How to Start a Bookkeeping Business

Inside: Embark on a profitable journey with our guide on starting a bookkeeping business. Find the steps on how to become a bookkeeper and find success.

Starting a bookkeeping business from scratch can be an exciting yet nerve-wracking venture.

For many budding entrepreneurs, the formidable task of setting up a business adds a mix of anxiety and anticipation. The initial trepidation often stems from dealing with the unknowns of a new venture and the pressure of ensuring meticulous financial management of someone else’s finances.

However, with thorough planning and an understanding of the essential steps, such as crafting a solid business plan and obtaining the necessary certifications, these nerves can be managed.

By embracing your entrepreneurial spirit and equipping yourself with the right knowledge, you can lay a strong foundation for a successful bookkeeping business.

Plus it is easier to get started than you thought…

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

What is a bookkeeping business?

At its core, a bookkeeping business manages the financial records of other businesses. They ensure accuracy, track receipts and expenses, and prepare financial statements – the financial bedrock upon which enterprises stand.

With an emphasis on accuracy and organization, they are responsible for keeping the financial data up to date and available for strategic decisions.

For many, this is a popular way to make money online.

Bookkeeping is the most stable, reliable & simple business to own. This is how to make a realistic income -either part-time or full-time.

Find out TODAY if this is THE business you’ve been looking for.

First Steps to Starting a Bookkeeping Business

Craft a Comprehensive Business Plan for Success

Your roadmap to success begins with a business plan. This document is crucial—it outlines your vision, goals, unique value proposition, target market, competitive landscape, marketing strategies, and detailed financial forecasts. Think of it as your strategic compass guiding you from startup to growth.

This takes your side hustle to an actual living thriving business.

Remember, your business plan is a living document. You must regularly review and update your business plan will help you stay on track toward your business objectives and adjust course as necessary to meet new challenges or opportunities.

Acquire Essential Certifications and Training

By obtaining the right certifications and training, you not only perfect your craft but also send a message of reliability and professionalism to prospective clients. While this may require an investment of time and resources, the credibility and expertise you gain are invaluable assets for your bookkeeping business.

- Select bookkeeping courses that cover crucial topics such as accounting principles, financial statements, tax preparation, and accounting software. This education will deepen your understanding and sharpen your skills.

- Stay updated with continuing professional education (CPE) credits to keep your certifications active and your knowledge fresh.

- Familiarize yourself with popular bookkeeping software that you’ll use day-to-day. Being proficient in these tools will increase your efficiency and accuracy—qualities clients highly value.

Once certified, don’t forget to prominently display your credentials on your website and marketing materials. This can significantly bolster potential clients’ trust in your abilities and help establish your reputation as a qualified bookkeeping professional.

Learn what you need to start your very own virtual bookkeeping business.

- An overview of the bookkeeping business so you can see if it is right for you.

- The tools you need to "wow" clients and get paid for your services and

- How to create a steady stream of new clients without the need to "sell" yourself.

Legal Considerations and Compliance

Setting the legal foundation for your bookkeeping business is not just a formality—it’s about protecting your operations and establishing credibility.

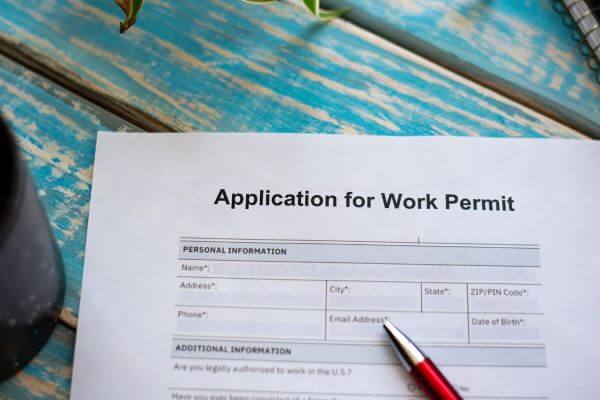

Register Your Business and Secure the Necessary Permits

Let’s look at the essential steps to ensure your business is registered correctly and fully compliant with regulatory requirements.

- Choose a Business Structure: Decide whether an LLC, sole proprietorship, partnership, or corporation best suits your needs.

- Register Your Business Name: This is a crucial branding element. Check for name availability and register it with the appropriate state agency, ensuring it’s unique and resonates with your target market.

