How to Create a Personal Financial Statement + [Free Template and Sample]

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Do you want to create a personal financial statement, but aren’t sure where to start?

According to Mint.com, over 65% of people have no clue how they spent money last month. So, you can probably be pretty sure even less know how their personal finance situation.

With rising costs for essentials like housing and education due to inflation, there is no better time to get an accurate picture of your current situation today.

If you’re wondering how your finances measure up, a Personal Financial Statement can be an invaluable tool in helping you understand where you stand financially and prepare for changes ahead.

This article will walk through creating a sample personal financial statement template with examples of what this document might look like based on your situation.

A personal financial statement isn’t just for your loan applications anymore, it’s an opportunity for transparency in your finances too!

What is a personal financial statement?

A personal financial statement is a document that summarizes your assets, liabilities, and net worth. A PFS can help you understand your financial health so you can make informed decisions about your money.

A personal financial statement template will typically include three sections:

- Assets: This section will list all of the money and property you own.

- Liabilities: This section will list all of the money you owe.

- Net Worth: This section will calculate your net worth by subtracting your total liabilities from your total assets.

Your personal financial statement should be updated on a regular basis, typically once a year. This will help you track your progress and make sure you’re on track to reach your financial goals.

What are the benefits of creating a personal financial statement?

There are many great benefits of a personal financial statement.

By creating a personal financial statement, you can see at a glance how much money you have coming in, going out, and what your net worth is. This information can be extremely helpful in making financial decisions and setting goals.

Benefit #1 – Understand Your Financial Situation

This is why you must spend the extra couple of minutes to create a personal financial statement form.

Most importantly, you get a better understanding of your financial situation. This includes seeing where your money is going each month and how much debt you have.

What we call around here at Money Bliss – the 1000-foot look from above. The outsider’s perspective of what is going on with your finances.

Benefit #2 – Helps you track your progress

When it comes to personal finance, one of the best things you can do is keep track of your progress.

Tracking your progress should be important to you! By seeing everything laid out in front of you, it becomes much easier to make informed financial decisions that will help improve your overall financial picture.

Benefit # 3- Find some areas of improvement

Since a personal financial statement is a document that summarizes your income, expenses, assets, and liabilities in one place it helps you see the financial big picture. Thus, spotting areas for improvement are easier.

For example, if you see that you are spending too much money on non-essential items, you can make changes to improve your financial health.

Benefit #4 – Useful Tool to Set Goals

Next, it can help you set goals. Once you see where you stand financially, you can set goals for paying off debt or saving more money each month.

This aids you to make better financial decisions by providing a clear picture of your financial situation.

Benefit #5 – Snapshot to help you stay motivated

Creating a personal financial statement can be incredibly helpful in staying motivated to save money and achieve your financial goals. Seeing your progress in black and white (or, more accurately, green and red) can be a strong motivator to keep going.

Using a personal finance statement is especially helpful if you’re working towards paying off debt or saving for a specific goal. It can be difficult to stay motivated when you’re not seeing progress, but seeing the numbers going down (or up) can give you the boost you need to keep going.

Benefit #6 – Monitor your financial health

Creating a personal financial statement can help you monitor your financial health and make informed decisions about your spending and saving habits.

- If you see that your expenses are consistently exceeding your income, for example, you may need to make some changes to ensure that you are able to meet your long-term financial goals.

- Easier to spot opportunities to save money or invest in assets that will grow in value over time.

Monitoring your financial health on a regular basis can help you avoid debt problems and keep track of your progress toward financial goals.

What are the types of personal financial statements?

A personal financial statement is a form or spreadsheet detailing a person’s overall financial health. This statement is typically used to apply for business loans or other forms of financing. There are two types of personal financial statements:

- The first type is the balance sheet, which lists a person’s assets and liabilities.

- The second type is the income statement, which details a person’s income and expenses.

The balance sheet provides an overview of a person’s financial situation at a particular point in time, while the income statement shows how much money a person has coming in and going out over a period of time.

Both types of statements are important in helping lenders evaluate a borrower’s ability to repay a loan. As well as for you to monitor your personal situation.

What are the components of a personal financial statement?

A personal financial statement is not just a document that shows how much money you have in your bank account. It also includes other important components to show a well-rounded picture.

Most people know that a personal finance statement includes income, assets, and liabilities. But did you know there are actually four main components of a personal financial statement?

A personal financial statement varies from a traditional balance sheet that is used for a company.

Income

Your income is everything you earn in a year from all sources, including your job, investments, alimony, and more.

