How Much Should I Save Before Moving Out? [Complete Guide]

Inside: Are you thinking about moving out? This guide will help you identify the costs of moving, calculate how much you need to save, and advice on expenses. You need to learn and plan for the practicalities of living on your own.

Taking the leap to move out and start living independently is a significant milestone.

However, it’s important to ensure you’re financially prepared for this exciting new chapter in your life.

One vital step you need to take is to start saving money, essential for covering your future expenses, emergency fund, and even fun activities. Through careful budgeting, consistent saving, and efficient spending, you can make the transition smoother and stress-free.

Around here at Money Bliss, we focus on the need to save money before making a purchase or taking the next step, so you will be better equipped and stay debt free.

This way, you can fully enjoy the freedom and responsibilities that come with having your own place.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Why is Moving Out on Your Own Important?

There comes a time in one’s life when one feels the need to spread their wings and live independently. We all wanted to move out at 18 – I remember!

This crucial step, however, requires substantial planning. Yet, most just jump right to moving out.

The key thing you must do? Save. But, why so important?

Here’s why: independence means bearing your own expenses. Rent, groceries, utilities, they’re all on you.

Plus, unforeseen emergencies are less shocking when you have a well-stocked safety net.

What’s a good amount of money to have before moving out?

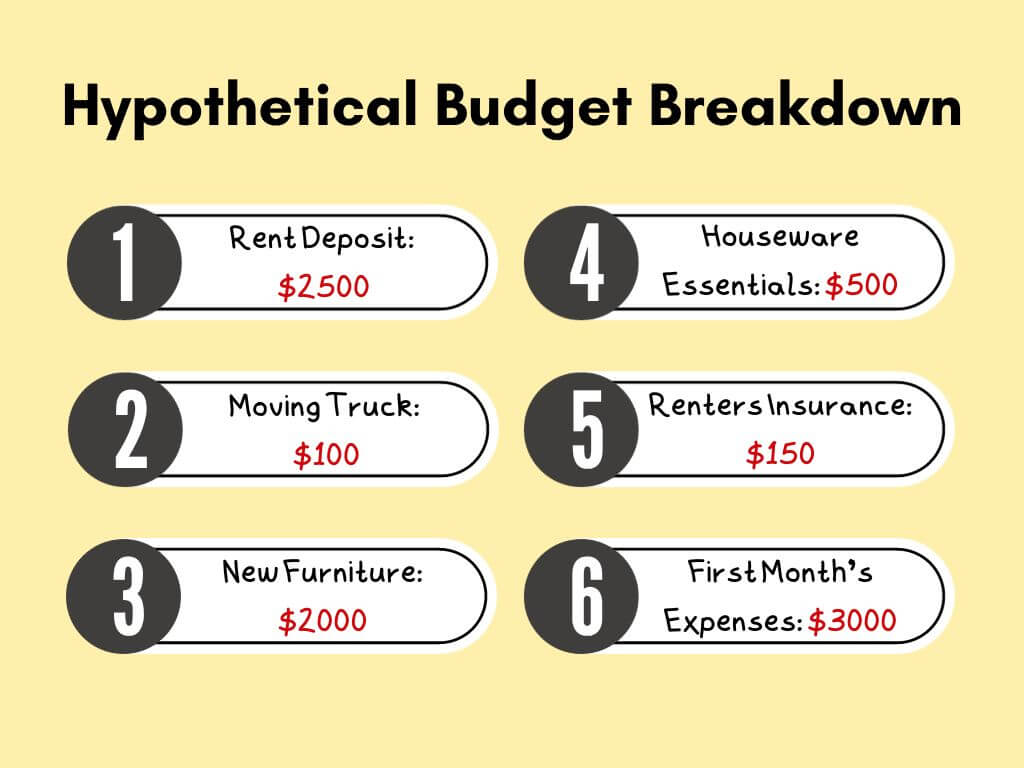

The amount you need to move out depends on many factors.

However, on average, you should aim to have between $6,000 and $12,000 stashed away before you pack your bags.

This sum would cover initial moving costs, deposits, furniture, essentials, and a few months of rent.

Remember, it’s not just about surviving your first month. You’ll need enough to keep you comfortable while you’re settling into your new life.

How much should I save before moving out?

Remember, there isn’t a “magic number.”

Yet, many wonder is $5000 enough to move out?

Your savings should cater to your housing costs, which ideally should not exceed 1/3 of your monthly income. Besides, factor in regional cost of living, moving expenses, and an emergency fund.

What determines the amount needed?

The amount to save before moving out varies greatly. It hinges on factors like your targeted living area because there is a wide fluctuation of HCOL vs LCOL areas, your projected expenses, and your income level. The rent in one city might be higher than in another.

As well as your personal lifestyle choices and spending habits will greatly affect monthly expenses.

Evaluation: Your Financial Status

Your financial status, including current income and expenditures, plays a crucial role in determining the proportion of your earnings you should save before moving out.