- Obtain an EIN: If you’re in the U.S., you’ll need an Employer Identification Number (EIN) for tax purposes, especially if you plan to hire employees. This number is also often required to open a business bank account and apply for business licenses.

- Apply for Licenses and Permits: Depending on your location and the structure of your business, you may need various licenses and permits. Check local and state regulations to ensure you meet all legal requirements.

- Register for State Taxes: If applicable, register for your state’s tax structure. This may include sales tax, unemployment insurance tax, and other business-related taxes.

- Comply with Local Regulations: Ensure you’re familiar with local zoning laws if operating from home, and obtain a Certificate of Occupancy if required. If you’re part of a homeowners’ association, review any stipulations they might have on home-based businesses.

- Understand Ongoing Compliance: Be aware of annual filings, renewals for licenses and permits, and other regulatory commitments to maintain compliance.

By being diligent with these legal prerequisites, you’re not just following the rules—you’re also sending a clear message about your professionalism and attention to detail.

Protect Your Endeavors with the Right Insurance

Insurance is the safety net that can save your bookkeeping business from unexpected financial challenges. It’s not about expecting the worst; it’s about being prepared for any situation that could undermine the stability and reputation of your business.

- General Liability Insurance: This covers a broad range of issues, including bodily injury or property damage claims made by others.

- Cyber Liability Insurance: As a bookkeeper dealing with sensitive data, you’ll want protection against cyber threats and data breaches.

- Property Insurance: If you have a physical office or own valuable equipment, property insurance can cover losses from events like fire or theft.

By integrating the right insurance policies into your business strategy, you set up a protective fortress around the hard work and dedication you put into your bookkeeping business. Insurance should not be perceived as an unnecessary expense but rather as a prudent investment in your business’s longevity and reputation.

Setting Up Shop

Establishing a Home Office vs. Renting Space

Choosing the right environment for your bookkeeping business is a balancing act between professionalism, cost-effectiveness, and personal working style. Whether you decide on a home office or opt for a rented space, the decision will significantly impact your operations.

| Home Office Advantages | Renting Space Advantages |

|---|---|

| Cost Savings: Eliminate commuting costs and monthly rent, channeling those savings back into your business. | Professionalism: A commercial office can provide a more professional setting for client meetings and create a clear boundary between work and home life. |

| Convenience: Enjoy the flexibility of setting your own hours and working in a stress-free environment. | Networking Opportunities: Proximity to other businesses in shared office spaces can foster relationships and potential client referrals. |

| Tax Deductions: You may be eligible for home office tax deductions, saving you money during tax season. | Amenities: Rented spaces often come with value-added services like receptionists or conference rooms. |

| Home Office Disadvantages | Renting Space Disadvantages |

|---|---|

| Distractions: Domestic life can disrupt your work, impacting productivity. | Overhead Costs: Monthly rent and utility bills will add to your business expenses. |

| Professional Image: Having a dedicated business address and separate workspace can often project a more professional image to clients. | Long-term Commitments: Leases typically require a long-term commitment that may be risky if your business circumstances change. |

Ultimately, the decision depends on the nature of your clientele, your personal work preferences, and your budget. Also, this is great for a stay at home mom to make money.

Many bookkeepers find success starting with a home office and transitioning to rented space as the business expands. Others may find that a small rented office fits their needs right from the onset, or that a virtual office setup provides the perfect middle ground.

Selecting State-of-the-Art Bookkeeping Software

With the right bookkeeping software, you can streamline your operations, foster transparency with clients, and confidently tackle complex financial scenarios.

Adopting top-notch software will serve as both a foundation and a catalyst for your bookkeeping business, ensuring you remain competitive and responsive in a rapidly evolving industry.

Look into popular bookkeeping software such as QuickBooks Online, Xero, FreshBooks, and MYOB. Compare them based on features, ease of use, scalability, and customer support.

By taking the time to carefully weigh these factors, you will be better positioned to select bookkeeping software that not only meets your current needs but also supports your business as it expands.

Financial Foundations for Your Firm

Unravel Funding Options and Small Business Loans

Before seeking funding, calculate your startup costs including equipment, software subscriptions, legal fees, marketing, and initial operating expenses. This will help you understand how much capital you need to secure.

Typically, you should be able to start your bookkeeping business with little investment and add additional expenses as you grow.

If needed, there are a variety of funding sources available for new businesses. Research options like traditional bank loans, credit unions, Small Business Administration (SBA) loans, online lenders, and crowdfunding. When applying for loans or pitching to investors, a comprehensive business plan is essential. It should outline your business concept, financial projections, and growth strategy to demonstrate the viability and potential profitability of your bookkeeping business.