You should list all of your sources of income on your personal financial statement so you have a clear picture of what you’re bringing in each month.

- Include all sources of income, even if they are irregular or one-time payments.

- List after-tax income.

- If you are married or have a partner, include their income as well.

- Update your income regularly to reflect any changes (e.g., new job, raise, bonus).

This will help you make informed decisions about your spending and saving.

Expenses

This is the money you spend each month on things like your mortgage or rent, car payments, groceries, and other necessary expenses.

Here are over 100 personal budget categories for various expenses.

Assets

Assets are everything you own like your home equity or the value of your car and can use to pay your debts. This includes cash, savings, investments, property, and possessions.

Calculate your total assets by adding up the value of all your cash, savings, investments, property, and possessions.

So, is a car an asset? Well it depends if there is a loan against it.

Liabilities

Your liabilities are everything you owe money on. This includes, but is not limited to:

- Mortgage

- Car loan

- Student loans

- Credit card debt

- Any other personal loans

Your liabilities also include any money you may owe in taxes.

How to create a personal financial statement – Part 1

There are a few key things you need to know in order to create a personal financial statement.

The first part includes what is needed for your net worth – assets and liabilities. The second part includes your current income, expenditures, and savings.

We will show you next how to collect all of this information, then you can start to work on creating a personal financial statement.

Step #1 – Determine your current assets and business profit

The first is your current assets. Your assets are everything you own and can use to pay your debts. This includes your savings, your home equity, and any investments you have. You will need to know the value of all of these things in order to create an accurate personal finance statement.

To determine the value of your assets, start by looking at your savings. This can be any money you have in the bank, including checking, savings, and money market accounts. Add up the total balance of all these accounts to get your total savings.

Next, determine the value of your home equity. This is the difference between what your home is worth and how much you still owe on it. To calculate this, look up the current value of your home and subtract any outstanding mortgage or other loan balances from it. This will give you an estimate of how much equity you have in your home.

Finally, add up the values of any investments you have. These can include stocks, bonds, mutual funds, and other types of investment accounts. Once you have all these values totaled up, this will give you an estimate of your current assets.

Step #2 – Determine your current liabilities

Your current liabilities are all of the debts and financial obligations that you currently have.

This can include things like credit card debt, car loans, student loans, and any other type of loan that you are currently paying off.

To get an accurate picture of your current liabilities, you will need to gather up all of your bills and statements so that you can see exactly how much you owe.

Step #3 – Determine your net worth

Your net worth is your assets – your savings, your home equity, and your stocks and investments – minus your liabilities. To calculate it, simply subtract your total liabilities from your total assets. This will give you your net worth.

Your net worth is a good indicator of your financial health.

It can help you make decisions about saving and investing, and it can also be a useful tool for budgeting. If you want to improve your financial health, focus on increasing your net worth by saving more money and investing in assets that will grow in value over time.

Your goal is to double your liquid net worth quickly.

How to create a personal financial statement – Part 2

Now, you have developed your next worth statement. The next step in creating a personal financial statement is to determine your monthly cash flow of money or annual cash flow.

This second part includes your current income, expenditures, and savings.

Step #1 – Determine your monthly income

Firstly, you will need your income flow section. This could come from your pay stubs, or if you are self-employed, your profit and loss statements.

Your monthly income includes all money that you earn in a month, including salary, wages, tips, commissions, child support, alimony, and any other regular payments that you receive.

Step #2 – Determine your monthly expenses

The next piece is to determine your monthly expenses. This includes things like your mortgage or rent, car payments, credit card bills, and any other regular expenses. You’ll also want to factor in occasional expenses, like doctor’s appointments or annual membership fees.

Your expenses can be divided into two categories: fixed and variable.

Fixed expenses are those that remain the same each month, such as rent or mortgage payments, car insurance, and minimum credit card payments. Variable expenses change from month to month and can include items such as groceries, utility bills, entertainment, and clothing.

Step #3 – Determine your monthly savings

Typically, most advice will leave out monthly savings. However, this. is a critical piece to learning how to FI – financial independence.

Once you have both your income and expense information, you can begin to calculate your monthly savings. To do this, simply take your total income and subtract your total expenses. The remaining amount is what you have available to save each month.

Maybe you just calculated this and realize you have a negative number (meaning you spend more than you earn each month), then you will need to make some changes in order to improve your financial situation.

It is important to note that a personal financial statement is not static.

Your income and expenses can change from month-to-month, so it is important to recalculate your statement on a regular basis. Additionally, as you begin to save more money each month, the amount available for savings will increase as well.

