How to Achieve Financial Independence Retire Early (FIRE)?

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

What is FIRE? Why should I care?

A term floating a lot recently is FIRE. What does fire stand for in finance? How does it affect me?

FIRE = Financial Independence Retire Early

This trend is catching on fast especially with the millennial generation.

Why?

Simple, millennials want more out of life and not to be tied down to a job their whole lives. They want experiences. They want to travel and see the world.

Bottom line, they want more in life. Period.

Now, why this concept seems great, most people shy away thinking it is impossible.

Retire early? Retiring at 30? 40? Or even 50?

Honestly, you can turn your money management around at any time. All it takes is you making the money goals and changing how you save / spend money.

The FIRE movement is on fire (all pun intended) because these individuals will sacrifice everything on their path to financial independence.

These individuals have a burning desire to retire early. More specifically, they are looking for more out of life than working a job that they don’t enjoy.

So, how does fire movement work?

Obstacles to FIRE

Before we dive into achieving financial independence, let’s look at the road blocks to FIRE.

As Americans, we are stuck in our ways.

Retirement for many means what is defined by the government and what the Social Security Administration states. As of right now, the earliest you can draw on Social Security benefits is age 62 or as late as age 70.

Thus, why people look to retire in their 60s.

So, in order to retire early, you must become financially independent.

And you don’t want to be stuck figure out what happens if you don’t save for retirement!

Financial Independence Definition

The definition of financial independence is your assets have reached a point in which you estimate they will cover all of your expenses for the remaining part of your life. There is no need to work unless you desire.

Now, the first question probably is “what is the magical number” needed to become financially independent.

Even if you can’t reach the complete retirement, maybe it is taking that job with less pay because you enjoy that line of work so much.

Overall, by becoming financial independent, you have more choices in life.

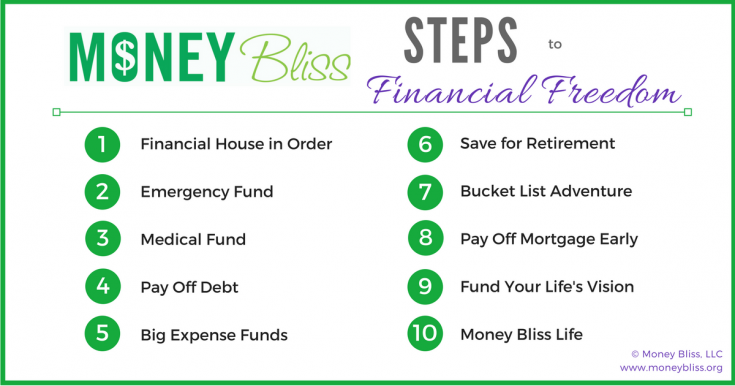

Too many times, people want to start their journey to FIRE, but don’t have a place to start. Start with the 10 Money Bliss Steps to Financial Freedom.

Figuring out your FIRE Number

The key part of this question is YOUR FIRE NUMBER!

This will be personal to each of us. Just like we are all created differently. Our FIRE Number will be different as well.

First, it varies for everyone based on their lifestyle, medical history, spending choices, money habits, etc. Next, you need to decide what number you are comfortable with. Lastly, remember this is an estimate and there is no guarantee that your money will outlive your life.

You need to learn how to FI quickly.

FIRE Retirement Calculator:

- As a VERY general rule of thumb, use 25x your annual expenses.

- Another general rule of thumb is 20x your annual income.

- Between those two numbers, you have a general idea of what your FIRE number would be.

(Yes, those numbers may vary greatly – like in the million range – but for now, we are looking at a general idea without diving into specifics for your situation.)

There are many FIRE retirement calculators available, but they are all estimates and assumptions of what will happen in 5, 10, 20 years.

And this is where most people give up. They look at those numbers and give up on starting to FIRE because it all seems too difficult to reach. That is where you will continue the cycle of money you are currently on.

You need to overcome your money management obstacles and pick up some millionaire habits in your life.

Related Reading: Money Bliss Steps for Financial Freedom

How to Achieve Financial Independence Retire Early FIRE:

FIRE involves a change of perspective with money.

Any person can achieve financial independence retire early (FIRE) if they chose to.

Your money mindset needs to be ready for the challenge and know that for once the grass is actually greener on the other side.

Now, if you are truly ready to learn how to achieve financial independence, then these tips will help you succeed.

1. Act like a True Fire Exists

Just like a real fire under foot, financial independence retire early (FIRE) is meant to be fast.

Move quickly to achieve FIRE. There is no time to drag feet while making decisions. You have to move quickly to reach financial independence.

That means get excited about your financial future.

You have to jump in with both feet. No standing with a foot on each side.

You must be willing to make the sacrifices for the long term success. Financial Freedom!

Just with a real burning (maybe out-of-control) fire, you need to make plans in order to act fast.

2. Save More than 50% of Income

In order to achieve financial independence, savings is a must.

The more you can save, the faster you can reach your goal.

The threshold goal is to save more than 50% of your income. Many people who have reached FIRE status said they saved upwards of 75% of their income.

The first reaction is yikes – how in the world am I going to save that much?

Well, it depends on how big your fire under foot is. Do you want to achieve financial independence soon or later? The amount you are able to save will determine how fast you reach your goal.

The saving 50% of your income can be attributed to this person.

However, for mainstream people like us, you have to start your savings percentage somewhere.

Pick a percentage that is a stretch from your current savings rate. Each year, grow it by another 5-10%. Receive a pay increase or lowering in expenses, put it straight towards your FIRE savings. A great way to kickstart your savings is with a 52 week money saving challenge!

Like everything with money, it is a personal decision of what works for you and your household.

