How to Organize Personal Finances in 8 Simple Steps

Inside: Organizing personal finances is key to financial success. Learn how to organize your personal finances in 8 simple steps. Get organized today!

Organizing your financial life is key to financial success. While it takes time to set up a system, in the long run, it will save countless hours of time.

Truth be told… You should finish all of the steps except for one in an hour.

Plus you know where all your money is (and where you want it to go moving forward).

This step is SO important that it is the #1 step in the Money Bliss Steps to Financial Freedom.

Learn how to organize personal finances.

(and actually follow through on doing it).

Don’t put it off until tomorrow. Make it a priority and get it done today.

You need to grasp how can to be financially organized.

And make sure to sign up for our mailing list to get a special offer to jumpstart this process!

Why Organize Personal Finances?

Simple.

So everything is one place.

Okay, that answer seems obvious. But, it is key to managing (and growing) your money effectively.

Another reason to keep an organized personal finance situation is what if something happens to you. It could be something big like an accident or coming down with a nasty flu. Wouldn’t it be nice if someone can be pointed in the right direction and your bills get paid?

Less stress.

No stressing out because you can’t find a bill. No worrying whether or not you paid a bill on time.

By spending time organizing your financial life, you are making sure your money situation is important and prioritized.

Bonus: Less time searching for papers because an organized paper system means more time to do something else. Spend one hour now organizing your personal finances and gain hours of lost, unproductive time in finding bills and papers.

Goal of Organizing Your Financial Life

The first step to living a life of Money Bliss is to get your financial house in order.

You need to find ways to organize personal finances that work for you. A system that is easy to maintain and overcome.

This step isn’t meant to be daunting at all.

At this point, look at your financial picture as a whole. The 1,000 foot view!

By the end of the organizing finances process, you must know:

- How many accounts do you have

- How many credit cards are open

- Any outstanding debt unpaid

- How you want to live your life with money

- When your bills are due

- Your net worth

- Your credit score

- A budget that will work for you

- How to handle that stack of paperwork and mail

- Know if you are adequately covered by insurance

- Update your estate planning documents

Now, let’s dig into how to organize personal finances in less than an hour.

Okay, the last step will take a little longer, but at the end of today, you can get organized with money.

Related Reading… How to Organize Your Life & Create a Simpler Life

Steps to Organize Personal Finances

Don’t just talk about organizing your financial life. In reality, only action will move you forward. And a complete mess if you don’t deal with it.

You need to understand how to organize your money.

1. Inventory All Accounts

Time to grab a pen and paper.

Start writing down ALL of your accounts.

To make this process easier, head to our resource library and grab some of our free printables to help you.

Assets:

- Checking Accounts

- Saving Accounts

- Money Market Accounts

- Online Savings Accounts

- Certificate of Deposits

- Cash

Investments:

- Brokerage

- Health Savings Accounts

- Real Estate

- Business Interests

- Insurance

Retirement Accounts:

- 401k or 403b or TSP

- IRAs or Roth IRAs

- Pension

- Annuity

Debts / Liabilities:

- Mortgage

- Credit Cards

- Student Loans

- Car Loans

- Personal Loans

- Medical Debt

- Collections

Key Note: I always recommend having a financial binder to hold all of your information. Also, store an additional copy of key information in a fireproof safe and digitally as well.

2. Figure Out Net Worth

Now, that you listed out all of your accounts, it is time to figure out your net worth.

This is a key indicator of progress!

So, don’t give up because the number may be negative or not where you thought you would be by this point. You have to start somewhere – just like the rest of us did.

Simply put… net worth is your assets minus any liabilities.

Net Worth = Assets – Debts

Personally, I keep a graph in our financial binder of our net worth. That is calculated by using a personal finance app that keeps everything up to date automatically.

Right now, I am working on increasing my liquid net worth.

3. Managing your Financial Files

This is a crucial step in organizing personal finances. For this step, you need to create the following things: a financial binder, a mail inbox, and a method to organize your online world.

You will find personal finance organization ideas that will make your life easier. This will also help with financial planning.

Financial Binder

The financial binder is key in our house.

It is the one location where everything current can be found.

These are tabs for our financial binder:

- List of all accounts

- Net worth graph

- Current Budget

- Bills Paid List

- Automatic Recurring bills list

- Current asset allocations for investment accounts

- Saving trackers (at one point… debt paid off tracker)

- Current money goals

- Any financial notes

This is a sample list of tabs for a financial binder. The longer you use your finance binder, the more tabs that naturally would be added like an investment allocation.

Create Mail Inbox

I’ll be honest… I don’t sort through our mail daily because I loathe the task. But, someone always has to bring it in until we get a locked mailbox.