If you have a higher income with lower outlays, you can save more, whereas having roommates can significantly cut down your living expenses, enabling better savings.

A careful review of these factors allows you to create a realistic saving plan tailored to your unique financial circumstances.

You need to make sure you are on track to how much money should you have saved by 25.

Assessing your current income

Take a deep look at your income. How much do you earn each month? How regular is this income? These are vital questions.

Your net income (what you earn after taxes) sets the tone for what you can afford. This is the amount listed on your paycheck.

Learn more about gross pay vs net pay.

Understanding your debt load

Debt can be a significant hindrance when contemplating moving out. How much do you owe monthly?

You need to consider your debt-to-income ratio. This is what mortgage lenders do to figure out if I make 70000 a year, how much house can I afford.

If your debt is taking up more than 30% of your income, you need to be careful on how much you spend on rent and other mandatory expenses.

Learn how to pay off your debt faster using Undebt.it.

Know Your Expenses: Breaking Down the Costs

I’ll be honest. This is what most people overlook when they move out or even purchase a new home.

For instance, the couch I loved couldn’t fit into our new house. Sigh.

Now, is the time to learn how to save 5000 in 6 months.

Identifying the cost of moving

Moving costs can bite! They depend on relocation distance, packing supplies, and the complexity of the move.

Movers can range from hundreds to thousands. According to Moving.com, the average costs for a studio or one bedroom range from $501 – $985. 1

Thankfully, you are young and you can pay friends for help with pizza. But, you still need to account for a moving truck if needed.

Hidden costs you need to consider

When moving out, some costs aren’t glaring. These include fees for installing new services, delivery fees for new furniture, or penalties if foregoing a current lease. Yes, these hidden costs can pile up!

Even, the costs to put blinds up at your new place! A room darkening shade can easily set you back $50; I know, I like my sleep.

So, be sure to consider them when saving for your move.

Setting Up a Personal Budget

A budget plays a crucial role in being financially stable. Period.

Call it adulting if you want to, but you cannot spend more money than you make. That is a recipe for a disaster and way too much debt.

By adhering to a well-planned budget, one can prevent financial stress to ensure financial security and start your journey to financial independence.

How to start a personal budget

Starting a personal budget is simple.

- List your income and expenditures. Include rent, groceries, utilities, subscriptions, and yes, even luxuries.

- The goal is to spend less than you earn.

- Then, you can save and plan for your future.

That means you may not be able to afford everything you want. And using credit cards to fill the gap isn’t smart.

The 50/30/20 budget rule explained

For many, the 50/30/20 rule serves as a rough guide for managing your finances.

It suggests allocating 50% of your income to necessities, 30% to wants, and 20% to savings.

This is a beginner-friendly method to manage spending without feeling overwhelmed.

Starting to use a budget app is extremely helpful.

Enjoy guilt-free spending and effortless saving with a friendly, flexible method for managing your finances.

- Comprehensive approach to budgeting, helping you plan monthly budgets based on your income.

- Offers expert advice, making it suitable for those who require an in-depth, forward-thinking budgeting strategy.

- Superior synchronization skills make it the winner in this area.

- YNAB has extra features like goal setting for budgeting, shared budgeting tools for partners.

- Option to manually add and upload transactions from accounts each month.

- YNAB prioritizes user privacy.

Avoid These Budget Downfall

The most common expenses that are forgotten are irregular expenses such as vacations, weddings, or holiday spending. These variable expenses do not occur on a consistent schedule.

To manage these, note these big-ticket events on a calendar, estimate their cost, divide by 12, and contribute that amount to a high-yield savings account each month, offering you a guilt-free way to cover these costs without stressing over money.

Make sure you remember all of your expenses by checking out this full list of personal budget categories.

Creating and Managing an Emergency Fund

Why an emergency fund? It provides you with a safety cushion.

This fund prevents unexpected expenses from ruining your plans or sending you spiraling into debt. It acts as your financial parachute when you need it the most.

Around here at Money Bliss, we consider it a staple in financial wisdom.

Ideal size of an emergency fund

As a rule of thumb, your emergency fund should cover at least $1000-2000 in savings. This will provide money to cover a car breakdown or new car tires. Honestly, the goal is never to use your emergency fund.

However, you may look at a bigger rainy day fund that will cover 3-6 months of living expenses. This will provide you with a comfortable safety net against unexpected events like job loss or medical emergencies.

But remember: start small. Even $1,000 can buffer you from financial shocks. Check out these mini savings challenges.

Enough Money for One Year

A year’s worth of savings may sound excessive.

However, it provides unmatched stress relief and financial stability that can be life-changing, especially for young adults.

This tip will change your financial landscape immensely and provide you with more opportunities than you can imagine.

You can handle life’s ups and downs more easily when you have an entire year’s expenses sitting in your bank account.

Simply select one of the high-yield savings products offered by their network of federally insured banks and credit unions to begin your savings journey.

