12 Money Rules You Need to Live By

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Have you ever thought of putting rules on your money?

It is a pretty interesting concept.

We tend to have rules for every other area of our life…how much to eat, how much we should watch TV, limiting the amount of social media, amount of time to brush our teeth, etc.

Then, that love hate relationship comes up with rules.

We love rules because they provide structure and guidance when we need it the most.

We hate rules because rules are meant to be broken.

The golden rules are the ones that should be so ingrained in our lives that we don’t think differently.

Do you have a list of money rules?

Maybe a few in your head? But, probably not on an actual list.

The bottom line is having a list of money rules to live by will life changing and make things easier.

These financial rules of thumb will make your life easier. Guaranteed.

Don’t worry… you will have a list of money rules shortly. You can grab the PDF in our free printables section.

More than likely, you hope to manage your money well and have extra left over each month.

Not that I want to burst your bubble, but does that truly happen every month? Be honest.

Learning how to manage money is a skill that must be learned. And unfortunately, for a good majority of us, that skill comes from the school of hard knocks. Money management and personal finance principles aren’t “important” subjects to be taught in schools.

Today, we are going to start out with a simple list of money rules.

A list to remember. There are more than 7 rules of money. Not a list of 30+ rules of money. A simple list of 12 money rules that you can actually memorize.

Money rules that will help us enjoy life and reach financial independence.

There is good reason to have financial rules guiding our path.

Why is Personal Finance Important?

Personal finance is not just for those that find it interesting.

Everyone needs to know the basics of personal finance principles to become wise with their money.

The best part is you need to know the minimum financial rules to be successful. You don’t need a CFP, a financial advisor, or have a degree in accounting and finance. You must be willing to learn a few things to be successful.

That is all.

Specifically, here are personal finance guidelines:

- Know where you money goes

- Improve your standard of living

- Actually have money to invest

- Increase your net worth

- Security blanket with proper insurance coverage

- Less stress with money

- Enhance your cash flow

- Don’t have to worry about your credit score

- Understand why ROI (return on investment) matters

- Life the live you dictate

- Prepared for life’s unexpected curve-balls

Personal finance is important.

But, too often we are still left wondering… What is the rule of thumb in finance?

These are all of the items we listed out above. These are the rules of thumb in finance you need to know.

Don’t ignore the obvious. Pick up one of the best finance books to get you started. And make sure to stick around Money Bliss, we have something coming up that you don’t want to miss!

What is the best money rule?

The best money rule is to live below your means.

That’s a good rule to have because it helps keep you from overspending, which can lead to a lot of problems in the future. It also helps you to avoid debt, which can be a huge burden on your finances.

Then, you will have money to pay yourself first.

Money Rules To Know by Heart

Here is a list of financial rules that have become ingrained in our life. These are things that are a must.

It doesn’t matter if you make $15 an hour or $60K salary per year or more, the same rules apply.

These money rules guide your path to financial independence.

This list of money rules are non-negotiable.

(And make sure to teach them to your kids.)

1. Spend Less Than You Make

This may seem obvious, but with so many easy ways to access credit and debt, that we must state it first.

Spend less than you make.

Your income EXCEEDS your expenses.

Each paycheck you spend less money than you bring in. This simple money rule will help you stay afloat during crisis, save more money, and become the millionaire next door.

Tips to Spend Less Than Your Make:

- 10 Ways on How to Drastically Cut Expenses Now

- The Vicious Cycle- Learn How to Stop Spending Money Now

2. Learn from Mistakes

I’ll admit. I am far from perfect. Most of the tips you will find on Money Bliss happened because of mistakes that I have made.

Call it the school of hard knocks.

These money lessons changed our trajectory of where we were headed… specifically from living paycheck to paycheck to on our path to financial freedom.

Once I become honest with myself and the stupid money decisions I made, it was easier to move forward and learn from my mistakes.

Don’t cower from your mistakes. You can keep making them if you want. Or wake up and do something different.

