30 Day Money Challenge: How to Make Your Money Work For You

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here.

Welcome to the 30 Day Money Challenge!

Today, you will learn how to make your money work for you. You don’t have to be a millionaire before knowing these things, but it’s important for everyone who wants financial stability.

Remember these keywords: saving and investing? This is where they come into play for long term success.

It’s not too late to make the right financial decisions.

But, finances are complicated and intimidating for most people so it can be hard to get started.

The 30 Day Money Challenge is here to help with that.

This 30 day financial challenge will help you create a strategy that can save, spend less, and make more by the end of this month!

Are you ready to dig into this month-long money challenge?

What is the 30 Day Money Challenge?

A money challenge is a plan for how to make your finances work better.

It can be as simple as spending less or eating out less, or something more complicated like saving up for retirement or buying a house.

During this month’s timeframe, you will dig into all areas of your finances to make sure you are on track to reach your money goals.

If you do not have financial goals, then we will make sure you do at the end of this money challenge.

I’ve seen a lot of spending challenges out there that are basically just a saving money chart telling you how much money to save each day to save $1000 or $500 in one month, but they don’t tell you how to save the money. That is where the rubber meets the road and this challenge will motivate you to improve your money habits.

Overall, you will learn more about your finances than you did previously.

Why a Money Challenge is Important

A 30 day challenge is a great way to get yourself motivated and focused on saving money and improving your money management.

The goal is not enough, you need the why behind it in order to see your savings grow.

This can be as simple as:

– Setting up a direct deposit from your paycheck to an account you control and only spending what’s in that account.

– Spending less on impulse buys.

– Cutting back on luxury items to save money.

– Living more in cash and less in credit card debt.

You can also take knowledge in knowing the number of our readers who have taken the challenge to improve their money management skills.

3 Steps to Start the Money Challenge

The 30 Day Money Challenge is a simple process that starts with 3 steps.

Your reward for participating in the challenge is pretty appealing, but the process can be hard for some.

So, know these steps before you start the challenge.

1. Pick a Time

While there is no good time to start, you need to find a time when you have the highest probability of success.

Starting the money challenge during the holidays will leave you defeated. Maybe starting as a New Year’s Resolution. Or during a quieter time throughout the year.

You need to find the “right” time because you will have to dedicate at least 10-30 minutes per day. However, the longer you put it off, the less likely you are to start.

2. Be Prepared

More than likely, you will be ripping off the band-aid on some old money failures and defeats. This is common.

You have to be mentally prepared to overcome these negative feelings towards money in order to find that breakthrough moment.

3. Accountability

Find someone to keep you accountable during the challenge.

There will be points when you want to accept defeat and run back to your old money ways. It’s great to create a support system for managing money wisely.

If those old money habits didn’t serve you well before, then how will they serve you moving forward.

You need to keep your eye on the prize!

Thirty Days of Money Challenges

A 30-day money challenge is a popular type of personal finance experiment in which participants take a pledge to review their finances and overcome any obstacles that are preventing them from long term financial stability.

The goal is to teach people how quickly they can change the trajectory of their personal finances before they snowball into a serious money problem.

Day 1 – Get Organized

If you don’t have an understanding of how many accounts you have, credit cards you have open, or debt payments that are due, then you must get your personal finances organized.

Start here to learn how to organize personal finances.

Day 2 – Understand your Income

If you do not know how much do I make a year, then you must figure that out first.

It is impossible to manage money if you do not know how much money is coming in.

Also, consider all types of income sources – earned, passive or investment.

Day 3 – Understand your Expenses

Understand where your paycheck is going. When you understand how much of your money is going to things like rent, utilities, and mortgage, you can make better decisions about spending.

This is not the time for “this-is-where-I-hope-my-spending-goes;” this is the true reality of how you spend money.

Day 4 – Pay Yourself First

This is a must for long-term success. Every time you get paid, you need to pay yourself first. Put a percentage of your paycheck into savings each month before anything else is spent on non-essential items.

We suggest starting with at least 5% of your income. Even better, you want to start with 20% of your income.

You must cut your fun spending until you can save money first.

When saving becomes an automatic habit, start investing through high yield accounts like IRAs and 401(K)s.

Day 5 – Automate your Emergency Savings

Set up a transfer to put $50 into your Emergency Fund every time you get paid.