So, a place to put mail is key and then a bill will never be lost.

At the bottom of my mail inbox, I put an envelope folder for any bills or paperwork that needs to be handled. When it is time to pay bills, that folder is pulled out and dealt with it.

Organize online accounts

The tech gurus always tell you to change your passwords every couple of weeks. But, seriously, how many people actually do it?!?!

However, it is something we need to take seriously.

A simple way to organize your passwords the old-fashioned way is with a password organizer. Personally, I found it very simple and easy to use. If an account is closed, then I just cross it out and make a note.

If you prefer a digital option, then look at Bitwarden.

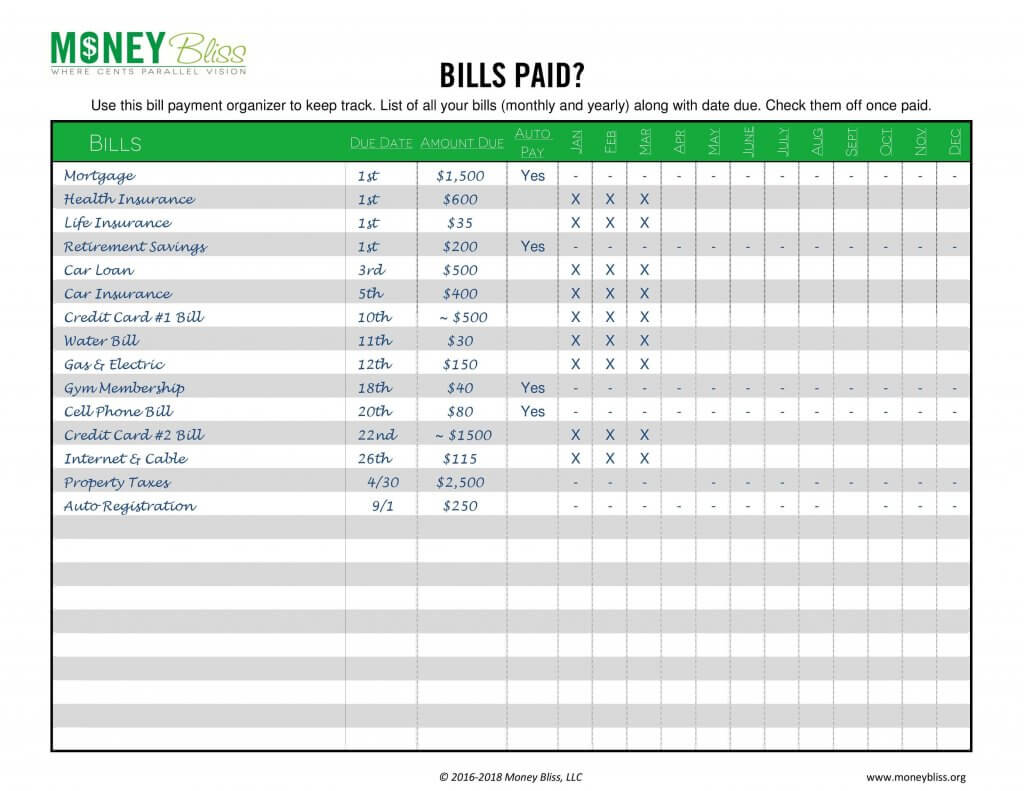

4. Bill Payment Organizer for Money & Bills

How do you handle money? Do you prefer cash, debit, or credit cards?

To stay organized with your money, make a decision that is best for your household.

If you plan to use cash, check out the best cash envelopes and cash envelope wallets (and options for men too).

Using a credit card is trickier to know how you are spending money, so check out cashless envelope system to help you succeed.

Next, it is imperative to get the bill under control!

One simple way to eliminate extra stress when paying bills is to check them off when paid.

This task can eliminate unnecessary time in determining if a bill was paid.

Learn more on how to use the bill calendar.

Key Note: Whenever possible, automate bill payments. This is so helpful for two reasons! One the bill is always paid in full and on time. Second, it is one task removed from your plate.

5. Set Money Goals

Whether you are a goal-setter or not, this is a step that can’t be overlooked.

Maybe better questions to ask yourself include:

- “What would you do differently from last year?”

- “Where do you want to be in 3 years or 5 years?”

- “What does retirement look like to you and when?”

- “Are you content with how you are spending money?”

Start setting goals!

Then, start making all of your personal finance decisions based on those goals!

Learn how to make money goals.

It is one thing to make awesome money goals, but it is a completely different thing to achieve them.

Action will move you forward!

