Ways to Save Money

Find actionable strategies, practical tips, and a mindset shift that empowers you to save more than you thought possible.

We guide you through the digital landscape to ensure that your spending habits align with your financial goals, allowing you to save effortlessly.

By paying yourself first, you will be saving effortlessly.

The Secret to Success…

Saving money is the basis of financial independence.

Tour the Multitude of Ways to Make Saving Fun

Savings become a thrilling adventure with Money Bliss, where each contribution is a step toward financial freedom.

The joy lies in watching your savings grow, celebrating milestones, and realizing that every dollar saved is a declaration of independence and a key to unlocking a life filled with possibilities.

Explore the importance of building an emergency fund as a cornerstone of financial stability.

Learn practical steps to create and maintain multiple sinking funds that serve as a financial safety net, providing peace of mind and protection against unforeseen circumstances.

Discover the art of strategic budgeting to optimize your expenses and maximize savings.

By incorporating money-saving challenges, you learn to pay yourself first with our practical guides into a powerful tool for achieving your financial goals.

Explore a curated collection of money saving tips and hacks designed to help you cut unnecessary expenses without sacrificing the quality of life.

Learn how to make intentional choices that align with your values, ensuring that frugality becomes a lifestyle choice, not a constraint.

Because at Money Bliss, saving money isn’t just a task—it’s a pathway to financial freedom.

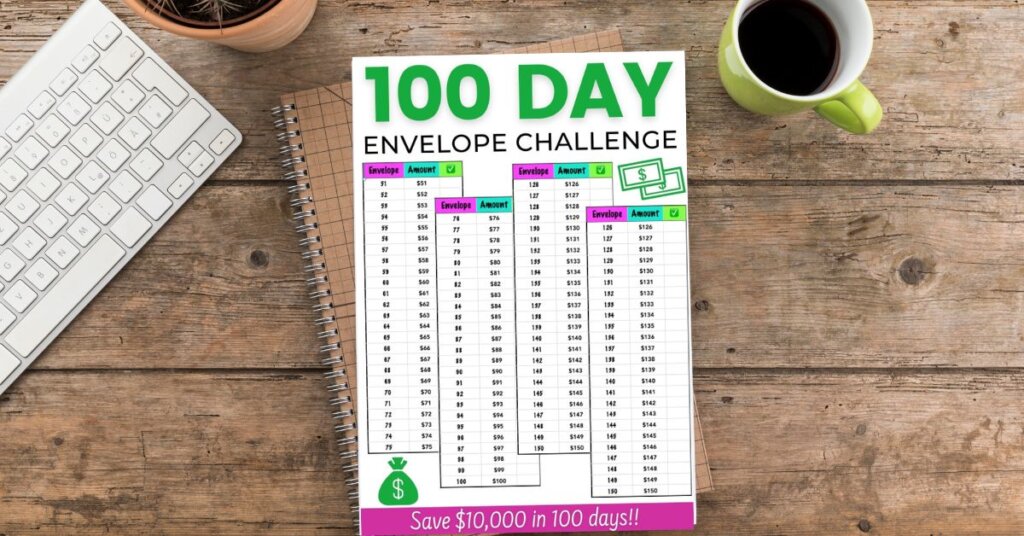

The 100 Envelope Challenge: Easy and Fun Way to Change Your Life!

Popular Save Money Challenges

High Interest Savings Accounts

We’ve built relationships with many of our favorite companies.

As a result, using these links supports what we do at no cost to you. Please read the full disclosure here. We greatly appreciate your support!

Hailed for its competitive APY rates and digital ease of use, GOBankingRates named CIT as one of the Best Online Banks for 2022.

Earn one of the nation's top rates.

Simply select one of the high-yield savings products offered by their network of federally insured banks and credit unions to begin your savings journey.

You can open a free Raisin account in just a few minutes!

Popular Save money Tools

Swagbucks is a fun rewards program that gives you free gift cards and cash for the everyday things you already do online.

Earn points when you shop at your favorite retailers, watch entertaining videos, search the web, answer surveys, and more!

Perfect for the person who hates to hassle with canceling subscriptions and checking spending.

Trim adds value in such ways as canceling old subscriptions, setting spending alerts, checking how much users spent on ride-sharing apps the previous month, and automatically fighting fees.

Recent Save Money Posts

Important to Know How to Save Money Each and Every Month

Saving money is key to reach financial freedom. However, more times that not saving isn’t taught (or caught for that matter). It…

Pick one Monthly Savings Challenges to find success

Inside: Find the perfect monthly money saving challenge for you to save more money! Which one will you choose? Saving money is…

Top 10 Personal Finance Tips for 2020

With each passing year, we start the beginning of the year fired up and ready to change our habits. But, with 2020…

The Ultimate Guide on How to Save Money on Amazon

Can you learn how to save money on Amazon? Amazon has changed the retail shopping experience. Whether you love it or hate…

35 Ways You Wasted Money This Year + Ways to Stop

Have you ever really considered what you buy? Or does it end up in your house without even realizing it? Too many…

12 Money Rules You Need to Live By

Have you ever thought of putting rules on your money? It is a pretty interesting concept. We tend to have rules for…