Learn how much you need in your emergency fund. Remember, the goal is never to use your emergency fund, but you always want one – just in case!

Day 6 – Create Money Goals

Figure out what your financial goals are and how much they will cost over time, then come up with a strategy to achieve them.

You need to make a plan to reach your money goals.

If you skip this step, you may be lucky and still reach your goals. But, you can find better prosperity but writing out those money goals and maybe even using a vision board.

Learn how to create smart financial goals.

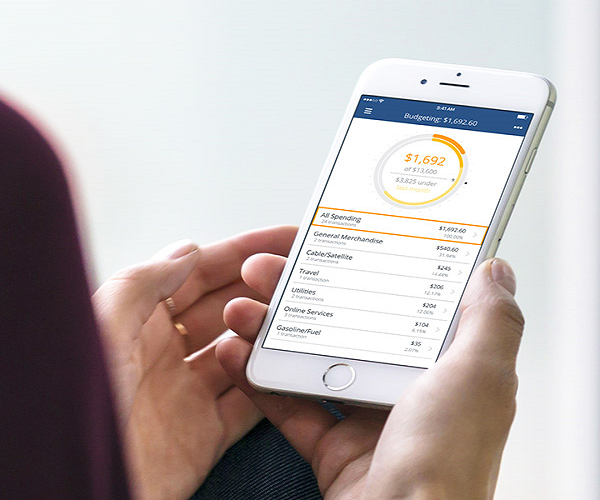

Day 7 – Budget Time

Crazy! I know. Most people would think that creating a budget would need to be first. But, it isn’t. You need to figure out days 1-6 first before you dig into budgeting.

Begin tracking your expenses on paper or online as soon as possible. Here are the best budgeting apps available.

The goal with the budget is to focus on saving first, then your expenses. you must spend less than you make.

Day 8 – Make More Money

Come up with ways to generate more income. Period. You need to make your money work for you.

You need to learn how to make your income work for you by creating streams of income outside of your primary work or “earned” income.

Theoretically, if multiple streams of revenue exist at your full-time job, you can work fewer hours than necessary.

Ways to Make Money:

- 21+ Genius Ways on How to Make Money Fast

- Best Gig Economy Jobs – 8 Quick, Easy Ways to Make Extra Cash

- How Fast Can you Make Money in Stocks? The Real Answer

Day 9 – Enough with Debt

Debt will hold you back. Period.

You need to recognize that paying off your debt is the best thing you can do for your finances. However, during this 30 day financial challenge, it is not the time to focus on paying off debt.

Calculate the total amount of debt (except mortgage).

Put down getting out of debt as one of your money goals and the timeframe to make it happen.

For now, don’t take on more debt, and make sure you’re paying the minimum on your credit card balance.

Day 10 – Understand Investing

Investing is a way of giving your money the opportunity to work for you. In other words, you are using what you have now in order to make more out of what you have in the future.

This is the first step to earning investment income that will fund your lifestyle.

Typically, most people associate investing in the stock market. Many people invest with their 401ks or IRAs. However, you can invest your personal income as well.

What if you could earn a return on that opportunity cost? For example, what if you invested the $10 in your wallet and it grew to be $20?

Learn how to start investing.

Learn to trade stocks with confidence.

Whether you want to:

- Retire in peace without financial anxiety

- Pay your bills without taking on a side hustle

- Quit your 9-5 and do what you love

- Or just make more than your current income....

Making $1,000 every.single.day is NOT a pie-in-the-sky goal.

It’s been done over and over again, and the 30,000 students that Teri has helped to be financially independent and fulfill their financial dreams are my witnesses…

Day 11 – Control Excess Spending

Every time you spend money, it is an opportunity cost to your future self. You are trading away your future self’s money to buy something today.

Is that what you want?

More than likely, no.

Learn how to drastically cut expenses.

Day 12 – Autopay your Bills

Consider setting up an autopay feature for your bills. It can help you avoid late fees and will have a steadier flow of money coming in.

This will help you to make sure you have the cash flow available to meet your expenses.

Day 13 – Avoid Fees

One of the best ways to save money is by avoiding fees.

- If you have a credit card, consider switching to one with no annual fee or an introductory offer that expires after one year.

- Check your bank and credit card statements for any fees you may not be aware of.

