The Penny Challenge Will Easily Save More Than $650

Inside: The Penny Challenge is an easy way to save money every day. By making small contributions of pennies each day, you can easily save hundreds of dollars. Plus a free printable!

Mastering the art of saving can be quite daunting, particularly for individuals living paycheck to paycheck. The idea of setting aside large sums of money daily might seem intimidating, leading to inertia and a lack of progress in saving attempts.

However, the Penny Challenge creates a refreshing approach to saving. You are saving pennies!

Thus, it takes away the pressure of dealing with large figures, making the saving process more accessible and manageable. Starting with as little as a penny a day, this challenge silently builds a savings habit and a more positive money mindset.

Rather than feeling overwhelmed, you gain slow and steady momentum in your saving journey, eventually accumulating a significant sum of $667.95 in 365 days. This subtle method of saving demonstrates that even slight changes in financial behavior can lead to impactful results.

The simplicity of the Penny Challenge is its greatest strength, making it an efficient and easy way to kickstart your savings journey.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

What is the Penny Challenge?

The Penny Challenge is a delightful saving endeavor that begins with saving just one penny on the first day. The idea is to incrementally increase your savings by one more penny every day.

So, on day two, you save 2 pennies, on day three, 3 pennies, and so on. By the end of the year, on day 365, you’d save $3.65.

All adds up to a substantial $667.95 by the end of the 365 days!

History and Popularity of Penny Challenge

The Penny Challenge, while not heavily documented, appears to have its roots prior to social media where people started sharing it as an easy and fun way to save. It rapidly gained popularity because of its simplicity and the significant accumulation of savings from mere coins.

Today, people from all walks of life participate in Penny Challenges, tracking their progress and sharing their successes online. It’s not only popular among individuals but also families, helping children understand the concept of saving.

How the Penny Challenge Works

Around here at Money Bliss, we have plenty of money saving challenges to install habits of saving money.

The Penny Challenge is a suitable strategy for beginners, and even seasoned savers, making a significant impact on one’s back account by the end of the year with over six hundred dollars with just pennies.

Daily Contributions: Saving a Penny a Day

The core of the Penny Challenge is rooted in daily contributions.

Starting with one cent on the first day, you’ll boost your savings by an additional penny each day.

This means you’ll end up with three cents on the third day, four cents on the fourth, and so on. Remember, each penny is a stepping stone to building your wealth, so no amount is too small to fit in your piggy bank.

This habit-building exercise is particularly beneficial for those just starting out or anyone looking to make the most of their loose change.

Penny Challenge Chart in Action

| Day | Penny Savings | Balance |

| Day 1 | $0.01 | $0.01 |

| Day 2 | $0.02 | $0.03 |

| Day 3 | $0.03 | $0.06 |

| Day 4 | $0.04 | $0.10 |

| Day 5 | $0.05 | $0.15 |

| Day 6 | $0.06 | $0.21 |

| Day 7 | $0.07 | $0.28 |

| Day 8 | $0.08 | $0.36 |

| Day 9 | $0.09 | $0.45 |

| Day 10 | $0.10 | $0.55 |

Don’t be fooled! Pennies add up over the course of the year!

Monthly Contributions: An Alternative Approach

If daily contributions seem daunting or easily forgettable, consider the alternative monthly approach. Instead of saving each penny per day, you can make a lump sum deposit each month equivalent to the total you’d save daily.

For instance, in January you’d put away $4.96, in February $12.74, and so forth. This approach lessens the daily burden and keeps your saving habit on track.

| Month | Penny Savings | Balance |

| January | $4.96 | $4.96 |

| February | $12.74 | $17.70 |

| March | $23.25 | $40.95 |

| April | $31.65 | $72.60 |

| May | $42.16 | $114.76 |

| June | $49.95 | $164.71 |

| July | $61.07 | $225.78 |

| August | $70.68 | $296.46 |

| September | $77.55 | $374.01 |

| October | $89.59 | $463.60 |

| November | $95.85 | $559.45 |

| December | $108.50 | $667.95 |

If you like simplicity and want to start on any month, this approach is for you! The assumption is you save for 30 days regardless of the number of days in the month.

| Month | Penny Savings | Balance |

| Month 1 | $4.65 | $4.65 |

| Month 2 | $13.65 | $18.30 |

| Month 3 | $22.65 | $40.95 |

| Month 4 | $31.65 | $72.60 |

| Month 5 | $40.65 | $113.25 |

| Month 6 | $49.65 | $162.90 |

| Month 7 | $58.65 | $221.55 |

| Month 8 | $67.85 | $289.20 |

| Month 9 | $76.65 | $365.85 |

| Month 10 | $85.65 | $451.50 |

| Month 11 | $94.65 | $546.15 |

| Month 12 | $103.65 | $649.80 |

Simply select one of the high-yield savings products offered by their network of federally insured banks and credit unions to begin your savings journey.

You can open a free Raisin account in just a few minutes!

Penny Challenge Variations

Great news! There are plenty of ways to maximize your savings deposit with one of the advanced strategies.

Modified Versions of the Penny Challenge: 26 Week and 52 Week Challenges

For those who wish to tweak the Penny Challenge to fit their lifestyle better, there are modified versions such as the 26 Week and 52 Week Challenges. Many people prefer this as they are paid on a biweekly basis for budgeting.

