Christmas Budget Challenge for a Debt Free Christmas

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Are you ready to save money in advance for Christmas this year? Then, you are in the right place.

With this Christmas Budget Challenge, you will be prepared for holiday spending and not be scrambling at the last minute.

Get prepared for a debt free Christmas!

Tired of overspending? This challenge is perfect for you.

Tired of the post-Christmas debt hangover? This is exactly what you need.

The Christmas Budget Challenge is wonderful for someone who wants to take control of their life both their time and their money. Plus enjoy a debt free holiday season!

In 2019, the average family spent $900 on Christmas, according to Statista. Do you have $900 lying around for just Christmas gifts, decor, food and any other miscellaneous Christmas items?

Be honest with yourself.

If the answer is no, don’t fret. That is probably 90% of society. Keep reading and you can change that.

In order to have a debt free Christmas, you must save up in advance and plan your Christmas budget.

If the statistics hold true, then collectively over one trillion will be spent on the holiday season. So, you need to be prepared for next Christmas.

Remember, saving money is setting money aside today to be used for a future purpose.

So, what are the tips and tricks on how to have a debt free Christmas?

We want a Debt Free Christmas!

In order to have less stress around Christmas, the goal is to fund your Christmas money envelopes the week of November 1st.

That way you have plenty of time to shop around, get the best deals, and be the first one with wrapped presents.

Let’s talk about Christmas money envelopes… They are the perfect place to put your cash so you have money saved when the holiday comes. No paying on credit cards and having the January debt hangover.

If you prefer an online option, then use a savings builder account.

We want a debt free holiday season!

Even a smaller holiday that you can afford is better than a huge holiday that you can’t afford. Period.

Please note… Just because you may finish your Christmas shopping early, doesn’t mean it is a free pass to keep spending on those last minute items. That will wreck every Christmas budget.

Download the Christmas Budget Tracker and Gift Planner now.

Celebrate a debt free Christmas

It’s that time of the year again. The Christmas budget is looming and you’re scrambling to find a way to pay for it, or at least limit how much it will cost.

Christmas is a time of giving, family fellowship, and memories.

Christmas is not an unexpected expense.

You don’t want to be stressed or worry about how you are going to pay for it.

Debt Free Christmas tips: Plan ahead and use these money saving tips.

How to have a Debt Free Christmas

Christmas is financial stress and debt, but there are ways to plan for it so that you can have a debt-free Christmas. By saving up now, you will be able to afford the things you want without having to worry about repaying loans in January.

You need these debt-free holiday tips in your life! This is exactly how to enjoy Christmas with no money – specifically NO DEBT.

A debt free Christmas!

Also, once you enjoy living a debt free Christmas, you have learned many of the millionaire habits that will help you all year round.

1. Save Up Money Early

The sooner you start saving for Christmas, the better off you will be when the holiday gets closer.

As with any of our money saving challenges, it takes a little discipline to set money aside for a specific purpose and only use it for that purpose.

Shortly, we will go into detail on how much money to save based on your budget for Christmas.

In our household, we have a sinking fund that each month we add a pre-determined amount towards. It is a lean $50 per month because we prefer a minimalist home and choose experiences over gifts.

2. Implement the 3 Gift Rule

This is the best way to make a minimalist Christmas a possibility by limiting the number of gifts each person gets – especially the kids.

Let’s be honest… so times, it is hard to limit ourselves to only buying a few items.

With the 3 gift rule at Christmas, you are able to stay with your Christmas budget. Plus you will be able to buy high-quality gifts instead of purchasing a bunch of small gifts (to make it seem like you are making Christmas gift-giving bigger and better).

For our household, our 3 gift rules follow this:

- Something to wear

- Something to read

- And don’t forget the fun!

3. Plan Ahead

There are two ways to plan ahead.

First, use our Christmas Budget template to help you decide how much you need to spend and how much you can spend. This will help you to plan in advance the best gifts for your loved ones.

Second, to shop off-season or on clearance. Our perfect example was our oldest needed new snowpants, so I bought them in June for the upcoming winter. I paid pennies compared to the retail price and had an awesome much-wanted present.

By planning ahead, it will also take off much of the stress that you are experiencing around the festive holiday parties.

4. Pick Your Traditions

Have you ever considered which traditions are your favorites? Which do you do because they are your traditions even if you don’t enjoy them and they are costly?

One year, I decided to poll my own family on their favorite family traditions. Their top five list were all things that were frugal, didn’t cost much money, or were volunteering to help others.

This is where family politics can become friction between families.

You have to choose what works for you and your family and your budget. (Not theirs!)

5. Be Brave and Say No

Let’s face it. Saying no is hard and sometimes isn’t fun.

But, you desire a debt free Christmas more than anything else this year.

Your personal financial future is more important than spending money you don’t have.

Quick example: you are invited to 5 parties with family and/or co-workers. Each party has a $20 gift limit for each person attending. So, you are dropping $200 as a couple on parties that aren’t your first priority.

It is okay to opt-out of gift exchanges. Be clear with your reasons and tame their expectations of you.

Make it is time to find a community that shares some of the same money values as you!

Christmas Budget Challenge for a Debt Free Christmas

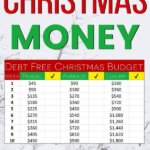

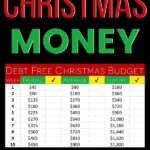

All of the Christmas Budget Challenges will be based on the average Christmas budget each year. (That number from above is based on average spending.) Just remember that number is a collective of gifts, food, decorations, and any miscellaneous holiday items.