Must read…Money Mistakes To Avoid That Will Leave You Broke

3. Pay Your Bills On Time

This is one lesson I learned from my parents.

A late payment was not acceptable. Period. End of story.

If you are unable to pay your bills on time, then you need to have less obligations to make sure bills are paid.

There are two ways this happens:

- You don’t have enough money

- Your personal finances are a mess

The second one is easier to overcome with our free Bill Payment Template. The first one is more difficult, but can be done by spending less money or earning more income.

Help for You: How to Organize your Personal Finances in 8 Simple Steps

4. Make a Plan for your Money

Don’t just assume… that your money can manage itself.

You need to take active control of your money management. Continuing to sit idly on the sidelines will continue your current path with money.

Is that what you want?

The great part of becoming an active participant in managing money is you learn what you like to spend your money on and what you don’t like spending your money on. A spending freeze will help jumpstart some savings when you start planning what you will do with your money.

Most people HATE the word budget. That is why we prefer to call it a Cents Plan. Figure out your “cents” and make a “plan.” A plain and simple way to make a plan for your money.

Make a Plan for Your Money Now:

5. Establish an Emergency Fund

The backbone of money rules lies in the emergency fund.

Don’t go with one!

Make sure your emergency fund is adequate for your spending. And make sure you don’t tap into your emergency fund for overspending.

Here is a wise financial rule to remember…

in the perfect world, you should never use your emergency fund. But, if you do, that is why you have one.

Must Reads…

- Emergency Fund – Everything You Need to Know

- Quickstart your Emergency Fund Challenge in Less than 60 Days

6. Say No to Debt

Debt is truly the cash flow killer. Those debt interest payments will hold you back from living the life you want to live.

Would you rather… be the person paying those interest payments? Or would you rather be the one collecting those interest payments?

My answer – I would much rather collect interest payments and make money on my money. When we decided to pay off our student loan debt, we shaved almost $10,000 in interest payments alone. Learn why we paid off debt.

The ability to access debt is easy and so very tempting with zero down and zero-interest payments.

Make it is money rule to say no to debt.

If the debt is a must, then truly decide if going into debt is worth it or if you can pay cash for it.

Side note on mortgage debt... in many cases, mortgage debt can be less than the cost of renting. So, it makes financial sense to finance debt for an appreciating asset. (A car does not appreciate in value. It is a decreasing asset and depreciates quickly.)

Tips to Get out of Debt:

- How to Get Out of Debt in 5 Easy Steps

- Are You Making One of these Common Debt Payoff Mistakes

- 7 Things to Give UP to Pay Off Debt Faster

7. Know where you want to Spend money

More often than not we spend out of habit. Not because we wanted something or needed something.

Spending money is a habit.

- Need = Something is something you CANNOT live without (shelter, food, clothing)

- Want = Something that makes our lives easier and we enjoy (you could go without and not notice).

Too many times the lines between a want and need become blurred.

Figure out where you want to spend money and where you actually spend money.

For example, if you are trying to pay off debt, but your entertainment spending is too large. You have to decide what to you want more – be out of debt or go to that latest concert.

Learn the difference by participating in a no spend month.

8. Invest in the Stock Market

This is a scary topic for most people. Yet the stock market rises more than your hourly wage on average (source).

If you have a desire to build wealth and your net worth, that starts with dabbling a toe into the stock market. Start with an ETF and $100.

Those who invest in the stock market will grow their net worth faster than those sitting on the sidelines.

Advice: Learn how to invest in stocks for beginners.

9. Talk about Money

Oh goodness! Money secrets can cause so many issues within a relationship.

Don’t think of talking about money is taboo.

Outside of a personal relationship, you don’t have to go into details about how you make, your mortgage, or how much you are paying for your kid’s sports. But, you can have open conversations about how you plan to pay off debt, ways you are saving money, and helpful money books you are reading.

By talking about money, you have people that will help you to be accountable for your money decisions.

Pro Tip: How to Talk about Money with your Spouse

10. Have Money Goals

Money rules and money goals in the same sentence?