- For the 26 Week variation, you’d start with the max you would save which is $3.65 on week one, and decrease the saving amount by one cent every subsequent week, ending with $95.04k.

- Similarly, the 52 Week variation begins with saving 3.65 on week one and ends with $3.13 on the 52nd week. Thus, saving $179.67.

These modifications are ideal for shorter time frames or lower savings targets.

Reverse Penny Challenge & its Benefits

The Reverse Penny Challenge works in the opposite direction to the traditional method. It starts by putting away $3.65 on day one and then decreases the amount by one penny each day.

The primary benefit of this approach is that it gets the more significant amounts out of the way early. For some, this method might be more digestible, and it can be particularly beneficial for those who find their finances tighter towards year-end.

All of our reverse money saving challenges are extremely popular since you may lose motivation to the end or other unexpected expenses pop up.

Coffee Habit Backwards Reward Challenge

Let’s be honest… most of these savings amounts are less than your cup of coffee at Starbucks or your Amazon order.

So, on those days you choose to spend money on coffee or a just-because purchase, then you must deposit the same amount into your penny challenge funds!

It’s just pennies, right?!?!

Other Popular Money Saving Challenges:

Grow your savings account with one of the other popular money savings challenges!

- 52 Week Money Saving Challenge

- 100 Envelope Challenge – popular thanks to TikTok

- Mini Savings Challenge

- Biweekly Money Saving Challenge

- Monthly Money Saving Challenge

Invest spare change, invest while you bank, earn bonus investments, grow your knowledge and more.

Every purchase you make means an opportunity to invest your spare change! So coffee for $3.25 becomes a $0.75 investment in your future.

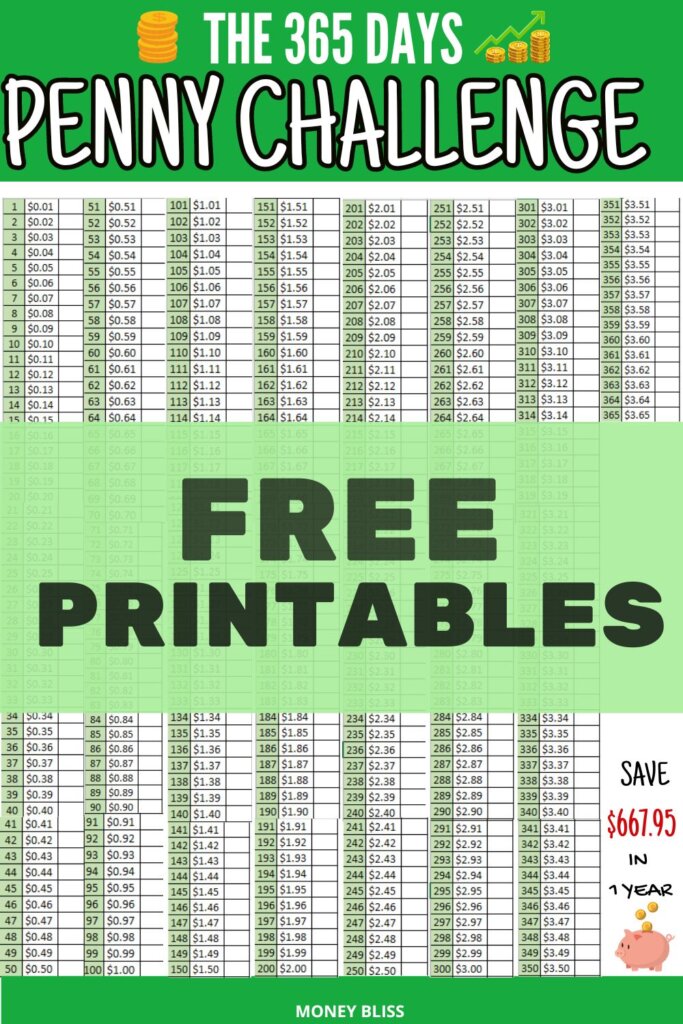

Penny Challenge Free Printable

Downloading the free printable penny saving challenge is a beneficial next step!

To access the free printable, you must subscribe to our email list. Then, you will be emailed the password to our free library – full of many printables to help you on your money journey.

FAQs about the Penny Challenge

Every Penny Counts: Significance of Small Savings

While a penny might seem insignificant, the Penny Challenge proves that even the smallest denominations can cumulate into a significant sum.

This challenge reinforces the age-old adage, “A penny saved is a penny earned.” Teaching us that regularity and persistence in saving, regardless of the amount, can make a meaningful impact. It’s a testament to the potency of small daily habits in shaping your financial future.

Diving headfirst into the world of saving can often seem daunting, but any type of challenge makes it approachable and fun.

Seeing the Penny Challenge through to the end provides more than just financial gains; it instills a powerful habit of saving and exhibits the enormous potential of minor daily contributions. Upon reaching your savings goal, not only will you feel a sense of accomplishment, but your brain will also crave the repetition of this gratifying experience, motivating you to save more and tackle larger financial goals.

Remember, the journey of a thousand miles begins with a single cent!

Check out these mini savings challenges!

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.