Related Reading: The Best Methods of Budgeting You Need to Know

3. Limit Spending

By how much you limit spending will determine how fast you reach FIRE.

This is a personal decision on how much you are willing to limit spending and expenses. Many times, this may mean become extremely frugal. Also, it may mean beginning to live a life of minimalism.

Today’s society focuses on materialism.

There are many ways to limit spending. However, when the price for little trinkets are SO cheap, it is easy to pick up items here or there. That $1, $5, $10, or $20 can add VERY fast and equate to $500-5,000 over the course of a year.

Make the decision of what is more important – limiting spending or accumulating stuff.

Personally, we limited our spending immensely while we paid off $53K in debt. Plus most of it was on the little $1-5 purchases! The interesting thing we never went back to our old spending habits.

Look around you… can you see how lifestyle creep has slowly moved into your life? If not, look around at your friends and family; it is easier to see how lifestyle creep can crumble your desire to achieve financial independence

Tricks to Spend Less Money:

- Ultimate Guide to a Successful No Spend Challenge

- Why a Thrifty Lifestyle is Something You Need Today

- The Vicious Cycle – Learn How to Stop Spending Money Now

4. Invest (Earn Passive Income)

The big piece of the FIRE puzzle is investing and passive income.

Part of your magic number from above assumes that your assets will make some rate of return for many years to come. Thus, being about to provide passive income for expenses.

There are many “experts” on how to invest, but the truth is there is no magic formula for investing. The biggest key to long term success is diversification. Simply put… don’t put all your eggs in one basket. Spread them out for greater success.

In the list of the best personal finance books, I compiled a list of just investing books. These are books I have read at some point and another. You need to know the lingo in order to be smart with investing (regardless of whether you use a financial advisor or not).

Bonus F.I.R.E Tip:

While FIRE is great in many components, life is precious and the future is completely unknown.

Rhythm needs to be found in achieving your FIRE while living life today. Not balance. RHYTHM!

A financial term for it is opportunity cost. The definition of opportunity cost is something that must be given up to achieve something else. It only takes one person who has lost a loved one to truly understand the impact of opportunity cost.

The idea of financial independence retire early is exciting! It is the ultimate path to freedom.

The FIRE movement is fantastic. Um, hello, have you seen the latest debt statistics? Join the thousands of people who are taking control of their financial lives and saving money with FIRE. All to live life to the fullest.

What has you excited about FIRE?

Looking for a digital option for your budget that is better than Mint?

Are You Ready to FIRE Finance?

Get excited about the possible future!

One of the main reasons I love the FIRE movement is because it focuses on saving money and less on materialistic items.

That is something that is cross culture and it is okay to be different.

By choosing FIRE finance, you are putting money management to the forefront and putting all of your effort into finding ways to save more money and spend less money.

That will make a solid impact on your personal finances immediately.

So, how much do I need to retire early?

Further Financial Freedom Reading

These steps are a guide. A path to build a solid foundation with money. Don't delay! Make sure you are on track today.

Serious Way to Make More Money

One of the best ways to improve your personal finance situation is to increase your income. Here are a variety of side hustles that are very lucrative. With time and effort, you can start enjoying the lifestyle you want.

Learn How To Create Printables That Sell!

This is the perfect side hustle if you don’t have much time, experience, or money.

Many earn over $10,000 in a year selling printables on Etsy. Learn how to get started by watching this free workshop.

Learn the Skill to Proofread Anywhere

Are you passionate about words and reading?

If so, proofreading could be a perfect fit for you, just like it’s been for countless of readers! Learn how you can create a freelance business as a proofreader.

Check out this free workshop!

FREE VIRTUAL ASSISTANT TRAINING

If you've ever wanted to make a full-time income while working from home, you're in the right place!

This intensive training combines thousands of hours of research, years of experience in growing a virtual assistant business, and the power of a coach who has helped thousands of students launch and grow their own business from scratch.

Earn Extra Income with Bookkeeping

Bookkeeping is the most stable, reliable & simple business to own. This is how to make a realistic income -either part-time or full-time.

Find out TODAY if this is THE business you’ve been looking for.

Earn More Writing - Learn How to Make Money as a Freelance Writer

You can make money as a freelance writer. Learn techniques to find those jobs and earn the kind of money you deserve!

Plus get tips to land your first freelance writing gig!

Free Flipping Video Training Series

Learn how to buy and resell items from flea markets, thrift stores and yard sales. They will teach you how to create a profitable reselling business quickly

…no matter how much or how little experience you have.

Trade & Travel with Teri Ijeoma

Learn how to supplement your daily, weekly, or monthly income with trading so that you can live your best life! This is a lifestyle trading style you need to learn.

Honestly, this course is a must for anyone who invests. You will lose more in the market than you will spend this quality education - guaranteed.

Freight 360 University

Designed as a 101-level course on freight brokerage, you’ll learn the basics of freight brokering in this online course.

This course is designed for freight brokers in any setting, regardless of their employment status.

If you want to start your brokerage, we’ll show you exactly how to do it. If you are an agent or employee of a brokerage, we’ll take you through sales and operations modules designed to help you source more leads and move more freight.

Empowered Business Lab

The Empowered Business Lab teaches you how to sell your digital products naturally with strategies that just make sense.

Monica helps thousands find momentum and create revenue streams in their businesses.

Be Inspired by One Gentleman's Trading Journey

After taking a second job as a driver for Amazon to make ends meet, this former teacher pivoted to be a successful stock trader.

Leaving behind the stress of teaching, now he sets his own schedule and makes more money than he ever imagined. He grew his account from $500 to $38000 in 8 months.

Check out this interview.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.