Yes!!

Money goals are so important to keep your personal finances on track.

This is probably the most important financial rule. Okay, probably not…all 12 money rules are equally important.

But, having a money goal will keep you motivated through the other financial rules. That is important. It is easier to say no to something when you have your bigger money goal in mind.

Learn… Powerful Truth Behind Money Goals that you Need to Know

11. Know Your Savings Percentage

And increase it every year.

Your savings percentage is the total amount of money saved across all of your accounts divided by your income.

This is one of the best ways to track your progress towards financial freedom. The rules for saving money!

Saving Percentage Example #1…

You saved a total of $5,000 with our 52 week money saving challenge. Your annual income is $48,000.

Your Savings Percentage = (5,000 / 48,000) * 100 = 10.4%

Saving Percentage Example #2…

You saved a total of $12,500 between your employer’s retirement plan, emergency fund, and vacation money. Your annual income is $97,000.

Your Savings Percentage = (12,500 / 97,000) * 100 = 12.9%

At the bare minimum, keep your savings percentage at 10%. Each year, increase your saving percentage. Opportunities open up the more you are able to save. Ultimately, a saving percentage of 50% will help you reach financial independence faster.

Learn to Save More Money

- How to Save Money Fast – Save $1,000 in a Month

- How To Double 10k Quickly: Realistic Guide to Help You

12. Don’t Have a Tight Fist

Be willing to open up your fist and let a few dollars slip through.

This is a tough money rule for all of us to learn.

We feel the need to hold onto our money so tightly that it won’t go away. However, it is a blessing to open up your tight fist and be generous to others.

It is a chance to help others. It is a way to pay it forward. And it doesn’t have to be money. You can volunteer your time.

But, the question is always asked, “what’s in it for me?” Charity doesn’t give back any monetary benefits. Everything is intrinsic in value. Watch someone’s reaction to giving them $10 or buying for the person behind you.

The lesson is in values and lending a hand to help others.

Give what you can without regrets.

Learn to let go of your tight fist:

Time to Memorize the Money Rules

Now, that we have gone into detail about all of the money rules, it is time to make them a normal part of your life.

You want the financial rules of thumb to become a natural part of how you make, spend, save, and invest money.

The goal is to implement them without even thinking about it.

These financial rules for success will transform your personal finances.

Are you ready for success? Then, these are where you start.

Use these 12 rules to live by. Start here in making decisions.