You can open a free Raisin account in just a few minutes!

Better Planning for Potential Bills and Fees

When preparing to live independently, don’t forget to plan for unanticipated costs.

Rental fees and deposits explained

When you rent, you’re likely to encounter a range of fees.

- First off, you’ll have to foot a security deposit – typically equal to one and a half month’s rent. This upfront cost acts as insurance for landlords against damages. If you leave the place in top shape, you’ll get your full deposit back!

- Additional fees could include application fees or non-refundable move-in fees like background checks. Know what you’re paying for before you sign the lease.

Utilities and recurring expenses

Electricity, gas, water, and internet – these utilities fall on your shoulders when you’re living solo.

These costs can eat a hole in your wallet if unchecked!

To avoid surprises, ask for estimates before signing a lease or find a place that includes utilities.

Other recurring expenses? Consider subscriptions. Gym, Netflix, Spotify – they all add up!

Perfect for the person who hates to hassle with canceling subscriptions and checking spending.

Trim adds value in such ways as canceling old subscriptions, setting spending alerts, checking how much users spent on ride-sharing apps the previous month, and automatically fighting fees.

Go for a Trial Run Before Moving Out

Adopt the practice of “paying rent” beforehand by setting aside a third of your income into a dedicated savings account which can test your financial readiness for the move. See if you can move out and afford it before you actually move.

Remember, being savvy with money while planning to move out involves carefully auditing your spending over the last 3-6 months and developing a budget that accounts for future expenses, savings, and essential purchases.

This may save you headaches in the future.

Smart Moves: Making Rent Like a Boss

You need to understand how you are starting to make financial decisions.

In fact, reading this financial advice for young adults would be helpful.

Understanding rent payments.

Rent payments can be daunting as prices for a single bedroom apartment are $1700/month. 2

- Many landlords may tenants to earn at least three times their rent.

- Payments are usually due on the first day of the month. Late payments can lead to hefty fees!

Stay organized by setting reminders or setting up auto-pay.

Considering a roommate.

On the fence about getting a roommate? It’s worth considering!

A roommate can drastically cut your living expenses. Half the rent, half the utility costs… that sounds like a sweet deal.

On the flip side, you may have less privacy and there can be disputes.

However, with clear communication and shared responsibilities, it can be a great experience. It’s a great option if your income is tight. Choose wisely!

Opting for second-hand furniture

Furniture expenses can add up quickly, but there’s a savvy solution: opt for second-hand furniture! Yes, it’s cool to be frugal.

In fact, vintage pieces can add character to your home. Perhaps snag a few items from your parent’s home, Buy Nothing Group, or thrift stores. It’s not about being cheap, but about being smart!

You can always upgrade later.

Key Takeaways Before Taking That Leap

Moving out with roommates not only gave me a firsthand experience of independent living but also exposed me to the nuances of financial management. These initial steps helped me understand budgeting and the importance of balancing expenditures with earnings.

Then transitioning into renting my own place, I was armed with the knowledge I gained and was better prepared to face the challenges, creating a smooth transition to living completely on my own.

You don’t want to be asking why you are constantly broke.

Checklist before getting your own place

Before making the big move, have you:

- Saved enough to cover deposit, rent, moving, and utility hook-up fees?

- Started a personal budget, tracking income and expenses?

- Drafted a rough spending plan using the 50/30/20 budget rule.

- Built an emergency fund?

- Discussed potential apartment rental fees and deposits?

- Considered recurring expenses and variable expenses?

- Weighed the pros and cons of having a roommate.

- Looked into second-hand furniture?

- Can you comfortably cover living expenses with your income?

- Have you accounted for all possible costs? Think of moving costs, utilities, groceries, health insurance, and more.

- Have you considered the cost of living in your preferred location?

- How stable is your income? Can it sustain your independence long-term?

Check out this first apartment checklist.

Frequently Asked Questions (FAQs)

Start Saving for How Much Money I Need to Move Out

Taking the leap into independent living can feel daunting. But with careful planning, budgeting, and saving, it’s an exhilarating journey.

The best advice I can give someone who is looking to move out is to plan ahead for the journey in front of you.

Remember, having anything between $6000 and $10,000 saved up is an excellent starting point.

As you navigate your financial freedom, adopt the 50/30/20 rule for managing expenses. Around here we call it the Cents Plan Formula.

Most importantly, stay prepared for life’s unexpected twists with an emergency fund. And don’t be shy to make some smart moves like considering a roommate or opting for second-hand furniture.

The journey towards independence is rewarding and fun – as long as you’re financially prepared. So pop that calculator, get budgeting, and start saving for your own place!

Source

- Moving.com. “Moving Cost Calculator for Moving Estimates.” https://www.moving.com/movers/moving-cost-calculator.asp. Accessed October 25, 2023.

- Rent Cafe. “Average Rent in the U.S.” https://www.rentcafe.com/average-rent-market-trends/us/. Accessed October 25, 2023.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.