Join the Save Age Challenge for Kids

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

The statistics are horribly true. We don’t save.

According the Federal Reserve in 2015, 50% of Americans couldn’t cover a $400 emergency expense out of savings. Even when you look across income levels, the same statistic was hardly varied.

People do not save. Period. It is an unfortunate truth in our society.

Honestly, I truly believe the reason why is because we are never taught to save as children.

The typical response is to start saving and investing once we have earned income. However, the basic principles of how to manage money is never taught. Then, young adults have to figure it out on their own and hope for the best.

Is that the best solution for teaching money basics?

In 2017, I hosted the first Save Age Challenge. It was meant for adults.

However, my kids heard what I was doing and they wanted to jump in. So, of course, I said okay!

Anything for my kids to learn basic money management skills is a high five.

Plus the best reason ever… they will save $2,000 under my roof!

By a kid saving their age each month from age 3-18, they will have $2,000 saved by the time they move out!!

What a great way to set your children up for success with money.

Related resource: Save Age Challenge for Adults

How to Save Age Challenge Works

This is one of the best ways I have found to teach kids the importance of savings!

Kids are always up for a challenge. So, this money challenge for kids is perfect for them!

Money Challenge Details:

- Each month deposit your AGE in dollars to a separate bank account.

- Make no withdrawals in the account.

- Prove to yourself that YOU CAN SAVE MONEY!

- Continue the save money challenge until age age 18.

Didn’t start at age 3? Here are some strategies to catch up:

- Add an extra dollar or two to the age.

- Ask for cash instead of gifts for birthdays and holidays.

- For older kids, challenge them to save their age each week (especially if they are working).

- Pay your children extra jobs around the house to catch up.

Personal Results on the Save Age Challenge for Kids

1. Understood What Paying Bills Meant

This one completely surprised me.

After my son deposited his save money and gave his give money, I told him, “Your bills are paid for the month.” He looked at me puzzled.

I simply told him when we pay bills, we have to do the same thing except for we have many more bills to pay.

A very simple concept of paying bills taught.

2. Priority of Saving First

Obviously, this result is very expected.

The goal of the Save Age Challenge is to teach our children to save first.

Save for the future. Save for something important. Remember, the statistic above most people don’t save.

3. How to Handle Money

The basic principles of how to pass money to one person to another.

It must be taught. Spend time teaching your children. It is the best gift you can give them.

Since cash is used less and less in our society, kids are less likely to learn by watching. Show kids how to face money the same direction and flattened out.

4. Encourage Math Skills

Counting money is a great way to enforce counting with money.

Ask the kids to put the one dollar bills in stacks of $10 or $20. Ask how many dollars until they reach $50.

The same can be done with coins.

There are many ways to reinforce math skills with money.

5. Shock & Awe of How Much Saved

This is definitely the most favorite memory of the Save Age Challenge.

My kids were shocked that they could save SO much money. (Those were their words.)

In their minds, $10 is a drop in the bucket for mom and dad. But, for them to have $10, it teaches the value of a dollar.

Grab your save age tracker in the free printables section.

Related Post: Unlock Money Lessons with Allowances, Chores, Commissions

Add Compound Interest to the Mix

The next step is to teach children the importance of compound interest.

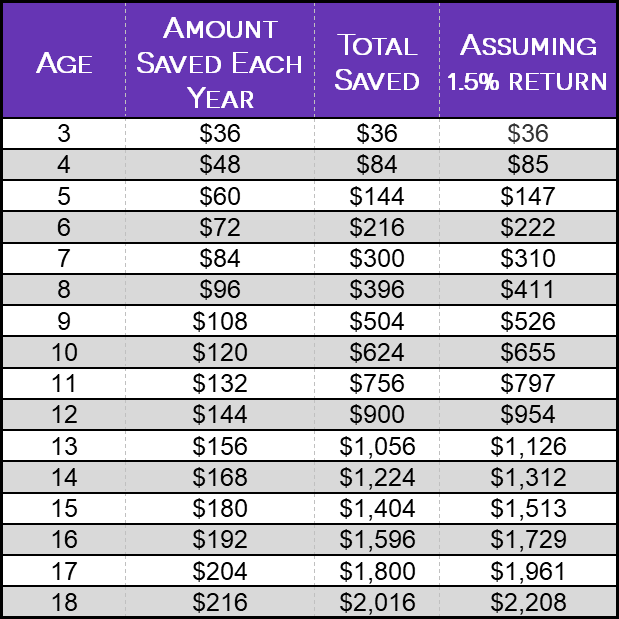

By putting the Save Age money into an online savings account, you teach the basics of compound interest. For this example, we used 1.5% interest rate. As of right now, this interest rate is very doable in the market.

An extra $192 saved! That is a win for kids.

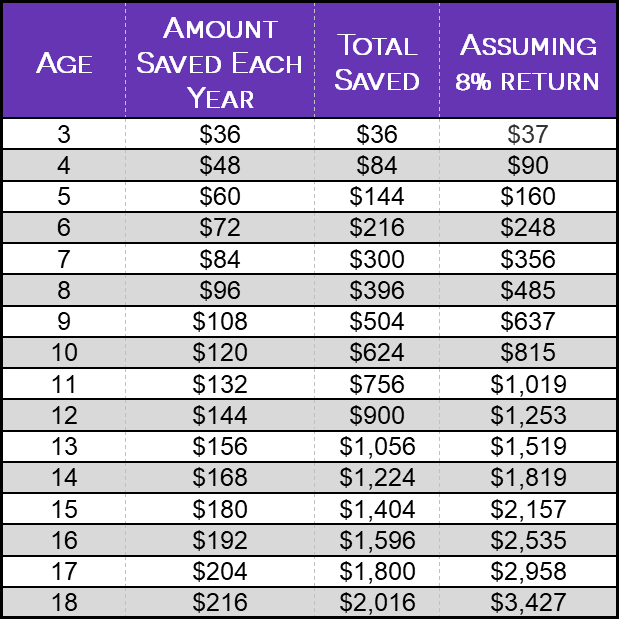

Want to up the game and start an investment account?

By putting the Save Age money into an investment account, the emphasis is on understanding compound interest. For this example, we used an 8% return rate. (This does not account for taxes.)

A whopping $1,411 added to the account. An additional 70% of the initial money saved.

Related Resource: How to Invest in the Stock Market – Beginner’s Guide

How to Save Money for Kids

Teaching kids about money is so important.

It is one thing to teach them to track money. But, it is completely a different action plan to have the learn to save money.

By teaching the importance of compound interest, the kids will be able to learn the basics necessary to invest and earn passive income.

Invaluable lessons to teach kids.

I love this save money challenge for kids. It is simple for kids to understand plus flourish!

Are you ready for your children to save $2,000 under your roof?!?!?

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.