learning is growing. Never stop learning.

To be fully honest, there was a period of my life when reading a book a year was truly impossible. We had young babies and other things going on that made it tough.

Looking back, I completely regret my decision not reading books.

There is always time to read a book if you are willing to carve out the time.

So, I made the decision to read a book a month. Period.

It goes with the mantra that I have been saying for years…

Learning is growing.

Never stop learning.

Also, this list is filled with ideas for the perfect Christmas, birthday, or graduation gift ideas!

Why Pick Up a Book?

There is plenty of free information on the Internet. Google until your heart is content and you will find tons of results.

Are the results actually what you are searching for?

Plus, there is something to be said for picking up a physical book and reading it.

The digital age is great for quick grab-and-go info. But, a book will exponentially expand your own personal knowledge and thinking.

And it is a good excuse to set down your phone!

Just a note… I was highly disappointed to find many of these books on the list not available at my local library.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

How to Read a Book Effectively

It is one thing to read a book. It is a completely different thing to actually read a book effectively.

These personal finance books are packed with knowledge and the ability to change your life forever.

The last thing you want to do is read a really-awesome life-changing book and not be able to remember any of the pertinent information.

This is especially true for life changing books.

So, be prepared with these tips to be successful.

1. Take Notes

As I go through any book (that I actually want to retain/reference the information again), I always take notes.

They can be quick snippets. Or full quotes of information that resonated with you.

Personally, I use my yearly planner to take notes (it is always with me). Then, I move them to a binder divided by topics.

Recently, I got into the digital realm with my note-taking. Currently, I am testing Goodnotes. But, Notability was a close 2nd.

You may want to download a printable reading journal to track your progress!

2. Reflect on What you Read

After finishing a chapter or a few pages, reflect on what you just read.

I’ll admit this is the hardest thing for me to do. But, if I stop and reflect, I retain key points.

How does that associate with your personal situation?

Including mental pictures is key for information retention. When we were paying off debt, my mental picture was a family beach vacation.

Bonus Tip: Tell someone else what you just read. Elementary kids have to do a retelling after reading a book in school. As adults, we should be able to do the same.

3. Keep the Book Nearby

In order to be successful, the book needs to be in arm’s reach to pick it up.

Everyone has different places to keep a book:

- Nightstand

- Coffee Table

- Car (for pickup lines or waiting on kids)

- Desk

- Bathroom

A book on a bookshelf is for reference!

Action is required to open a book and read it. Put it somewhere you will remember to pick it up and read. (Even if for 10 minutes.)

4. Quality is Key

My goal is to read at least one book a month.

As much as I strive to achieve my goal, it is pointless to read a book and not retain the information.

Don’t just read a book to read a book.

Sometimes the quantity of books doesn’t equate to the quality of books you read.

If you aren’t grooving with a book, set it aside and come back at another time. Or move on to a different book that resonates with you.

5. Read it Twice

Think back to school… how many times did you have to read something to fully understand it? What did your study habits look like? How did you best retain information?

Every single time you read something, watch something or listen to something, you are guaranteed to pick up something new.

Read it twice.

Especially the really good finance books – read them twice.

6. Take Action

Okay, it is great and dandy to read good finance books.

But, if you never take action, then what?

What was the point?

You have to gain small tidbits of knowledge that pooled together will impact your personal finance situation.

Take action on what you just read.

The Glocusent Willow Book Light is specially designed for bright & even illumination with 10 scientifically placed LEDs.

Choose from 3 colors that allow you to set the perfect light for blissful night readings.

Why read books about finance?

Books about finance can teach you how to manage your finances, or create a budget. There are also many books about investing, real estate, and other topics related to finance.

There are numerous great books out there about finance and money. In this post, you will find our favorites that you should read right now to improve your understanding of a variety of topics.

Best Personal Finance Books – Overall

There are over 40,000 personal finance books listed on Amazon. That is a ton!

Unless you are a super, duper speed reader, there is no possible way to get through them all.

To help you narrow down the best financial books, here are the top must read books to get you started.

1. Simple Path to Wealth by J.L. Collins

This is the #1 personal finance book I recommend all the time.

It is simple enough for anyone to comprehend. Plus, life-changing for anyone’s personal finance situation.

The parables are catchy, which helps every reader retain information.

The book starts as letters the author wrote to his daughter while she was a young child. Unlike her dad, when she grew up she had zero interest in managing money. As the dad, he wanted to make sure she knew the basic money management skills needed to be successful long-term with money.

