The [Ultimate] Biweekly Money Saving Challenge – Save

Inside: Are you looking for a way to save money each paycheck instead of every week or month? The biweekly Money Saving Challenge can help you achieve that goal and free printables track your progress.

Are you looking for a fun and easy way to save money?

If so, you’re in luck!

I created the ultimate biweekly money saving challenge when we started being paid on a biweekly basis.

This Biweekly Money Saving Challenge is a guide designed to help you save money every biweekly paycheck.

The biweekly challenge will help you save money every paycheck and learn new money-saving strategies.

This challenge is designed to help you save money each paycheck without feeling like you’re depriving yourself.

You will save money each paycheck without feeling like you’re depriving yourself. It’s a way to stretch your dollars while still getting the things you need and want.

Best of all, it only takes a few minutes to set up and get started.

Given that almost one-third of private businesses, pay on a biweekly pay (source), then it is about time to have a money saving challenge that matches that biweekly pay schedule.

So what are you waiting for? Let’s get started!

What is the definition of a biweekly money saving challenge?

The biweekly money saving challenge is a plan to save money every other week.

This can be customized depending on your personal circumstances, such as whether you prefer smaller amounts saved every week or larger amounts saved over a longer period of time.

The biweekly money saving challenge helps you stay motivated and on track toward your savings goal.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

How Much Can I Save with a Biweekly Money Saving Challenge or 26 Week Money Challenge?

In order to help you save money, we have put together a variety of different biweekly money saving challenges or 26 week money challenges.

Whether you want to save money for an emergency fund, a vacation, a downpayment, or retirement, we have a challenge for you!

Now, you get to tackle one of these challenges and save yourself some extra money and reach your financial goals.

Depending on the money saving challenge you pick, this amount will be saved at the end of 26 weeks or 26 paychecks:

- Traditional $1 challenge and Save $351

- Traditional $2 challenge and Save $702

- Bump by $5 challenge

- $5,000

- $10,000

Hailed for its competitive APY rates and digital ease of use, GOBankingRates named CIT as one of the Best Online Banks for 2022.

Earn one of the nation's top rates.

- Daily compounding interest.

- No account opening or maintenance fees.

- Your deposits are FDIC insured.

- Deposit checks remotely.

- Make transfers with the CIT Bank mobile app.

What are the benefits of doing a biweekly money saving challenge?

A biweekly money saving challenge is a great way to save money that is tailored to how you get paid. As you know, learning how to use a biweekly budget template is different than other budgeting methods.

You can save up to $1,000 in a year by doing this challenge. Or more if you choose!

Benefit #1 – Save more money than a monthly savings challenge

The biweekly money saving challenge is a great option for people who get paid bi-weekly. The challenge follows the original challenge but with a different number of paychecks.

With the monthly challenge, you have 12 opportunities to save money. However, with this biweekly savings challenge, you have 26 times to save.

Yes, that is more than double the chances to save money, which can really add up over the course of a year. This is an easy way to save money and improve your financial life overall.

Benefit #2 – Learn about your spending and make changes accordingly

Since you have 2x opportunities to save money, you also have 2x as many chances to correct your overspending mistakes and make changes.

The challenge is flexible, so you can make it work for your unique financial situation.

You can save money in a number of ways, including on groceries, transportation, utilities, and other expenses. By making small changes in your spending habits, you can make a big impact on your overall financial health.

Benefit #3 – Biweekly challenges help you stay motivated and focused

If you are looking to save money and stay motivated, a biweekly challenge can be a great way to go.

Setting a small but challenging goal for yourself, and then reminding yourself of your end goal every week can help you stay on track.

You get the opportunity to actively save fourteen more times than a monthly savings challenge.

Benefit #4 – Keep yourself accountable

A biweekly challenge helps you stay accountable by giving you a deadline to save money every two weeks.

This builds your money management skills and makes it easier since you are reviewing your finances every biweekly paycheck.

Plus you get to check off or color in the square for each savings amount on the biweekly money saving challenge printable.