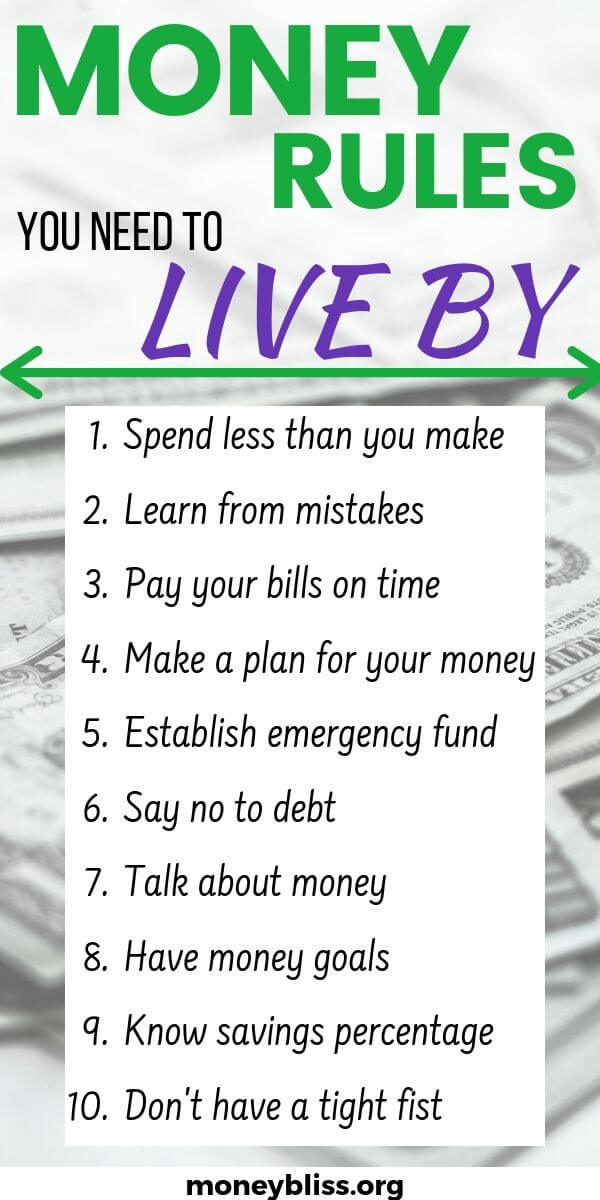

Just to recap the rules of money…

12 Money Rules

- Spend less than you make

- Learn from mistakes

- Pay your bills on time

- Make a plan for your money

- Establish an emergency fund

- Say no to debt

- Know where you want to spend money

- Invest in the stock market

- Talk about money

- Have money goals

- Know your savings percentage

- Don’t have a tight fist

There you go!

At the end of the day, you will be grateful you did.

The 12 money rules of thumb help guide your money situation on this journey of life.

Don’t leave home without them!

Serious Way to Make More Money

One of the best ways to improve your personal finance situation is to increase your income. Here are a variety of side hustles that are very lucrative. With time and effort, you can start enjoying the lifestyle you want.

Learn How To Create Printables That Sell!

This is the perfect side hustle if you don’t have much time, experience, or money.

Many earn over $10,000 in a year selling printables on Etsy. Learn how to get started by watching this free workshop.

Learn the Skill to Proofread Anywhere

Are you passionate about words and reading?

If so, proofreading could be a perfect fit for you, just like it’s been for countless of readers! Learn how you can create a freelance business as a proofreader.

Check out this free workshop!

FREE VIRTUAL ASSISTANT TRAINING

If you've ever wanted to make a full-time income while working from home, you're in the right place!

This intensive training combines thousands of hours of research, years of experience in growing a virtual assistant business, and the power of a coach who has helped thousands of students launch and grow their own business from scratch.

Earn Extra Income with Bookkeeping

Bookkeeping is the most stable, reliable & simple business to own. This is how to make a realistic income -either part-time or full-time.

Find out TODAY if this is THE business you’ve been looking for.

Earn More Writing - Learn How to Make Money as a Freelance Writer

You can make money as a freelance writer. Learn techniques to find those jobs and earn the kind of money you deserve!

Plus get tips to land your first freelance writing gig!

Free Flipping Video Training Series

Learn how to buy and resell items from flea markets, thrift stores and yard sales. They will teach you how to create a profitable reselling business quickly

…no matter how much or how little experience you have.

Trade & Travel with Teri Ijeoma

Learn how to supplement your daily, weekly, or monthly income with trading so that you can live your best life! This is a lifestyle trading style you need to learn.

Honestly, this course is a must for anyone who invests. You will lose more in the market than you will spend this quality education - guaranteed.

Freight 360 University

Designed as a 101-level course on freight brokerage, you’ll learn the basics of freight brokering in this online course.

This course is designed for freight brokers in any setting, regardless of their employment status.

If you want to start your brokerage, we’ll show you exactly how to do it. If you are an agent or employee of a brokerage, we’ll take you through sales and operations modules designed to help you source more leads and move more freight.

Empowered Business Lab

The Empowered Business Lab teaches you how to sell your digital products naturally with strategies that just make sense.

Monica helps thousands find momentum and create revenue streams in their businesses.

Be Inspired by One Gentleman's Trading Journey

After taking a second job as a driver for Amazon to make ends meet, this former teacher pivoted to be a successful stock trader.

Leaving behind the stress of teaching, now he sets his own schedule and makes more money than he ever imagined. He grew his account from $500 to $38000 in 8 months.

Check out this interview.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.