This book is to be bought. Period.

And, this book was husband-approved and motivated to take action.

This personal finance book is a simple approach to understanding the basics of money in a very complex financial world.

Not everyone loves spending all of their time managing money; this book provides the framework for financial success. This is one of the few books I actually recommend buying and keeping on hand.

- Quotable Moment: “Stop thinking about what your money can buy. Start thinking about what your money can earn.”

- Favorite Takeaway: F you money

- Best for: EVERYONE

Check out the Simple Path to Wealth reviews to see I’m not the only one.

2. Automatic Millionaire by David Bach

While this book is known as a great personal finance book for beginners, it is much more than that.

You get to step foot into an actual story of a couple on their path to financial freedom with a very modest salary of $55,000.

This book gives you a mental picture of what you desire with your money and your life. That helped us to pay off our debt.

Many times, that is what is needed to break the current cycle and change our finances forever.

- Quotable Moment: “Don’t buy on credit. Either pay for the things you purchase with cash or don’t buy.“

- Favorite Takeaway: Saving money is more important than how much I make per year.

- Best for: those who don’t think they make enough money

Learn the steps taken to achieve financial success with this book.

3. Your Money or Your Life by Vicki Robin

This book flows with the FI movement as well as the simple living lifestyle.

Many people are choosing their lifestyle and how they want to live.

If you are sick and tired of the day to day grind, then this book might be a game changer for you.

The financial independent retire early movement isn’t just for millennials. Read Your Money or Your Life and decide for yourself what is more important.

- Quotable Moment: “Money is something you trade your life energy for. You sell your time for money.“

- Favorite Takeaway: Even the small purchases make an impact on our overall finances.

- Best for: those who have habits of overspending

Check out this recently updated book in 2018.

4. Quit Like a Millionaire

Okay, first of all, you do not have to be a millennial to enjoy this book and learn a lesson or two or five.

This is an eye opening book for anyone who are tired and don’t want to work anymore.

This book gives you an action plan on how to actual “quit like a millionaire.”

- Quotable Moment: “The more stuff people owned, the unhappier and more stressed they tended to be. Conversely, the less stuff people owned and the more they spent on experiences like travel or learning new skills, the happier and more content they were.”

- Favorite Takeaway: You can travel the world for a year for the same cost of owning a house.

- Best for: those looking to quit their 9-5 job

Learn how to quit like a millionaire sooner than later.

5. You are A Badass Series

Seriously, there isn’t one book that is more dominant in the money space. You need to read them all.

Since managing money is more than just making money and spending money, you need to uncover the mental side of your emotions.

As Jen states, you need to stop doubting your greatness and start living an awesome life.

- Quotable Moment: “What you focus on you create more of.”

- Favorite Takeaway: I can be more positive each day. It is a choice.

- Best for: those who constantly question themselves and their worth

You can buy the whole series or read each book individually.

6. Millionaire Next Door by Thomas Stanley

If you have every wondered what it takes to become a millionaire, then this book is for you.

Pick up the seven common qualities it takes to become a millionaire.

Being an average millionaire is within the reach of everyone! Especially those who put the simple traits into action.

See for yourself why the Millionaire Next Door is the #1 best seller in wealth management books.

- Quotable Moment: “One of the reasons that millionaires are economically successful is that they think differently.”

- Favorite Takeaway: You do not know who can be the millionaire next door.

- Best for: everyone

Check out the updated version in 2018, The Next Millionaire Next Door, by the author’s daughter that fits into today’s society.

8. Unshakeable by Tony Robbins

This is the latest book from Tony Robbins.

It is a much easier (and shorter) read than his previous best-selling book.

I would call this an advanced money book. As the focus is more on investing than starting to build a strong money foundation.

As with any investing book, there is a heavy presence on his favorite companies to invest your money. Regardless of that, there is solid investing advice throughout the book.

Also, 100% of the profits from his latest book, UNSHAKEABLE, will be donated to Feeding America. That means 1 book purchased contributes 50 meals to those in need. That is one simple way for you to give back to his cause.

- Quotable Moment: “Yesterday is but a dream, And tomorrow is only a vision. But today well lived makes every yesterday a dream of happiness, And every tomorrow a vision of hope.”

- Favorite Takeaway: Diversification is helpful to achieve financial freedom faster.

- Best for: those who want to dive deeper into the world of investing

If you want a more in-depth read from Tony Robbins, check out Money, Master the Game.

9. Enough: True Measures of Money, Business, and Life by John Bogle

What does enough mean?