Smart Money Management from the Start

Establishing smart money management practices from the very inception is the same as being financially sound with your personal finances.

- Open a Dedicated Business Bank Account: Keep your personal and business finances separate. This is fundamental for accurate bookkeeping and simplifies your tax situation come year-end.

- Start With a Budget: Even before your first client, create a realistic budget for your business. Know the costs of all aspects, including marketing, equipment, insurance, and any other operational expenses. This will help prevent overspending and ensure your resources are allocated effectively.

- Use the Profit First Formula: This simple formula will help you to pay yourself as well as have enough money for operational expenses and to pay your self-employment taxes.

By establishing and maintaining these smart money management practices from the outset, you’re not just safeguarding your bookkeeping business against common financial pitfalls—you’re also building a foundation for a prosperous financial future.

Marketing Your Bookkeeper Business

Digital Presence: Creating a Website That Converts

In today’s digital-first world, your website often makes the first impression for your bookkeeping business. It’s not just an online brochure; it’s a crucial tool engineered to turn visitors into leads and leads into loyal clients.

- User-Friendly Design: Your website should be easy to navigate with a clean layout that directs visitors naturally from one section to the next. Prioritize quick load times and mobile responsiveness with Kadence to cater to all potential clients.

- Clear Value Proposition: Immediately communicate what you offer and why a potential client should choose your bookkeeping services. Highlight your unique selling points front and center on the homepage.

- Strong Call-to-Actions (CTAs): Use compelling CTAs to guide visitors towards taking action, whether that’s contacting you, scheduling a consultation, or signing up for your newsletter. Make it easy for them to engage with you.

- Client Testimonials and Case Studies: Social proof can be incredibly persuasive. Showcase positive reviews, client testimonials, and case studies to build trust and credibility with prospective clients.

With a well-crafted website, your bookkeeping business demonstrates its expertise and readiness to cater to client needs, no matter where they are in their financial journey.

Networking and Navigating Social Media Strategies

Building a robust network and mastering social media can turbocharge your bookkeeping business’s growth. It positions you not just as a service provider, but as a thought leader in your field.

- Identify the Right Platforms: Choose one or two social media platforms where your target audience is most active. LinkedIn, for instance, is a goldmine for professional networking, while Instagram can showcase your brand’s personality.

- Create Valuable Content: Share content that resonates with your audience — tips to manage business finances, tax updates, or insights into bookkeeping trends. This positions you as an expert and invites engagement.

- Engage Actively: Don’t just post and disappear; interact with your followers. Answer questions, join discussions, and show appreciation for their engagement. Building relationships is key to networking success.

- Leverage Professional Groups and Forums: Beyond your own social channels, be active in online groups or forums related to bookkeeping and your clients’ industries to expand your visibility and establish credibility.

Your network and social media are not just channels for promoting your services; they’re platforms for sharing your expertise, engaging with peers and potential clients, and building a community around your bookkeeping brand.

Bookkeeping Startup Pricing, Clients, and Growth

Determining Competitive Rates for Your Services

Setting competitive, yet fair pricing for your bookkeeping services is a balancing act that ensures value for your clients and viability for your business.

Let’s explore how to establish a rate structure that meets the market demands and supports your financial goals.

- Market Research: Begin by understanding what other bookkeepers in your area or within your niche are charging. This insight will help you benchmark your rates competitively. Keep in mind factors like experience, specialization, and location.

- Value Your Expertise: Assess your qualifications, experience, and the quality of services you offer. Clients are willing to pay for the value you bring to their business, so price your services accordingly.

- Consider Your Costs: Ensure your rates cover your expenses, including software subscriptions, continuing education, insurance, and taxes, while also leaving room for profit.

- Pricing Models: Decide whether you’ll charge hourly, offer flat-fee packages, or adopt a value-based pricing model. Each model has its advantages and can be chosen based on the type of service or client preferences.

- Communicate Your Pricing Clearly: Be transparent with clients about your rates. Clear communication prevents misunderstandings and builds trust from the outset. [Placeholder for sample pricing page]

Within your pricing strategy, consider the lifetime value of client relationships and the potential for added services down the line.

How will you find clients for your bookkeeping business?

Finding clients is the engine that powers your bookkeeping business and your income. With a strategic combination of diligent networking, tactical marketing, and leveraging existing relationships, you can start building your client base.