How to use a personal finance statement template

A personal financial statement is a snapshot of your financial health at a given point in time. It lists your assets, liabilities, and net worth so you can see the big picture of your finances.

You can use a personal finance statement template to track your progress over time and make changes to improve your financial health.

Here’s how to use a personal finance statement template:

- Enter your information into the template. This includes details about your income, expenses, debts, and assets.

- Review your numbers and calculate your net worth. This is the difference between your total assets and total liabilities.

- Watch for comparisons. Compare your net worth from one period to another to track your progress over time.

- Make tweaks. Make changes in areas where you want to improve, such as increasing savings or paying down debt.

- Repeat steps 1-4 periodically. Then you can see how well you’re doing and make necessary changes

How to interpret a personal finance statement

A personal financial statement is a document that shows your current financial health. It lists your assets and liabilities, giving you a clear picture of your net worth.

- Positive net worth means you have more assets than debt.

- Negative net worth means you have more debt than assets.

Your personal financial statement will help you to set financial goals and track your progress over time. For example, if you want to become debt-free within five years, you can use your statement to create a budget and track your progress each year.

If you have a negative net worth, don’t panic! You can improve your financial health by paying off debts and building up your savings.

Creating a budget will help you make the most of your income and make headway on your financial goals.

How to use a personal financial statement to make financial decisions?

This is the important piece of becoming a millionaire.

A personal financial statement can help you see where your money is going each month and make changes to ensure that you are saving enough for your future goals.

Way #1 – Look at your current financial situation

Your personal financial statement is a record of your income and expenses over a period of time. This information can be used to make financial decisions, such as whether to save money or invest in a new business venture.

If you are looking to save money, you will want to compare your total income to your total expenses. If your expenses are greater than your income, you will need to find ways to reduce your spending. You may also want to consider investing in a savings account or retirement fund.

If you are looking to invest in a new business venture, you will want to assess your current financial situation. You will need to determine how much money you can afford to invest and whether or not the venture is likely to be successful.

Doing this analysis before making any decisions can help you avoid making costly mistakes.

Way #2 – Determine your financial goals

There are a few key things to keep in mind when you’re determining your financial goals.

First, you need to think about your short-term and long-term goals.

- Your short-term goals might include things like saving up for a down payment on a house or car or paying off high-interest debt.

- Your long-term goals might include things like saving for retirement or sending your kids to college.

Once you’ve determined your goals, you need to think about how much money you’ll need to reach them. This is where a personal financial statement can come in handy.

This information can help you figure out how much money you have available to put towards your financial goals.

Once you have an idea of how much money you need to reach your financial goals, the next step is to develop a plan for how you’re going to save that money. This might involve setting up a budget and sticking to it, investing in a specific savings account or investment account, or taking advantage of employer matching programs if they’re available.

Making smart financial decisions is important for achieving both your short-term and long-term goals. A personal financial statement can help you determine how much money you need to reach your goals, and develop a plan for saving that money.

Way #3 – Make a budget

Your personal financial statement can be a helpful tool when you’re trying to make a budget. This document lists your income and expenses and can give you a clear picture of your financial situation.

To use your personal financial statement to make a budget:

- Look at your overall income and expenses. This will give you an idea of where your money is going each month.

- What are Necessary Expenses? Determine which expenses are necessary and which ones you can cut back on.

- Prioritize your List. Make a list of your monthly income and expenses, with the necessary expenses first. And drop the expenses at the bottom of the list.

- How Much is Left? Determine how much money you have left over each month after paying for necessities. This is the money you can use for savings or other goals.

- Adjust your budget as needed based on changes in your income or expenses.

Way #4 – Invest in yourself

There are a lot of things you can do to invest in yourself, but one of the smartest things you can do is to invest in your personal finance education.

In fact, one of the popular millionaire quotes from Warren Buffet is:

Invest in yourself as much as possible.

Warren Buffet

Investing in yourself is one of the smartest things you can do.

Way #5 – Stay disciplined

Making financial decisions can be difficult, but if you have a personal financial statement, it can help you stay disciplined.

A personal financial statement is a document that shows your income, expenses, and assets. It can help you track your spending and see where you can save money. That my friend is black and white information.

Making financial decisions can be difficult, but if you have a personal financial statement, it can help you stay disciplined and on track.

What are some common mistakes to avoid when creating a personal finance statement?

There are many common mistakes people make when creating a personal financial statement. This can lead to an inaccurate picture of your financial situation and make it difficult to make informed decisions about your finances.

Any of these common mistakes can also lead to problems down the road because you will be unable to meet your financial obligations.

