How to Make the Cashless Envelope System Work For You

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

The cashless envelope method is a fabulous way to jumpstart your budgeting process.

It is proven that the cash method will help you to save money, get out of debt, and make sure you’re spending your money that you actually have to spend.

There is no overspending allowed with the envelope system.

When using envelopes whether with cash or cashless, if you are out of money, you’re out of cash to spend.

In today’s society, more and more transactions are being done online, which makes using the “traditional” cash envelope system very tricky and complicated. So many people are looking into alternatives – specifically using a cashless envelope method.

Personally, a cashless envelope system is something that we have used for many, many years. As much as I would like to say that I’m great with cash. I’m not. I tend to misplace it more often than I prefer. Also, I do enjoy my credit card rewards that I receive the extra couple $1,000 helps to pay for quick travel getaways.

Today, in this post, you are going to learn how to be successful with the cashless envelope method. We’re going to outline how to use the cashless envelope system, provide the trackers and templates that you need.

Then, you can start budgeting with success today.

How do you Use envelope System without cash?

The method of using the cashless envelope system is much like the traditional cash envelope system, except you’re actually not physically stuffing your envelopes with real cash.

You are tracking your spending either with a printable template or a spreadsheet. Whatever method you choose it doesn’t matter. It is the basics of cash system that matter.

The principles are the same. You cannot spend more money than you allocated for a certain category.

Later in the post, we will discuss how to track your “cash” using either a printable template or a spreadsheet.

Reasons to Not Use Cash

There are many reasons you may not want to have cash on hand. Here are some of the most popular reasons not to use cash:

- It gets lost.

Personally, I am guilty of misplaced cash. Thankfully, it has always appeared. But, it is hard when you can’t find the money you need to make purchases. - It gets stolen.

Getting your wallet stolen sucks. Getting your wallet stolen when you just stuffed your envelopes with cash is even worse. You are left without spending money for a week or two. - You can’t earn rewards.

A very simple way to earn extra money is with rewards on your credit or debit card. You can earn 2% cash back by paying with these cashless methods. - Counterfeit money is a real problem.

Unfortunately, there is more counterfeit money in circulation than you would believe. The cash withdrawn from the bank is always checked. But, the change you receive from stores may be counterfeit. - Bacteria on cash.

Have you thought about how many people have touched your $20 dollar bill? There is a lot of stuff lurking on cash and coins. Nowadays, many companies are not even accepting cash.

There are many more reasons you may not like to use cash. Plus you need to account for online purchases where another payment method is a must.

Now, you are going to learn to manage money by using the cashless envelope system.

How to Use the Cash Envelope System Without Cash?

Just like the traditional cash envelope system, you are allocating money to each of your categories or envelopes.

Instead of actively putting money in envelopes, you are tracking your spending with a spreadsheet, an app, or a paper cashless envelope tracker.

First, you need to decide what cash envelope categories you want to track. Typically, these are the most popular envelopes to use “cash” for:

- Groceries

- Eating Out

- Clothing

- Gas

- Gifts

- Entertainment

- Haircuts / Beauty / Personal Care

- Pocket Money or Slush Money

However, you can use as many of the budget categories as you want.

1. Create a Budget

The first step to proper money management is to make a budget. First of all, a budget isn’t meant to be constricting, it is a money plan of how you want to spend your money.

By creating a budget, you are prioritizing where you want to spend your income.

It is a good thing to have a budget even though 69% of society doesn’t know how they spent their money last month (source).

If you have never created a budget, then I would highly recommend our Budgeting Course that goes into detail about how to properly create a budget.

Related reading: How to Make a Budget in 7 Simple Steps

2. Track Purchases Immediately

When you make a purchase, you need to write it down on your cashless envelope tracker – just like you would when using cash. You need to see the money being subtracted from your account.

This is what makes you understand the impact of every single purchase you make over the month.

If you can’t do it right away, save the receipt and write it down when you get home. Just don’t forget to do it!!

By waiting more than a day to track purchases, you may get caught over budget on your envelope budget.

You must stay on top of your envelope budgets!

3. Money is Gone, It is Gone

Don’t get caught with overspending! That is a quick cycle to end up in debt or even worse “borrowing” money from other envelopes.

This is where the rubber meets the road. That popular saying will make sure you don’t continue spending money once you are out of money.

The temptation to spend money will happen over and over. You just need to find ways to stretch what money you have left or be patient until you have more money from your next paycheck.

Make adjustments in the next month for categories where money always seems to be gone early.

4. Money if Leftover, Then Roll it Over

This is why the cash envelope system works so well.