Benefit #5 – Builds a healthy savings habit

Biweekly money saving challenges can help you save money on a regular basis, which is a great way to jumpstart your savings goals

The goal of the challenge is to save a specific amount of money over the course of a term, usually two weeks. This type of challenge can help you build a healthy savings habit by getting yourself motivated and comfortable with making regular savings deposits.

By following a biweekly challenge, you can increase your savings immensely depending on which amount you choose.

How does the biweekly money saving challenge work?

There are no strict rules, so you can customize the challenge to fit your needs.

The goal of the biweekly money saving challenge is to save a specific amount of money over the course of a term.

Step 1: Choose your savings challenge

If you’re looking to save money in the coming year, choosing a biweekly money saving challenge is a great way to get started.

We have plenty of options available below, and you can choose one that is relevant to your current goals and life situation.

It’s important to be determined and motivated when undertaking a challenge like this, but with the right approach, it can be easy to become successful.

Step 2: How do you plan to complete the challenge

There are three different ways you can complete this challenge:

- In Order – Check off biweekly by biweekly – just like the challenge is written.

- Reverse Order / Backwards – Start by saving the higher amount early in the challenge and then slowly work your way to the smaller amounts.

- Hacked method – You choose which date you want to save what amount. You still save but on your terms.

There is no one preferred method over another method. At the end of the challenge, you must save the amount you decided on. That is what is important.

Step 3: Set up your account

To participate in the biweekly money saving challenge, you need to open a savings account or increase your 401(k) contribution. This will make sure you stay consistent with your savings.

If you prefer to save in envelopes, then check out our 100 envelope challenge.

Here are great online savings accounts that you won’t be tempted to spend the money:

Also, make sure you set up automatic transfers with your bank so it transfers money automatically into your savings account. This is an easy way to start saving money.

Step 4: Make a Budget work for you

When you create your biweekly budget, make sure that it’s realistic and reflects your actual income and expenses. You want to prioritize your 26 week money challenge with the amount you plan to save.

Begin by creating a budget and tracking your spending every two weeks. Simplifi is a great system to get started. This will help you set realistic goals for the challenge and track your progress over time.

Get creative with your spending habits. Don’t be afraid to try new ways of spending less money – whether that means investing in cheaper products or spending time outside instead of inside to find free things to do. Experimenting with different expenses will help you learn more about your spending patterns and save even more money in the long run.

Step 5: Start saving

Now, the fun part, you get to start saving money!

You should feel proud every other week you save money. Saving money is not easy when you first start out.

If you chose the original $1 challenges, then to begin, start by putting $1 into savings each week. As your money begins to grow, you can slowly increase the amount until it feels like a stretch.

Step 6: Track your progress

To stay motivated throughout the money saving challenge, you can print out a free tracker and color in a box each time you save the amount listed.

Keeping track of your progress will help you stay motivated and on track.

Step 7: Celebrate your success!

This is a big accomplishment, and you should be proud of yourself! If you’re able to save money throughout the biweekly challenge, celebrate!

Taking some time to reflect on your progress can help you stay motivated and continue saving over time.

Remember to keep learning about money management so that you can continue improving your finances. There are many other challenges out there for you to try, so don’t stop here.

You’ve completed the challenge! And now, it is time to move to the next money saving challenge.