- Utilize Online Platforms: Websites like Upwork, Fiverr, and LinkedIn can connect you with businesses looking for bookkeeping services.

- Local Business Outreach: Approach local businesses directly. Offer to discuss how your bookkeeping services can alleviate their financial stress and add value to their operations.

- Referral Program: Encourage word-of-mouth by setting up a referral program. Incentivize your current clients or network to refer others to you.

- Social Media and Content Marketing: Create and share engaging content on your social media profiles to build brand awareness.

- Community Involvement: Join local business associations, attend chamber of commerce events, or contribute to community projects. These can lead to connections and opportunities.

- Offer Free Workshops or Webinars: By providing value upfront through informative sessions on bookkeeping and financial management, you can attract potential clients who are interested in improving their business finances. Also, you can partner with other professionals.

- Professional Partnerships: Build relationships with accountants, lawyers, and business consultants who might not offer bookkeeping services but can refer their clients to you.

With a consistent and strategic approach, you can attract and retain the clients that are the best fit for your business, ultimately building a robust client portfolio. Remember, it’s not just about finding any clients—it’s about finding the right clients who treasure you.

Discovering and Retaining Your Ideal Clientele

Attracting clients is one feat, but discovering and retaining those who are the perfect fit for your bookkeeping business is where the real growth happens.

- Offer Customized Solutions: Set yourself apart by tailoring your services to meet the specific needs of your clients. Show that you understand their industry and are invested in their success.

- Provide Exceptional Service: Consistently deliver high-quality work, be responsive, and proactively address your clients’ needs. Clients will stay with a bookkeeper who goes above and beyond.

- Host Client Appreciation Events: Small gestures of appreciation or exclusive events can strengthen business relationships and foster client loyalty.

- Stay on Top of Industry Trends: Being knowledgeable about your clients’ industries can make you indispensable. Offer insights that can help them stay ahead of the curve.

Stay Ahead in the Bookkeeping Scene

Continuous Learning and Leveraging Industry Trends

The bookkeeping industry doesn’t stand still, and neither should you. Continuous learning keeps you at the forefront of evolving practices, ensuring your services remain relevant and your advice sound.

- Keep Abreast of Regulatory Changes: Tax laws, financial regulations, and compliance standards can affect your clients; stay updated through webinars, online courses, and industry news.

- Embrace Technological Innovations: New software and tools can streamline bookkeeping tasks. Be open to adopting tech that can improve your efficiency and the services you provide.

- Participate in Professional Development: Attend workshops, seminars, and conferences geared toward bookkeeping professionals. Networking with peers can also uncover new trends and techniques.

By maintaining a commitment to continuous learning, you not only improve your own skillset but also enhance the overall value of your bookkeeping services.

Join Professional Associations for Peer Support

Being part of a professional association offers more than just credentials; it’s a direct line to a community of peers who can share insights, resources, and support as you build and grow your bookkeeping business.

By joining professional associations such as the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB), you demonstrate a commitment to professionalism and continuous improvement. These affiliations provide a wealth of resources to support you in delivering high-quality services and growing a thriving bookkeeping business.

Plus you can take advantage of seminars, webinars, and certification courses offered by associations to further your education and maintain any required continuing education credits.

Learn what you need to start your very own virtual bookkeeping business.

- An overview of the bookkeeping business so you can see if it is right for you.

- The tools you need to "wow" clients and get paid for your services and

- How to create a steady stream of new clients without the need to "sell" yourself.

Frequently Asked Questions (FAQs)

Ready to Open Bookkeeping Business?

Starting your own bookkeeping business can be a fruitful endeavor with the right preparation and education.

This guide outlines the key steps and provides direction on how to start a bookkeeping business, ensuring you cover all essential elements for a successful launch. With focus and attention to these structured steps, you’ll be well on your way to establishing a thriving bookkeeping business.

Still on the fence? Check out this free bookkeeping webinar to learn more.

With the right preparation, tools, and mindset, you can launch a thriving venture that supports businesses in their financial journey while growing your own entrepreneurial dreams.

Embrace the adventure—your future in finance awaits!

Just remember if you are looking for ways to make money fast, this one comes with patience and perseverance to make things happen.

Bookkeeping is the most stable, reliable & simple business to own. This is how to make a realistic income -either part-time or full-time.

Find out TODAY if this is THE business you’ve been looking for.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.