It helps you to create sinking funds. When using the cashless envelope method, it helps you to have one BIG account with all of your sinking funds collected together.

When using a spreadsheet or printable, you can visually see how much money you have rolled over from month to month.

Here is a great example: You set aside $50 a month for gifts. But, only spend money when for birthdays and Christmas and not every month. Typically, you would roll your money over to the next month. So, when Christmas comes you have more money to spend.

For those, who are actively trying to get out of debt, you may take your money left over and put it towards debt. Just make sure those are discretionary accounts that you don’t need money for in future months (spending money would be a good example).

You don’t want to be caught without money set aside for a big bill.

virtual envelope system

The virtual envelope system is the wave of the future. The use of cash is going away.

While cash in the bank is still king, the actual physical transaction of paying with cash is going away. The use of debit and credit cards continue to increase.

You need to have a virtual envelope system in place, so that way you can track your purchase purchases in person, online, and those that are reoccurring.

With the virtual envelope system, you will use a spreadsheet that tracks your spending with a couple of inputs from you. The other option is to use a cashless envelope app with a monthly fee like Empower or Qube Money.

Thankfully, here at Money Bliss, we created a virtual envelope system that works perfectly for cashless budgets and creates sinking funds for you. Learn more about the cashless envelope spreadsheet here.

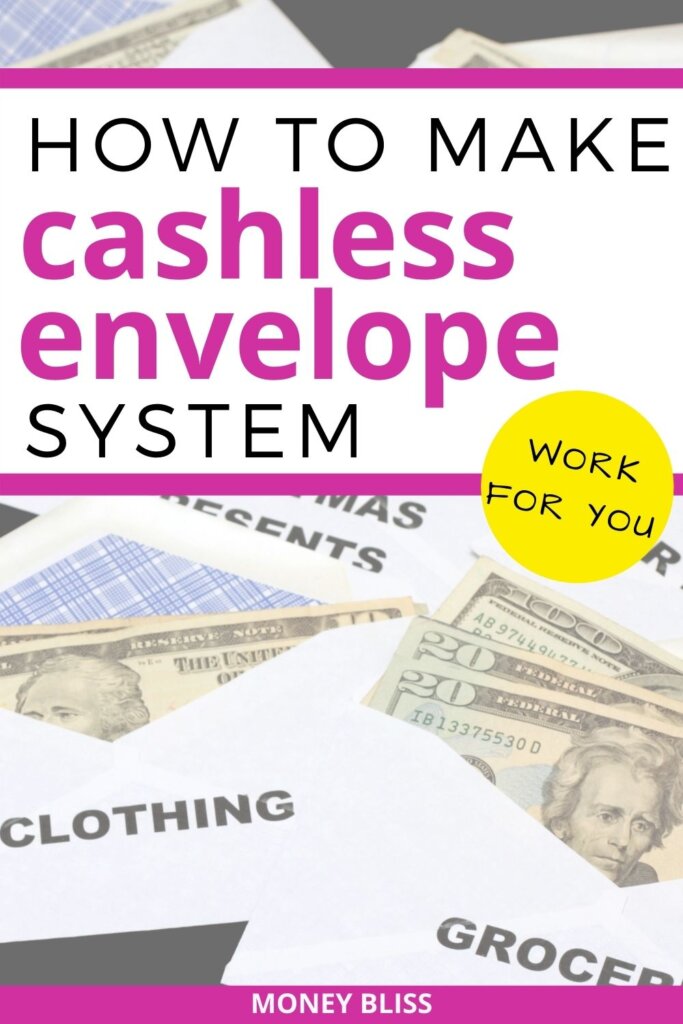

cashless envelope template

A simple way to start using the cashless system is with free cashless envelope trackers. There is nothing super fancy about the system.

You just have to track your expenses.

This is exactly how do you do the envelope without cash.

Here is a perfect example of how to use the cashless envelope template:

These are great for a mom on the go! Simply stick them in your wallet and write down your purchases.

Ready to Use the Cashless Envelope System?

While Dave Ramsey has created a movement of using cash envelopes. It is becoming harder and harder to use in a cashless society. So, you must find something that works for you.

Personally, we prefer the virtual envelope system. It allows the flexibility of being cashless while still benefiting from the cash envelope system.

To be successful, you must track your spending.

Transitioning to a new system will have some quirks, but over time you will get used to it. The pros are you will live with your means. Then, you move away from living paycheck to paycheck.

By tracking your spending with the cashless envelope method, you are putting your money management forefront and can see your pain points with money.

You can download your cash envelope trackers from our free printables area.

For those who want to use the cashless envelope spreadsheet, then enroll in our in-depth budgeting course.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.