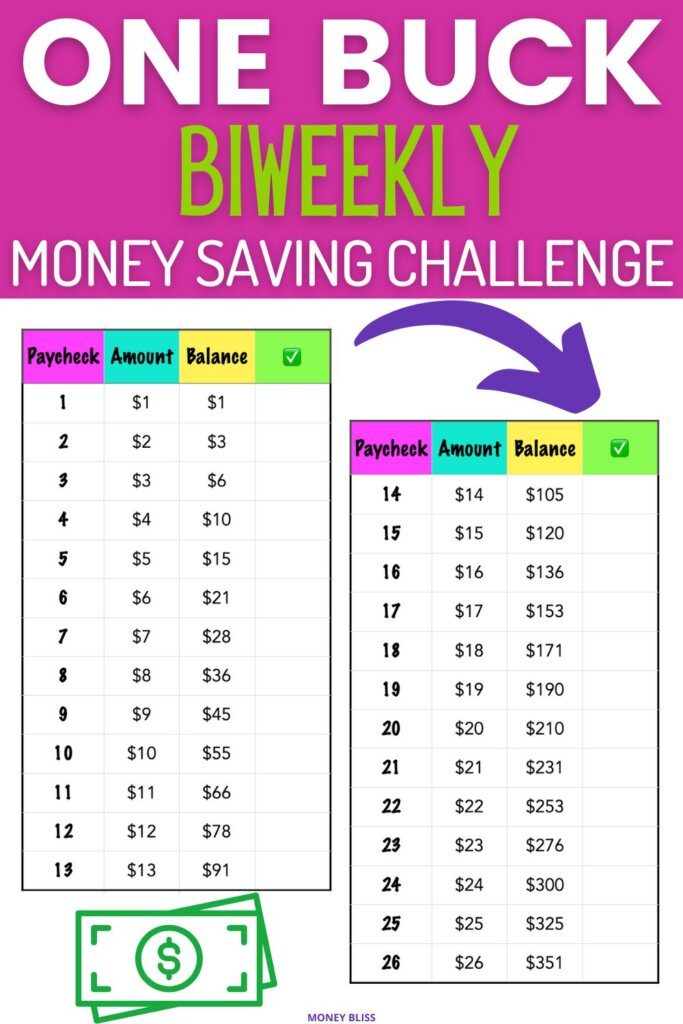

#1 – Traditional 26 Week Money Saving Challenge

The premise behind the original $1 money challenge is simple.

Start with a $1. Each week, add another $1.

At the end of 26 weeks or 26 paychecks, you have $351 saved. If you continue for another block of 26 weeks or paychecks (for a total of 52 weeks), you have saved $1,378.

And let’s be honest, it is easy to find a dollar or two here and there when starting out.

With these saving money challenges, you prove to yourself that you are capable of saving money. That is huge for your money mindset and becoming financially sound.

Prefer to save the same amount each paycheck? $13.50 per paycheck it is. $351/26 = $13.50

#2- Reverse 26 Week Money Saving Challenge

With the reverse biweekly money saving challenge, it is still an easy-to-follow plan that put the heavy saving at the beginning of the challenge.

You start by saving $26 in the first week or paycheck, and the amount you save decreases by $1 each week until week 26 when you save $1. If you have struggled with consistency in the past and are not able to maintain motivation throughout the year, the Reverse 26 Week Money Saving Challenge may be for you.

You will still save $351 in 26 weeks or biweekly paychecks. If you want to save the same amount, it would be the same at $13.50 per paycheck.

#3 – $2 Bumped Up 26 Week Money Saving Challenge

Much like the traditional $1 challenge, but this one ups the ante by $1.

Start with $2 and add an additional $2 each week or biweekly paycheck.

By the end of 26 paychecks or 26 weeks, you will have saved a total of $702!

This is a great way to challenge yourself and see how much money you can save on a tight budget.

#4 – Save $5 More than Last Time Money Saving Challenge

With this money saving challenge, you will start to see the impact of saving an additional $5 on each biweekly paycheck.

Start with a $5. Each week, add another $5.

At the end of 26 weeks or 26 paychecks, you have $1,755 saved. If you continue for another block of 26 weeks (for a total of 52 weeks) or paychecks (for a total of 2 years), you have saved $6,890.

It is easy to start finding five bucks to save by cutting out that coffee run.

#5 – Biweekly 5k Savings Challenge

The biweekly 5k savings challenge is about really putting a focus on saving and hitting a substantial amount.

When you save $5000, you prove to yourself that you are capable of saving money.

This challenge is great for saving for vacation fund, home repairs, or a Roth IRA. This is how to save $5000 in a year.

The biweekly 5k savings challenge is flexible and adaptable to your personal finances.

This is exactly how to save 5000 in 26 paychecks.