In today’s society, it is always about comparison, score-keeping, and status. When is enough enough?

In this book, the founder of Vanguard uncovers some of what is actually enough in money, business, and life.

This is a lasting testimony of a man who worked hard to achieve what he did and all the time maintained his ethics and values.

- Quotable Moment: “It is character, not numbers, that make the world go ‘round.”

- Favorite Takeaway: There is more to life than just money.

- Best for: someone who wants to take a deeper look at how they spend money

FYI…this book is heavy on the investing realm.

10. Think and Grow Rich

This is an old classic personal finance book. While, yes, some of it is outdated. There are some sections that are timeless.

If you are trying to break out of living paycheck to paycheck, getting out of debt, and changing your family’s history with money, then you need to read this book for a change in money mindset.

If you want to achieve anything in life, you need some basic principles that aren’t taught in school. With this book, you can learn the key principles of success to get what you want.

- Quotable Moment: “You are the master of your destiny. You can influence, direct and control your own environment. You can make your life what you want it to be.”

- Favorite Takeaway: The problems with money before are the same problems today.

- Best for: this is a classic and needs to be read

In order to succeed with money, you must understand how desire, belief, and persistence can make a difference. Pick up your copy.

Best Finance Books for Beginners

If you ask any person older than you, they would probably say “I wish I would have done this sooner.”

These are life lessons that we had to learn the hard way.

Start today by reading one of these books and be more advanced in money knowledge than the co-worker next to you.

- The Simple Path to Wealth by J.L. Collins

- Automatic Millionaire by David Bach

- Your Money or Your Life by Vicki Robin

- Millionaire Next Door by Thomas Stanley

- Smart Couples Finish Rich by David Bach

- Get Good with Money: Ten Simple Steps to Becoming Financially Whole by Tiffany Aliche the Budgetnista

- Napkin Finance: Build Your Wealth in 30 Seconds or Less by Tina Hay

Related Reading for You: How to Budget Money and Still Enjoy Life

Best Financial Management Books to Pay Off Debt

Paying off debt is essential for long-term financial success. There is absolutely no way to get around that.

Many of the best financial books speak on why debt will hold you back.

These personal finance books are more known to motivate people to pay off debt.

- The Money Book for the Young, Fabulous & Broke by Suze Orman

- Total Money Makeover by Dave Ramsey

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse Mecham

- How to Get Out of Debt, Stay Out of Debt, and Live Prosperously by Jerrold Mundis

- Money Honey: A Simple 7-Step Guide For Getting Your Financial $hit Together by Rachel Richards

Related reading: Are You Making One of these Common Debt Payoff Mistakes?

Must Read Financial Books to Retire Early

For many people the concept of early retirement is difficult to grasp and that is okay.

These financial books are opening your eyes to the possibility of what life could look like if you changed your spending habits.

This could be the motivation needed in your personal finances.

- Financial Freedom: A Proven Path to All the Money You Will Ever Need by Grant Sabatier

- Playing with FIRE (Financial Independence Retire Early): How Far Would You Go for Financial Freedom? by Scott Rieckens

- Work Optional: Retire Early the Non-Penny-Pinching Way by Tanja Hester

- Set for Life: Dominate Life, Money, and the American Dream by Scott Trench

- Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required bt Kristy Shen

- You Can Retire Sooner than You Think by Wes Moss

- How to Retire Happy, Wild, and Free: Retirement Wisdom That You Won’t Get from Your Financial Advisor by Ernie J. Zelinski

- How To Retire Early: Your Guide to Getting Rich Slowly and Retiring on Less by Robert & Robin Charlton

Related post for you: How to Achieve Financial Independence Retire Early (FIRE)?

Best Money Management Books for Young Adults

Adulting is hard. Even for adults.

However, be smart with your money young and you will thank yourself later.

Pick up one of these best financial books to change your money’s future.

- The Simple Path to Wealth by J.L. Collins

- I Will Teach You to Be Rich by Ramit Sethi

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse Mecham

- Smart Couples Finish Rich by David Bach

- Broke Millennial: Stop Scraping By and Get Your Financial Life Together by Erin Lowry

Best Wealth Management Books

Many people believe they can never attain wealth. Guess what?

With that type of attitude it won’t happen!

Change your perspective on wealth and start the wealth creation process.

