What is Annual Income? Meaning, Gross, Net, and How to Calculate

Inside: Are you wondering what annual income is, what it means, and how to calculate it? This guide will teach you all about annual income, including definitions, examples, and calculations.

Your struggle (and you prefer not to admit it)…You don’t know what annual income is or how to calculate it.

There are a lot of ways to calculate annual income – which can make it a confusing concept. But it’s actually not that difficult to understand.

Annual income can be calculated as gross income, after-tax income, or net income.

This guide will explain everything you need to know about annual income, including definitions, examples, and calculations.

What is annual income?

Annual income is the total amount of money earned over a year.

It is broken down into two parts: gross annual income and net annual income.

Why does annual income matter?

Well, the obvious one is you prefer to increase your annual income year over year. That is the #1 gauge for most people.

However, annual income can be used for budgeting, applying for loans, and calculating child support and alimony payments.

Calculating annual income requires taking into account factors such as salary, bonuses, investments, and tax deductions.

What is the difference between gross and net income?

First of all, there is a big difference between gross income and net income. So, make sure you take the time to learn the differences.

Gross income is your annual income before taxes and deductions are taken off.

For example, your employer pays you 80000 a year for your job. That is your gross pay.

Net income refers to the amount of income you earn after taking all taxes and deductions are taken out.

For example, your biweekly paycheck is 3000 per check. That means taxes and deductions are already taken out and this is your net income.

Simply put, gross income is the whole pie you are paid. Yet, annual net income is the money that is left over to live on.

Understand the difference between gross pay vs net pay.

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Learn How To Create Printables That Sell!

This is the perfect side hustle if you don’t have much time, experience, or money.

Many earn over $10,000 in a year selling printables on Etsy. Learn how to get started by watching this free workshop.

FREE VIRTUAL ASSISTANT TRAINING

If you've ever wanted to make a full-time income while working from home, you're in the right place!

This intensive training combines thousands of hours of research, years of experience in growing a virtual assistant business, and the power of a coach who has helped thousands of students launch and grow their own business from scratch.

What are the different types of annual income?

Your annual income is the total amount of money you earn in one year from all sources, including your salary, tips, bonuses, commissions, and long-term capital gains.

More than likely, you consider your 9-5 job as your wages or salary earned as income. However, there are many types of income used to calculate your overall annual income.

You can calculate your annual income by adding up all of your sources of income for the year.

1. Earned Income (Active Income)

Furthermore, the most common types of annual income are employment wages and salary, commissions, and overtime pay.

These all fall into the category of earned income. AKA working a normal regular job or active income.

Active income is earned when you are working and actively doing something that brings in money. This could be working a normal job, self-employment, or anything else that brings in a regular income.

There are a few different types of income that you could earn. The first is active

2. Passive Income

Passive income is also known as unearned income. This money you receive without having to work for it. This can come from sources such as online businesses, business partnerships, rental income, or affiliate income.

You have heard the saying, “Earn money while you sleep,” which refers to making passive income.

Passive income is earned when you have investments or property that is generating money without you having to do anything. This could be rental income, dividends, or other forms of investment.

In fact, learning how to make money online for beginners is a big push towards passive income.

3. Portfolio or Investment Income

Again, this is a non-passive income that earns money without you actively working on it.

For example, earning money on a high-interest savings account is a type of income.

Another example of portfolio or investment income is when you invest in your retirement accounts.

The ultimate goal of being financially independent is to solely rely on investment income to live.

4 – Other Types of Income

These types of income are uncommon and not as prevalent but may be pertinent to you.

Other types of annual income include tips, self-employment income, pensions, annuities, alimony, child support, and government benefits.

Learn the difference between earned income, passive income, and investment income.

What is base annual income or base salary?

Base annual income is the amount of your base salary from your employer. This is before any bonuses, commissions, or any other incentive.

For budgeting purposes, you want to use your base annual income.

How do you calculate your annual income?

To calculate your annual income, one should first list all of your income sources and add them up.

This can be done in a variety of ways, such as through reviewing pay stubs, checking accounts, or your budget app.

Look at each type of income and make sure you have everything accounted for.

What if I know my income is monthly?

If you know your monthly income, then take your monthly income and multiply by 12. That will give you your annual income.

monthly income * 12 = annual income

Now, make sure to check if anything is deducted. If so, that is your net income and not your gross income.

What if I know my income is biweekly?

Don’t worry, we have you covered.

Take your biweekly income and multiply by 26 for your annual income.

biweekly income * 26 pay periods = annual income

Once again, check to see if anything is deducted for gross or net income.

Household Income

Household income is the total gross income of all members in a household and is typically used to gauge the standard and cost of living for an area.

To calculate household income, one must add up the gross incomes earned by all members of the household, including wages from salaried or hourly jobs, self-employment earnings, pensions, investments, and other sources.

Depending on your individual tax situation, households may also be able to include tax deductions or credits when determining their total income.

How to Calculate Annual Income With an Example

Your annual income is your total earnings from all sources over a one-year period.

To calculate your annual income, you’ll need to gather information about your employment status, pay stubs, tips, investment earnings, and any other sources of income.

Betsy’s Example

Let’s say Betsy has a base annual salary of $85000 per year. She receives an $8000 bonus. Recently, she started a side hustle that makes her $1000 a month.