- Not including all sources of income

- Not including all debts and expenses

- Forgetting to track new sources of income

- Overstating or understating expenses

- Not properly categorizing expenses

- Forgetting to update (or review) the statement regularly

- Not tracking progress over time

- Too scared to seek professional help if needed.

By avoiding these common mistakes, you can create a personal financial statement that accurately reflects your financial situation and helps you make better decisions about your money.

How often should a personal finance statement be updated?

You should update your personal finance statement at least once a year.

However, you may want to update it more frequently if you have significant changes in your income or expenses. For example, you may want to update your personal finance statement after you get a raise or buy a new car.

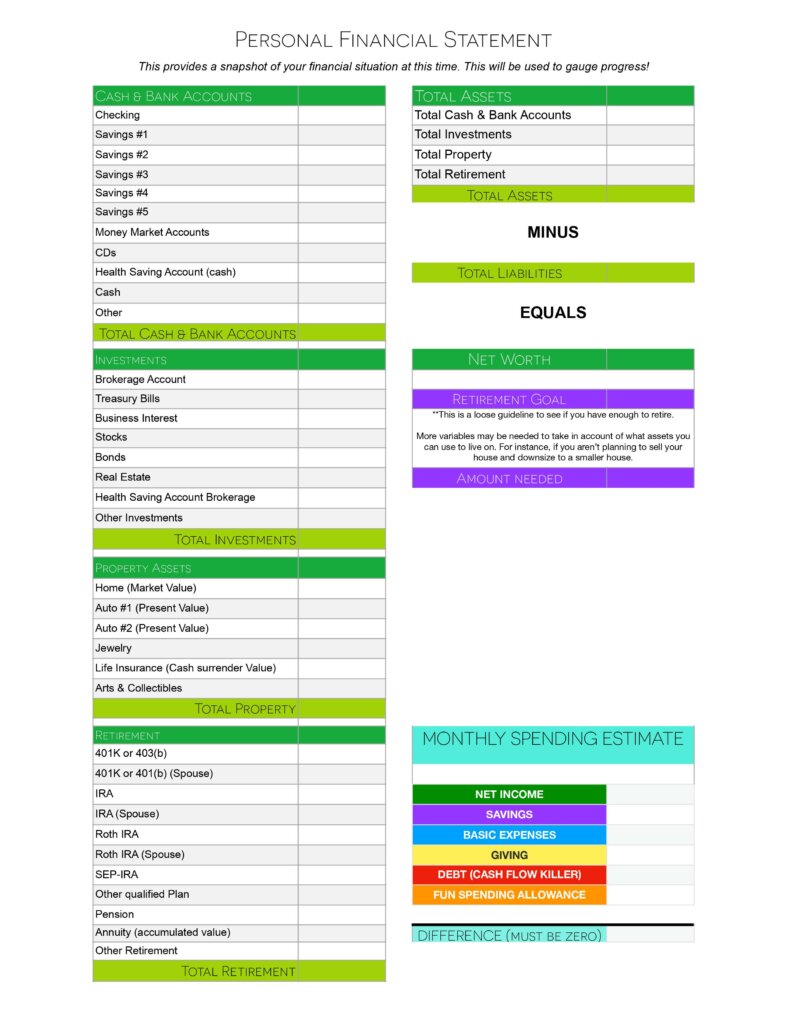

A Personal Financial Statement Template Example

A personal financial statement is a document that summarizes your financial health.

It includes information about your income, expenses, debts, and assets. This information can be used to make informed decisions about your finances.

There are many personal finance statement templates available online. Some banks and financial institutions offer their own templates. You can also find templates in our free resource library. Once you find a template you like, you can download it and fill it out with your own information.

When filling out a personal financial statement template, be sure to include accurate and up-to-date information.

This will give you the most accurate picture of your financial health. Review your statements regularly to track your progress and make changes as needed.

Time to Create A Sample Personal Financial Statement

When creating a personal financial statement, it is important to include all sources of income, not just your salary. This includes any freelance work, investments, or other forms of passive income. Additionally, make sure to include any government benefits or assistance you receive.

Excluding all sources of income will give you an inaccurate picture of your financial situation and make it difficult to create a realistic budget.

This is something you need to spend dedicated time doing to create a personal financial statement worksheet.

Over time, this wealth management tool will help you to become the next millionaire.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

There was a template offer that popped up when I first visited the page and then it disappeared. Could you please send me the spreadsheet?

Stephanie,

You can go here to subscribe to our email list: https://moneybliss.org/email-subscribe/