Because every family and their personal finance situation is unique, we will break this Christmas Budget challenge up into various spending levels.

You choose which will work best for your family.

Related Resource: 8 Simple Tips to Stay on Budget at Christmas

Let’s discuss how these numbers we decided on for the Christmas Budget Challenge. First, the average family spent $900 on Christmas in 2019, according to Statista. Regardless of whether you think that number is jaw-dropping high or way too low. That was the average amount spent. Those are the statistics.

So, for this challenge to have a debt free Christmas, we are going to break that into three different levels.

Christmas Budget Challenges Levels:

- Average Christmas Budget – $900

- Frugal Christmas Budget – $450

- Luxury Christmas Budget – $1,800

Just a side note…The average spending of $900 at Christmas includes amounts put on credit cards that weren’t able to be fully paid off.

The goal is to save $900 by the week of November 1st. (Don’t worry about counting weeks. The key dates and weeks are listed below.)

That means saving money for Christmas weekly.

This challenge is about having a debt-free Christmas and holiday season.

Don’t think it is possible to have a fabulous holiday season without debt?

Let me tell you… IT IS POSSIBLE!

We have done it each and every year. There is no post-hangover stress or guilt on how much was spent.

Also, makes sure to check the end of the post for the dates for 2020!

Average Christmas Budget – $900

For the first challenge, we are going to be average. Plain, old average. Nothing fancy here. Also, we are assuming the average spending is the same as the average Christmas budget.

We are making the assumption that you plan to spend the average amount as each American family did in 2017.

| Average Plan | Weekly Amount to Save |

| 44 Weeks | $20 |

| 30 Weeks | $30 |

| 23 Weeks | $40 |

| 18 Weeks | $50 |

| 15 Weeks | $60 |

| 9 Weeks | $100 |

Frugal Christmas Budget – $450

Next, the frugal Christmas budget is half of the average amount spent on the holidays. A fabulous Christmas put together for under $450. Personally, we have always limited the number of gifts.

Think outside the (Amazon) box!

Or take on a frugal lifestyle or thrifty lifestyle.

Simplicity is key.

| Frugal Budget | Weekly Amount to Save |

| 44 Weeks | $10 |

| 30 Weeks | $15 |

| 23 Weeks | $20 |

| 18 Weeks | $25 |

| 15 Weeks | $30 |

| 9 Weeks | $50 |

Luxury Christmas Budget – $1,800

Lastly, the luxury Christmas budget is for someone who has the capability to spend more and wants to make sure it is done without debt. By saving in advance, there are so many more options available when the holidays roll around.

You plan to save $1,800 for the holiday season.

| Luxury Plan | Weekly Amount to Save |

| 44 Weeks | $40 |

| 30 Weeks | $60 |

| 23 Weeks | $80 |

| 18 Weeks | $100 |

| 15 Weeks | $120 |

| 9 Weeks | $200 |

Key Dates:

Based on when you are reading this post will determine how much to start saving by date.

Don’t just pin this post later… be prepared!!

52 Week Savings Plan: November 1st

40 Week Savings Plan: January 25th

30 Week Savings Plan: April 5th

23 Week Savings Plan: May 24th

18 Week Savings Plan: June 28th

15 Week Savings Plan: July 19th

9 Week Savings Plan: August 30th

Download the Christmas Budget Tracker and Gift Planner now.

Where to Save Christmas Money

Now, it is one thing to say, “I’m going to start saving money for Christmas this year.”

It is completely different to actually act on it.

The BIG recommendation is to get it outside your temptation to spend!!

There are two options on where to save your Christmas budget money.

Savings Option 1 –

The first option is an online account.

Personally, this is my favorite. Simple reason on why. It is harder to access the money (it takes 2-3 days for the money to be transferred back to your local bank account). Plus, it is simple to set up an automatic transfer and forget. Then, money is set aside in a separate account until you need the funds.

Every month, we add the same amount to our sinking fund.

Savings Option 2 –

The second option is to use a cash envelope.

This one comes with the temptation to dive into the money set aside for a debt free Christmas. Personally, I think the prettier the envelope, the likelihood to actually use it goes up, too.

Check out the list of Best Cash Envelopes. Pick up your Christmas money envelope now!

Large family: How to have a debt-free Christmas

In order to avoid a debt-free Christmas, you need to start the year by saving your first paycheck. The rest of the money from that point on went towards Christmas expenses and was budgeted for that holiday.

The key is you cannot spend money set aside for this purpose.

By doing this, you are able to have an exciting Christmas without any debts.

Still, stressed about giving the best gifts for your large family? Here are great gift ideas that are affordable and thoughtful.

- Cheap Christmas Gifts: Best Presents that Don’t Look Inexpensive

- Overcome Gift Regret: Experience Gift Ideas That Do Not Go To Waste

- The Most Epic Gift Ideas for Kids Under $10

Enjoy These Debt Free Holiday Tips?

That is a bunch of simple and easy tips to make sure you learn how to have a debt free Christmas!

Are you up for the challenge? Make this year your first debt-free holiday season.

Start saving now in order to have a debt free Christmas.

And enjoy a stress-free holiday!

More Christmas Resources for you!

- Savvy Ways to Spend Less at Christmas & Give Real Presents

- How to Spend ZERO at Christmas in a Materialistic Society

- Awesome Gift Ideas When you’re Broke

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.