If there is a fee, call the company and negotiate to have it removed or reduced.

Day 14 – Automate Retirement Contributions

You should automatically make a certain percentage of your salary go to a 401k or other savings account, and the other percentage goes to your checking account for spending money.

This is something your human resources department can help you set up.

Day 15 – Increase your Retirement Contributions

Now, that you have automated your retirement contribution, you want to increase you much your contribution each year until you are maxed out by IRS limits.

Start to increase your retirement contributions by 1%.

Set a five-year goal to fully max your retirement contributions!

Halfway Point!!

You’re halfway through the 30 day money challenge!

Keep up the good work and keep reaching for your goals.

You’ve made it this far, so just imagine what you’ll be able to do in another month of working hard towards saving more money.

Day 16 – Communication

Don’t think money has to be a taboo topic. In fact, you need to be comfortable talking about money.

The key is to be on the same page with key family members about where money should go. This is something that we struggled with our marriage and had to overcome. Thankfully, we did and we made way more progress than previously.

Day 17: Invest in yourself

I know you’re probably tired of hearing about investing in yourself, but it’s important. Investing means putting money into something that will make more money back. You might not think this applies to you, but it really can! You might not have a big budget for investing in stocks or mutual funds right now, so let’s talk about something you do spend money on every day: you.

You only learn by growing.

Day 18 – Start Reading About Personal FInance

This isn’t something that you do once or twice. Make it a goal to read books on money or personal finances each month.

Importantly, make sure you are reading books, regardless of what aspect they look at money. It is never too late to pick up new tricks or ideas.

Plus learning from others’ money stories is powerful.

- 10 Financially Sound Books on How to Manage Money + Best All Time List

- Best Finance Books for Unparalleled Success with Money

Day 19 – Free Fun

Participating in only free activities for 30 days, and refusing to spend a single penny, we created a guide to make that happen for you.

101+ Things to Do with No Money

After writing that post, we discovered this is one of the best money saving ideas out there. This guide not only teaches you how to save money but also teaches about where you want to spend money and the importance of living a purposeful life.

Day 20 – Review Insurance

You need to make sure you are properly covered with insurance as well as not paying too much money for your policies.

There are all of the types of insurance you need to review:

This is something you should do once a year.

Day 21 – Waste Less Food

You need to learn to save money by wasting less food.

This doesn’t mean you have to make homemade meals every night of the week! The goal is not to throw food away – that is hard earned cash going right down the trash.

Ways to Save Money on Groceries:

- Plan to use leftovers- freeze them if possible.

- Stockpile cheap foods

- Meal planning for the next 30 days or at least week

- Are Meal Plan Subscriptions worth the cost?

Day 22 – Buy Second Hand

Consider second-hand stores and consignment sales as options for buying used items. Thrift stores are also great to save money on clothes and other household items.

The same is true for buying cars, baby equipment, kids clothes, etc. Plus you protect our world.

Day 23 – Save Money

So, this day is all about saving money and I think that it’s the most important one of them all because if you’re not saving your money, then what are you doing with it? You’re throwing it away.

So today, I want to talk about two different types of saving money – physical and mental. The first one is all about physically saving your money. This is the easiest one because it doesn’t require any effort on your part to do so, but it’s also very important as well.

The second type of saving money is mental saving. This is all about saving your money because you know that something better will come along soon and it gives you hope for the future!

So, I think these two types of savings are both really important.

Day 24 – Give Back

This is the time to give back to others, donate money to charities, and put small contributions into charity.

By hoarding money, you are not learning the principles of helping others just like you have been helped along the way.

Day 25 – Renegoite Interest Rates

Right now, we are not starting to pay off debt. We are looking for ways to save on higher interest payments.

Make calls to renegotiate your interest rates on your debt. If the credit card company says no, then look at a zero interest transfer.

Just no more debt.

Day 26 – Avoid Scarity Mindset

You have to believe in yourself that you are capable of achieving great things and that includes success money.

However, we get caught in this trap of hoarding materialistic items in order to make up for the dollars in our bank account or money that was wasted in buying them.

If you don’t believe how poverty mentality overwhelms your life, then read this story of reclaiming your home with decluttering.

Day 27 – Cut Out What you Don’t Need

If you are not using something, sell it or give it away to someone who can use it more than you do!

