3 Easy Steps on How to Make a Yearly Budget

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Determining a budget just for a month may seem impossible. Budgeting by paycheck may leave you stuck with high expenses during a pay cycle.

That is why learning how to make a yearly budget is much simpler.

Here is why – you will anticipate every single item throughout the year.

Thus, eliminating the urgency of any emergency expenses. Honestly, most emergency expenses are just expenses that we knew would happen we just didn’t want to deal with them or the cost. This is the time to anticipate yearly expenses.

The thought of budgeting once a year shouldn’t be cumbersome. Interestingly enough, it will be freeing. You are managing your cash flow.

Once we finally got this very concept ourselves, it has changed our life, our net worth, and our happiness. (And it feels great!)

By budgeting yearly, precious time and energy will be saved.

The one year budget is a game changer for most households.

Since time was spent upfront, all expenses are covered. You’ve made a plan for your money. You can stop living paycheck to paycheck. No more letting your money control you!

You will control your money. This yearly budgeting process is very helpful for those who don’t know how much money they spend by category.

Now, let’s get into how do you create a yearly budget.

How to Make a Yearly Budget

First of all, this is the exact same process you would use to budget by paycheck, monthly, or bi-weekly.

The overall concept is the same you are just looking at longer time frame.

It will help you to forecast cash flow issues that may arise.

1. Create a Budget (or Cents Plan)

The very first step is to sit down and create a yearly budget. Or what at Money Bliss we call a Cents Plan.

Here is why we prefer to call it a Cents Plan – a Cents Plan puts your Money “Cents” with your Head “Sense” to come up with a plan.

Take time to create your yearly budget with a pencil and paper. Remember, you are working with yearly numbers not monthly.

To Do This:

- Use your yearly income (net of taxes)

- Review your expenses from the previous year

- Increase any expenses that will be higher this year

- Make sure all expenses are covered especially irregular expenses

When creating a yearly budget, you will heavily rely on sinking funds to cover your expenses.

For example, your yearly car registration is $450. Then, you set aside $37.50 each month into your sinking fund.

Not sure everything is covered, check out our courses to help you in this budgeting process.

The goal is to make sure your income is less than savings, giving, and your expenses.

2. Stay Consistent with Yearly Budget

Once you have sat down and created your budget, stay consistent.

I know you are thinking that is easier said than done. Guaranteed, the first few months will be toughest! That is when 95% of people give up and run back to their old habits.

Don’t give up on your vision and how you want to live your life.

Do not change your budget every month or every couple of months. Please don’t do it. (Sinking funds won’t let you get caught with a month without enough money.)

Here is why… When your yearly budget is created, you already allocated every possible expense you may have. Thus, there is no reason to change it. You are setting money aside in buckets.

The temptation to constantly change a budget happens because staying within the said budget is too hard. It is too difficult. It is no fun.

Don’t fall into temptation.

3. Tweak Only with Big Changes

There are times when tweaks are necessary for the yearly budget. Some examples include a pay raise, your oldest kid is starting preschool for the first time, the cost for medical insurance is rising, or a move changed all of your expenses.

As a general rule of thumb, tweak your yearly budget plan on with these qualifications:

- The new expense or income will be recurring.

- The new expense or income is a significant change to your Cents Plan (2% or more of your income). Rule of thumb – greater than $200.

This isn’t the place to change your Cents Plan because of overspending. That does not qualify as a big change. That is plan overspending. No sugar coating that one.

Look at ways to overcome why the overspending is occurring. The easiest solution…switch to cash for that category. Learn how to use the cash envelope system or cashless envelope system.

When the cash envelope or sinking fund is empty, no pulling money from other categories. Resist temptation. It is crucial to stop overspending in order to become free with money.

How do I make a 12 month budget?

If you don’t want to keep the same consistent budget each month or paycheck, that it completely okay.

You need the budget to work for you. That is what is most important.

You will follow the same budgeting process as above, but plan out each month for a year.

The main difference is instead of using sinking funds you would allocate the actual spending during that month.

This 12 month budget process is similar to cash flow planning. You anticipate all of your yearly expenses and which month and/or paycheck they will be paid.