If you prefer to save the same amount each paycheck? $192.31 a week it is. $5000/26 = $192.31

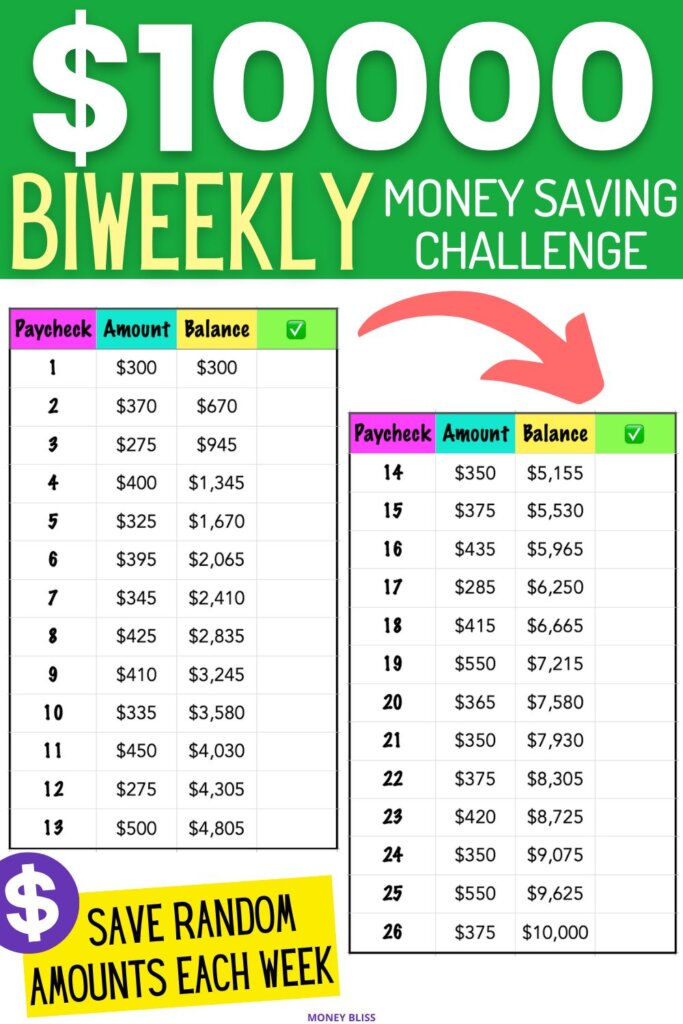

#6 – $10000 Biweekly Pay Savings Challenge

Of course, we would have the $10k challenge! That is what Money Bliss is known for – challenging you to save $10000.

In our own home, I am known to say, “GO Big or GO Home.”

Well, saving $10k would be GO big! The number of reasons to save $10000 could be for a new-to-you-car, downpayment, home repairs, or any other big money goal. Or my hubby’s favorite… F*** You money, courtesy of this book.

By saving $10k, you are putting yourself in a higher level of being about to save money and you are putting an emphasis on your financial future. There’s no better way to build a strong money foundation than by routinely saving $10000 or more each year.

How much should I save a paycheck to reach 10000? If you prefer to save the same amount each paycheck, then $385 per paycheck. 10000/26 = $385

Just remember, that means you are saving under $200 each week -to be exact $193 per week.

FAQs

Bi weekly savings challenge printable

These money saving charts are crucial to help you stay on track. No need to DIY your own cute printable.

To help your saving success, we have all of these biweekly money saving challenge free printables in our resource library. You can access everything for free – just check it out.

Our way to help you!

These are free worksheets and printables to help you save money and reach financial freedom.

Make sure to download your copies today! Start your money saving challenge! Change your financial future now!

What are some alternative options to the Biweekly Money Saving Challenge?

Money saving challenges can help you to develop better budgeting and saving habits. That is the ultimate goal of saving money.

Here are other popular money saving challenges available and can be tailored to your specific needs.

How can I make the most of the Biweekly Money Saving Challenge?

The best way is to start! To take action in saving money.

The biweekly money saving challenge is a great way to save money. By saving money each paycheck, you can make the most of your money.

This guide has shown you the benefits of saving money, resources to be successful, and free printables to track your progress.

Saving money doesn’t have to be difficult. Also, making sure to take some time to reflect on your progress can help you stay motivated and continue saving over a longer period of time than just 26 paychecks or one year.

Give the challenge a try today and see how much you can save!

Join the challenge today! There’s no bad option when it comes to saving money!

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.