- The Simple Path to Wealth by J.L. Collins

- Five Lessons a Millionaire Taught Me by Richard Paul Evans

- Richest Man in Babylon by George Clason

- How to Make Your Money Last: The Indispensable Retirement Guide by Jane Bryant Quinn

- Millionaire Next Door by Thomas Stanley

Related Post for You: Money Bliss Steps to Financial Freedom

Best Investing Books

Investing plays a key role in accumulating wealth. Passive income is key to long term financial success and exiting the day to day grind of a job.

There are two types of people out there…

- Those who don’t try to learn the investing game and pay a financial advisor 1% of their assets

- Those who learn everything they can to invest their own money.

The choice is yours… But, that little 1% advisor fee can shave hundreds of thousands of dollars off your retirement next egg.

Here are the best investing books; learn from the top gurus in the business.

- The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham, Jason Zweig, Warren E. Buffett

- Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude by Mark Douglas

- Think & Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard by Mark Minervini

- Learn to Earn: A Beginner’s Guide to the Basics of Investing and Business by Peter Lynch & John Rothchild

- UNSHAKEABLE by Tony Robbins

- The Little Book of Common Sense Investing by John C. Bogle

- Bogleheads Guide to Investing by Taylor Larimore, Mel Lindauer, Michael LeBoeuf, and John C. Bogle

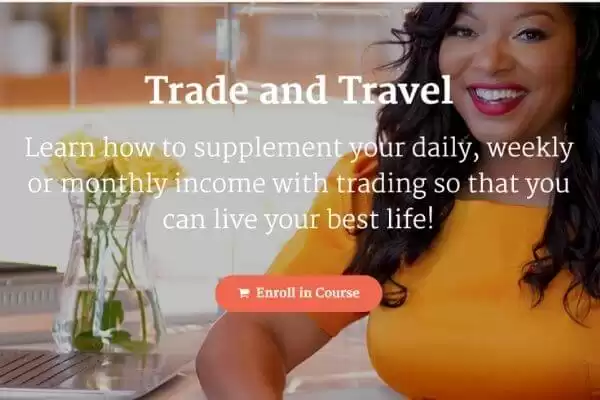

Trade and Travel Course

Trade and Travel Course

Learn to trade stocks with confidence.

Whether you want to:

- Retire in peace without financial anxiety

- Pay your bills without taking on a side hustle

- Quit your 9-5 and do what you love

- Or just make more than your current income....

Making $1,000 every.single.day is NOT a pie-in-the-sky goal.

It’s been done over and over again, and the 30,000 students that Teri has helped to be financially independent and fulfill their financial dreams are my witnesses…

Best Life Lesson Books

Let’s face it… many times, we need to adjust our lives to match our money.

Whether it is habits, how we work, or how we view the world, these books provide life lessons that can impact more than just your finances.

Many on this list are recently released highly acclaimed nonfiction books.

- Atomic Habits by James Clear

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 Months by Brian Moran

- Time, Money, Freedom: 10 Simple Rules to Redefine What’s Possible and Radically Reshape Your Life by Ray Higdon

- UNSCRIPTED: Life, Liberty, and the Pursuit of Entrepreneurship by MJ DeMarco

- Make Time: How to Focus on What Matters Every Day by Jake Knapp & John Zeratsky

Best Simple Living Books

The fastest way to accelerate your personal finance situation is to live within our means.

However, in our society, everything is so cheap to pick up items here and there; and still not break the bank.

Pick up one of these simple living books to change your perspective. In the end, your bank account will thank you.

- The Joy of Less: A Minimalist Guide to Declutter, Organize, and Simplify by Francine Jay

- You Can Buy Happiness (and It’s Cheap): How One Woman Radically Simplified Her Life and How You Can Too by Tammy Strobel

- The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing by Marie Kondō

- The More of Less: Finding the Life You Want Under Everything You Own by Joshua Becker

- The Minimalist Home: A Room-by-Room Guide to a Decluttered, Refocused Life by Joshua Becker

- Goodbye Things by Fumio Sasaki (a guy’s perspective)

Which Financial Books are your Favorite?

There are a ton of books on personal finance that you can read. Pick one a month that you are interested and start there.

One of these financial books has the power to change your financial future forever.

The question is… Did you order it now?

If you did, awesome! You are one step closer to financial freedom. If you didn’t, then each day is another day wasted in obtaining money success.

Just remember…

<<<<<ACTION MOVES YOU FORWARD>>>>>

So, in order to be successful, you have to first read the book and then put the book into action.

Now, I am ready to get my next must read financial book delivered, cozy up, and continue the path towards financial freedom.

One book at a time.

Must read: Money Bliss Steps to Financial Freedom

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.