Betsy’s gross annual income is $105,000.

85000 + 8000 + (1000 *12) = 105000

John’s Example

Let’s say John has a base annual salary of $40000 per year with quarterly commissions. On average, his commissions are $6000 per quarter. He has a rental property that generates $500 a month.

Johnn’s gross annual income is $70,000.

40000 + (6000 * 4) + (500 *12) = 70000

Easy Ways to increase your annual income

Now, this is where the money is made…

When you are manifesting ways to increase your annual income.

Here are the most practical ways:

Idea #1 – Ask for a Raise or Change Employers

One option is to ask for a raise from your current employer. If you are not at market level for your job, then this is a must.

Another option is to look for a new job by changing employers. There are many companies that are looking for employees and are willing to give you a raise if you are a good fit for the job.

Idea #2 – Add Streams of Income

Additionally, adding any additional streams of income can also help to increase one’s annual income.

Adding streams of income can help to increase one’s annual income. Additional streams of income can come from any number of sources, such as working additional hours in a job, starting a business, or investing in assets.

By diversifying one’s income sources, one can help to reduce the impact of any one event or circumstance that may negatively impact one’s financial situation.

I cannot STRESS how important it is to have more than one stream of income in today’s society.

Idea #3 – Start Hustling

A third option is to make more money through side hustles or other forms of supplemental income. This can be done by starting a small business, doing freelance work, or investing in real estate.

Taking on part-time jobs or freelance work are other options that can be explored in order to further increase one’s total yearly earnings.

No matter what option you choose, it is important to know how to calculate your annual income. This will help you set goals and make informed decisions about your finances.

What is a good annual income?

Annual income is determined by how you define it and your cost of living.

So, what works for you and someone else is completely different. Studies have shown that the median annual income is $70000 per year.

The cost of living also plays a role in determining your annual income. For example, if you live in an expensive city, you will need to make more money to maintain the same standard of living as someone who lives in a less expensive city.

Here is my personal rule of thumb whether or not you make a good annual income:

- Consistently save 20% of your salary.

- You are able to meet your financial obligations and bills.

- You are able to sleep at night and financial stress is not keeping you awake.

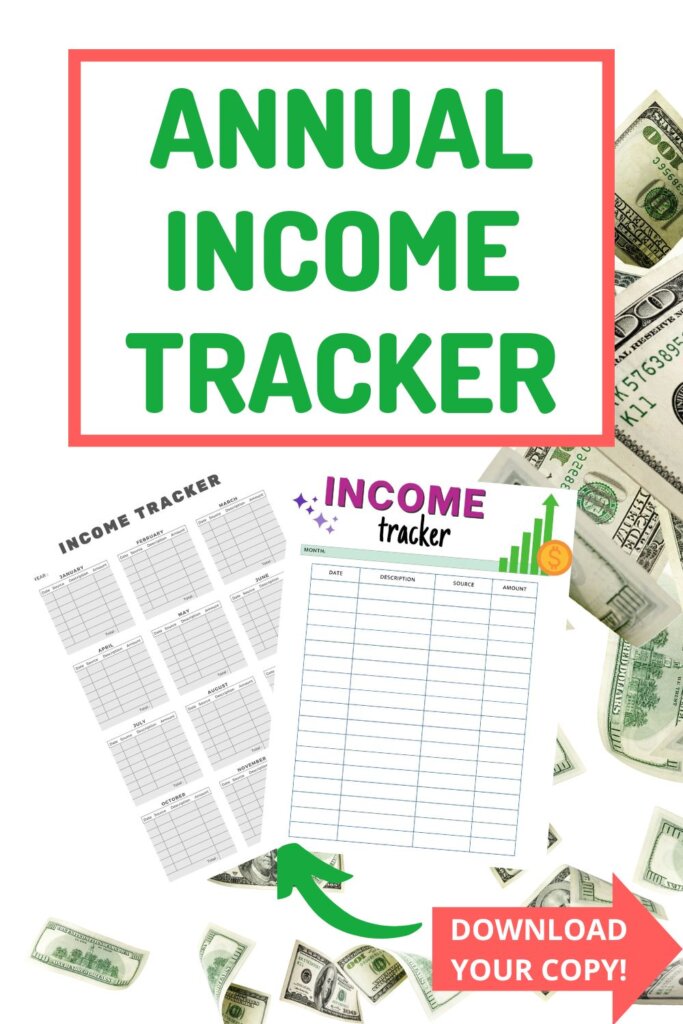

Annual Income Tracker

By tracking your annual income, you can get a better understanding of how much money you are bringing in each year.

This can help you budget better and make more informed financial decisions. Additionally, it can help you keep track of your progress toward financial goals.

Download your annual income tracker today.

FAQs

Let’s Recap = Annual Income

Annual income is the total amount of money earned in one year. This can be from employment, investments, or other sources.

- Gross annual income is the total amount of money earned before taxes and other deductions are taken out.

- Net annual income is the total amount of money earned after taxes and other deductions are taken out.

To calculate your annual income, simply add up all of your earnings from all sources for the year.

Both earned and passive income is important in building long-term wealth. However, most people will need to focus on active income in order to make ends meet in the short-term.

This is because it can take time to build up a significant amount of passive income, but worth investing the time and energy to do it.

Learn why you may owe taxes this year.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.