Just for Fun: What Happens If you Don’t Save for Retirement

6. Organize Your Income and Expenses

Overcoming the anxiety about how to organize my income and expenses is imperative.

This is key to getting ahead financially. To have long term financial success, you must spend less than you make.

Expenses must be lower than income. Period.

In our resource library, we have plenty of free printables to help you

To fully list out all of your income and expenses, these resources will help you:

- How to Make a Budget in 7 Simple Steps

- Do You Know the Ideal Household Budget Percentages?

- How to Budget Your Money With Percentages – Cents Plan Formula

Beyond knowing just your income and expenses, it is important to understand two basic money management concepts.

The first one is cash flow. This isn’t a term that needs to be complicated; simply put…

Cash flow is the timing when your income and expenses are coming in and out of your accounts.

This will help to stop living paycheck to paycheck.

Knowing your cash flow is key to making sure you have income to cover your expenses. In this post, we detail how to make a cash flow budget.

And then, the next piece to organize income and expenses is… the budget word!

Personally, I like to look at a budget in this way… this is how I choose to spend my money … rather than my spending telling me where my money was spent.

This is a key segment of organizing your personal finances. Don’t delay – learn how to make a budget work for you!

7. Get your Credit Score Number

Here is the reality about your credit score… it doesn’t matter until you actually need it.

Most people think about a credit score when borrowing money in the form of a loan (mortgage, car loan, credit cards, etc). However, a credit score can be pulled to rent a place or even to get a job.

Highly recommend pulling your credit once a year. Plus it is free to do.

If you looking to rebuild your credit score, then check out a secured credit card.

8. The Big Financial “Stuff”

Okay, this is the step that can’t be done in an hour. It will probably take a week or a month (pending your situation) to make sure you are properly insured and your documents are in order.

This is the boring stuff that 99% of people don’t want to do. Review their insurance to make sure it is adequate and make a will.

* Review Insurance *

Another important part of getting your financial house in order is to make sure you are properly insured.

On these types of insurance, you will have to work with a broker or financial advisor that sells the specific type of insurance you are looking for. The insurance industry is highly regulated, so ask for referrals in your area.

Types of Insurance to Review:

- Homeowner’s

- Renter’s

- Auto

- Health

- Long Term Care

- Umbrella

- Disability

- Identity Theft

- Flood Insurance

- Business Insurance

- Life Insurance

Why is Insurance so important to financial freedom?

If you can replace the cost of a home or car with cash and not take a financial hit, then you don’t need insurance.

Let’s be real… no one can do that!

Insurance is crucial to cover the assets that matter most to you, your stability, and your financial security.

The first piece is life insurance. A basic guideline with life insurance is to have enough coverage to pay off your home plus living expenses for your immediate family. If you are single with no dependents, a small life insurance policy to cover funeral expenses and travel costs for your family is enough.

However, it is important to review all insurance policies – auto, home, renter’s, umbrella, identity theft – to make sure you are properly covered.

* Update Financial Documents *

This is another step many people overlook because, well, they just don’t want to deal with it.

It is no fun and difficult for many people to come to terms with.

The first part is to verify the beneficiaries on all of your accounts listed above are who you want to be. And double check to make sure their systems were updated with your preferences.

Personal note: I just happened to glance at the beneficiaries for a life insurance policy and the beneficiary was not lined up with our wishes. I had to submit the same paperwork again to get it changed.

The second part is to have a solid estate plan in place. Nowadays, this includes more than a will.

Estate Plan Documents (at minimum) should include:

- Last Will and Testament with guardianship designations and beneficiary designations

- Trust (if deemed necessary)

- Living Will

- Power of Attorney (Medical, General, and Financial)

- Advance Medical Directive

Personally, I have always used an estate planning attorney. Many online legal websites offer to create estate planning documents at a fraction of the price. Plus every state varies on their laws. However, if your situation is *somewhat* complicated and weird, I highly recommend using an attorney. Then, your documents and your wishes will be solid enough to stand up in court.

What are Your Personal Finance Organization Ideas?

We have covered the bare minimum to help you improve your personal finances. This is just one step to improving your financial planning and moving towards financial independence.

Now, that you have taken the time to get your financial house in order, it is time to move to the next step towards financial freedom.

Understand the Money Bliss Steps to Financial Freedom.

Completing the first step puts you on the Money Bliss Steps to Financial Freedom. Remember to focus on each step individually. It is impossible to work through all of the steps at once.

Take one of our courses to make sure you keep transforming your finances.

What is your next step to organize your personal finances?

We outlined all of the steps for you to make things easier. The resource library is full of printables to help you!

Get one step closer to financial freedom today!

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.