How to File Taxes Without W2: The Simple Guide

Inside: In this guide, learn how to file taxes without W2 in the shortest possible time.

If you are like most people, tax season is a time of stress and anxiety. But it doesn’t have to be that way.

You know you must file your taxes, but the paperwork is daunting especially if you are missing key pieces like your W2.

For many people (like us last weekend), tax season starts with one simple question: where is my W2?

Your W2 form proves that you have earned income and paid taxes on that income.

So, if you don’t have a W2, how can you file your taxes?

The good news is that you can still file your taxes without a W2. This guide will show you how.

What is a W-2?

A W-2 form is an Internal Revenue Service (IRS) tax form used to report wages paid to employees and taxes withheld from those wages.

The IRS deadline for employers to their employee’s W2 sent out is January 31st (source).

The form contains important information including total wages earned, amount of taxes withheld, tips, 401(k) contributions, health savings account contributions, and health care premium payments.

What are the benefits of filing taxes with a W-2?

1. Tax return is accurate and complete.

2. Tax refunds are easier to obtain.

3. Tax filing is simpler.

4. Multiple forms and schedules are avoided.

5. Proper understanding of tax liability.

6. Improved compliance with IRS regulations

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

What happens if you file your taxes without a W-2?

If you file your taxes without a W-2, the IRS may contact you and ask for more information.

If they determine that you owe taxes, they will send you a bill for the taxes due. Be careful, if you don’t pay the bill, they may take collection action against you, which could include wage garnishment or seizure of assets.

It is better to use the steps below for can you file taxes without a W2.

Will the IRS catch a missing W-2?

The IRS will catch a missing W-2.

You are responsible for ensuring that all required information is included on your tax return.

If you do not have a W-2, you should contact your employer and request a copy.

Related: Is Social Security Disability Taxable?

How to file your taxes without a W-2?

If you didn’t receive a W-2 from your employer, don’t worry.

There are still ways to file your taxes without one.

This guide will show you how.

Step 1: Check online

Most employers offer an online portal where you can log in to see your employment information like last paystubs and W2 information.

Log into the employer’s online HR portal. The W-2 form should be accessible there.

This is the best place to check if your W2 wasn’t delivered to your mailing address.

If you cannot find it, ask a co-worker or someone in Human Resources to help you.

Step 2: Check Your Email

This is the next place to look as a notification may have been sent telling you where to locate your W2 online or how to open the digital attachment.

Checking to see if you received a W-2 in your email is a relatively simple process.

First, search your inbox for emails from the company that you work for. This can be done by entering the company’s name in the search bar.

- If the company has sent you a W-2 digitally, you should find an email containing a link to a secure site where your W-2 form is stored.

- If you do not find this email, check your spam folder.