This type of 12 month budget is helpful when saving a consistent amount is difficult because of income variations. Then, you are able to save more at certain points throughout the year and cover basic expenses when income is tight.

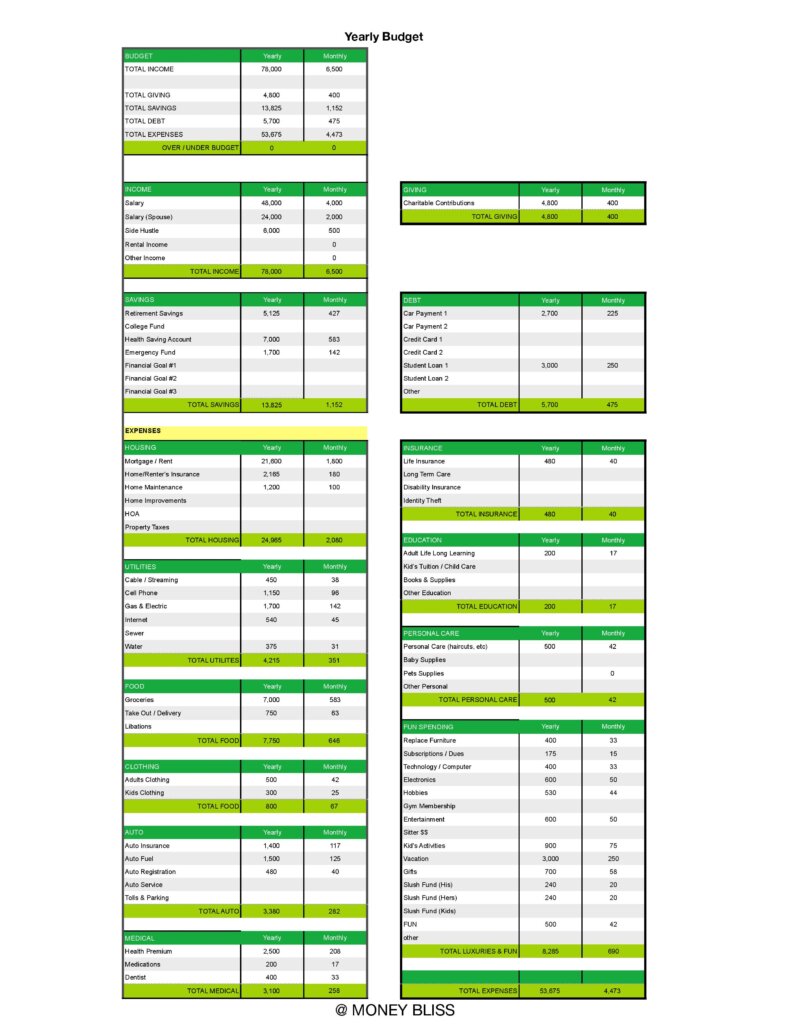

Yearly Budget Example

It won’t take long does it take to create the annual budget. It provides a different perspective – a birds eye view to make sure your expenses are covered.

In case you are a visual person, here is a case study on how to make a yearly budget work.

You can download this yearly budget template in our free printables area.

Now, you are controlling your money and not have your money control you. Write the Cents Plan in pen, so it can’t be changed.

Reviewing a Yearly Budget

Every paycheck or month, you must review that your plan is matching up to what you actually did.

There is no point to create a yearly budget plan and not use it.

It is very doable to budget once a year. The biggest step is starting.

This will help you to stop living paycheck to paycheck. Take the stress away knowing that your expenses are covered. Eliminate the urgency of emergency expenses that are truly expenses you didn’t want to plan for (hint: tires).

The best feeling is to know you are on a path with money (even if it is difficult for the time being), so you can sleep better at night.

Make your personal finances a priority.

Once we learned how to budget yearly, it made such a huge change with how money was handled in our life. We knew where our money was going in advance and how much we had to spend.

Comment below on your struggles with budgeting and learning how to budget once a year will make things so much easy for you.

More Budgeting Tips:

- Why You Need a Cash Flow Budget + How To Start

- 110+ Personal Budget Categories for a Fail-Proof Budget

- How to Make Living on a Budget Painless

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.