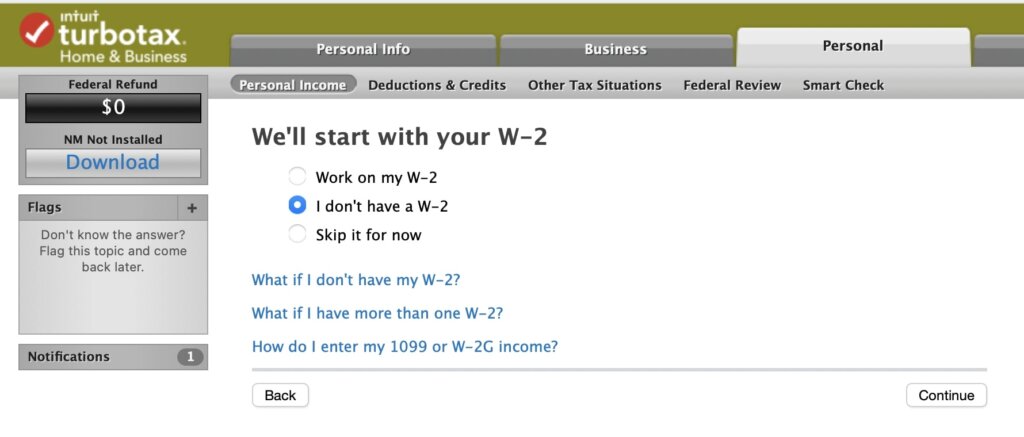

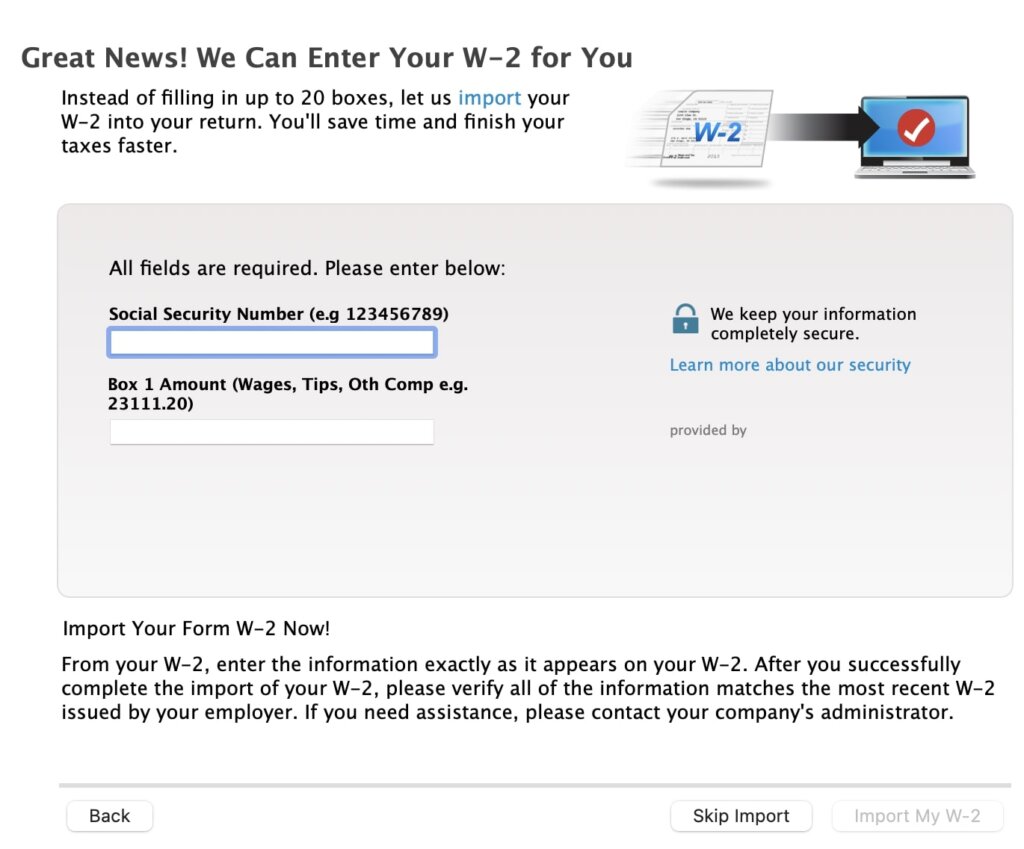

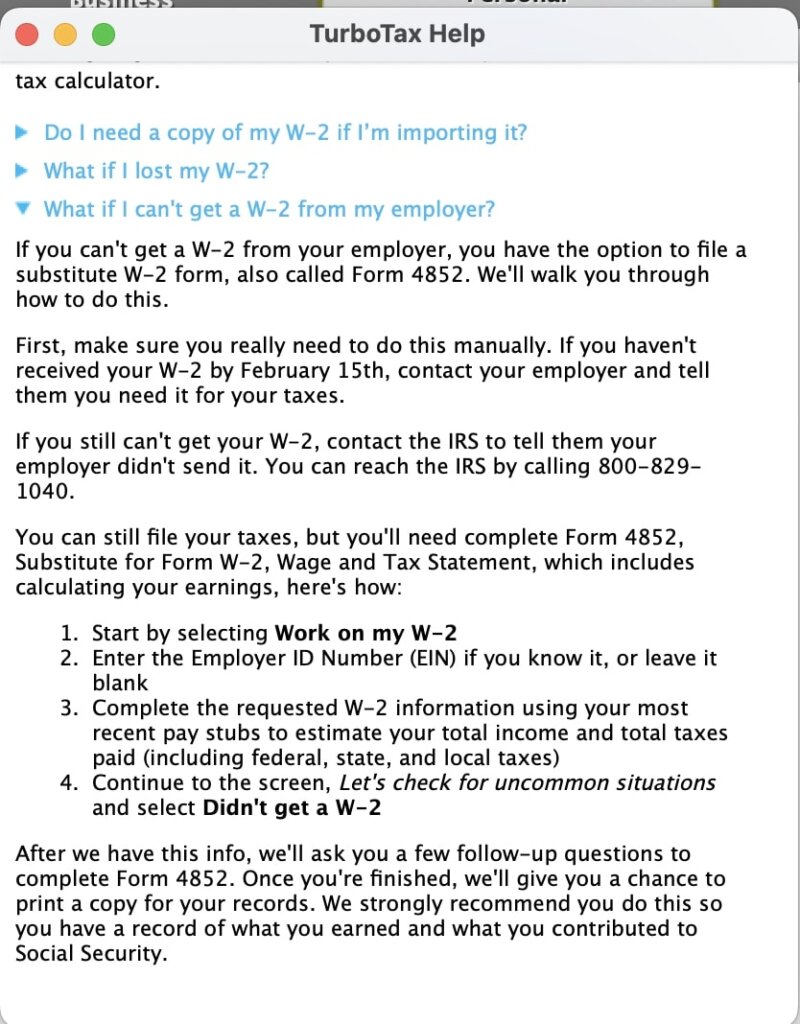

Step 3: Use Turbotax Import

If you have a few key pieces of information, you may use the import tool on TurboTax.

You will need your Employers EIN or Federal ID, know your social security number, and Box 1 of wages, which should be equal to the wages on your last pay stub for the year.

Just to note… some employers may require a Control ID number, which is found on the W2, and this method won’t work when filing online.

However, this may save you a lot of time and hassle as your employer is required to submit your W2 to the IRS.

Step 4: Ask your employer

If the deadline for filing taxes has arrived and you have still not received your W-2 form, it is time to take action.

Here are the steps you should take:

- Contact your employer and ask if they will provide you with a W-2. Speak to the company leadership and find out if they will provide W-2s to all employees.

- Verify the employer has the correct address on file for you. Is it possible you moved after your employment ended and the company doesn’t have your old address?

- If the company is no longer in business, contact the former payroll provider to see if you can still get a W-2.

- If they have, ask them when and how they sent it. If they have not yet sent it, ask them to reissue it.

It is important to get your taxes filed correctly and on time, and one way to do this is to ask your employer to file your taxes without a W-2.

Step 5: Contact the IRS

If you are unable to obtain your W-2 from your employer, you can still file your income taxes. The first step is to contact your employer and try to get the missing form.

If contacting your employer fails, you can contact the IRS or visit a local Taxpayer Assistance Center.

When you do so, you should be prepared to provide:

- your name, address, Social Security number, phone number,

- your employer’s name and address

- dates you worked for them

- an estimate of your wages and federal income tax withheld.

The IRS will contact your employer directly and try to obtain the missing form on your behalf.

Step 6: Request a Wage and Income Transcript

If you need to request a Wage and Income Transcript from the IRS, there are two ways you can do it.

The first is to use the Get Transcript Online tool, which allows you to quickly and easily access the transcript online. All you need to do is create a secure account and fill out the required information.

Once you receive the transcript, you can use it to compare the information you provided on Form 4852 to the wage and withholding information that the IRS has on record.

This is helpful when you need to get years of back tax returns filed and do not have the proper information.

Step 7: File Form 4852 with your tax return

If all of the above steps have failed, then you can complete IRS Form 4852, Substitute for Form W-2, with your tax return. This form is used to estimate your wages and withholding for the year.

It is important to note that it should only be used as a last resort.

Here are the steps for filing Form 4852 with your tax return:

- Download Form 4852 from the IRS website and complete it using a copy of your last pay stub. You’ll need your pay stub to include details on wages, tips, and other compensation, social security wages, Medicare wages, and taxes withheld throughout the year.

- Once complete, attach IRS Form 4852 to your 1040 or other federal tax return forms and send it to the IRS.

- If you are filing your return without a W-2, you will need to complete Form 4852.

Remember that the information you enter on form 4852 is supposed to be a good faith estimate.

Step 8: Possibly Amend your return

If you receive a W-2 or order a Wage and Income Transcript after filing your tax return and the information you receive is different from what you reported on your tax return, you may need to amend your tax return.

TurboTax can help you make any necessary corrections and file Form 1040-X easily and accurately.

This is something you want to be accurate, so take the time to correct your tax returns.

Another Option: File an Extension

Finally, if you don’t mind waiting, you can request an extension.

This gives you time to get your W-2 and file a return before October 15th.

Just keep in mind that you still need to pay any taxes due by the April 15th tax deadline, so an extension to file is not an extension of time to pay any taxes you may owe.

Know one tells you how to become an adult.

You might as well get a quick guide to help you get started.

Can you file taxes with last pay stub?

No, you cannot file your taxes with your last pay stub.

You will need to gather all of your tax documents, including W-2s and 1099s, in order to accurately file your taxes.

If you still can’t get your W-2, you can file using form 4852 using the last pay stub of the tax year for these figures.

Do you have to file taxes if you have no income?

Are there any tax filing services available to help with filing taxes without a W-2?

Yes, there are tax filing services available to help with filing taxes without a W-2.

Any of the popular online tax services can help:

FAQs

What are you Waiting for? See if you have a Tax refund coming your way

By following these steps, you will be able to file your taxes without a W-2 and ensure that you are in compliance with the Internal Revenue Service’s filing requirements.

Don’t let your anxiety about filing taxes slow you down—get started filing your taxes today with online tax software like Turbotax.

In this guide, we outline everything you need to know about filing taxes without a W-2, including what documents you will need and how to file in the quickest possible time.

You may be wondering Can I claim my girlfriend as a dependent?

By following our tips and using online tax software, you can get your taxes done quickly and avoid any headaches.

Are you wondering why do I owe taxes this year?

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.