You’ll save money and make room in your budget for the things that matter.

We learned a lot when we started to own less stuff.

Day 28 – Prepare for a No Spend Challenge

If you have not been able to keep your spending in check, this is an excellent opportunity for you to try out a no spend challenge once this challenge finishes.

A no spend challenge will help you to review your budget and see what areas of spending need more attention in order to increase savings or pay down debt.

Also, it will help you focus on what area are important to spend money.

Day 29 – Reward Yourself

This is the biggest lesson I learned when paying off debt and trying to increase our savings percentage. I became unable to spend money. I would feel guilty about spending money.

That is not the type of life you want. You must be comfortable spending money (especially if you are a thrifty person).

Pick rewards to match your smart financial goals. Keep motivated with those rewards.

Day 30 – Stay on Track

Proper money management does not end just because the end of the 30 day challenge is over. This is a lifelong skill to master and perfect.

Keep focused by not going over budget limits and being honest about where you really stand financially today as opposed to where you want it to be in the future.

You can stay on track if you have a deep desire to continue.

30 Day Money Saving Challenge

This one is just about saving money. Period.

Each day, you save money to reach your goal.

For many people, the 30 day money saving challenge will make sure you are on track with your goals and objectives.

At the minimum, you should be able to save $500 in 30 days. But, you need to decide what you want to save in a month.

The challenge is open to everyone, so this might be the perfect opportunity for you!

What is the 30 Day Money saving Challenge?

The 30 day money saving challenge is saving a set amount of money during the month.

Keep in mind, not everyone will be able to save this much in 30 days and that’s perfectly okay.

You need to make it work with your budget.

Another option for the 30 Day Money Challenge is committing to give up one or more expenses for the whole month. For instance, pick ten things that cost you money and give them up for 30 days.

How to get started with the 30 day savings challenge

The 30 day savings challenge is a simple but effective way to get started saving money.

You can choose any of these methods:

- Take the amount you want to save and divide by 30. That is how much to save daily.

- Determine the amount to save and take that immediately when you are paid.

- It is easy to go in order or skip around depending on what amount you want to save each day.

- Keep change hidden in jars and watch it add up over time, then put the money away every day and see where they rank at the end of the month.

- Give up a certain expense and save that money.

- Try a modified version of the 100 day challenge.

You can find plenty of money saving challenge printable or PDF in our resource library.

Want more easy money saving challenges?

- 20 Simple Money Saving Challenge to Save More in 2022

- 100 Envelope Challenge – Fun $5000 Money Saving Plan

- How to Save $5000 in 6 Months: Quick, Easy & Useful Tips for Saving

- Your 52 Week Money Saving Challenge + Free Printable

- These Monthly Money Saving Challenges You Need to Try

- Can you Beat Your Savings Percentage?

Are you in for this 30 Day Money Reset Challenge?

This is only a 30 day money challenge because it’s a short period of time to gain a win. That is what you need to keep up the motivation as well as have a strong kickstart to your finances.

In order to build wealth through their finances, these are 30 smart moves that require no time on some days.

Don’t lose momentum. If you miss a day, then jump back into the challenge the next day.

The key to success for 2021 is to take control of your finances.

Apps to Save Money

Rakuten: Earn Cash Back at stores you ?

Personally, I love to shop online from the convenience of my own home and have packages delivered to my house. Plus you can get paid to shop online!! The process is super simple.

Just head here to get an Rakuten/Ebates account, click on the retailer you are shopping online, and then complete your checkout process as normal.

Already a Rakuten / Ebtaes member? Make sure you have the Extension Button for automatic savings!

Trim: This website actually saves you money.

Perfect for the person who hates to hassle with canceling subscriptions and checking spending. Trim is a virtual personal assistant that constantly works to save users money.

Trim adds value in such ways as canceling old subscriptions, setting spending alerts, checking how much users spent on ride-sharing apps the previous month, and automatically fighting fees.

Ibotta: Earn Cash Back & Save With In-App Offers

Ibotta can be used for grocery stores, drugstores or online shopping. Once you accrue $20 in your account, you can transfer it to PayPal or venmo or buy gift cards to selected retailers.

Just for signing up, they will give you a bonus when you use use this link. Ibotta rocks at bonus categories and offers. This is where your cash back can really add up fast.

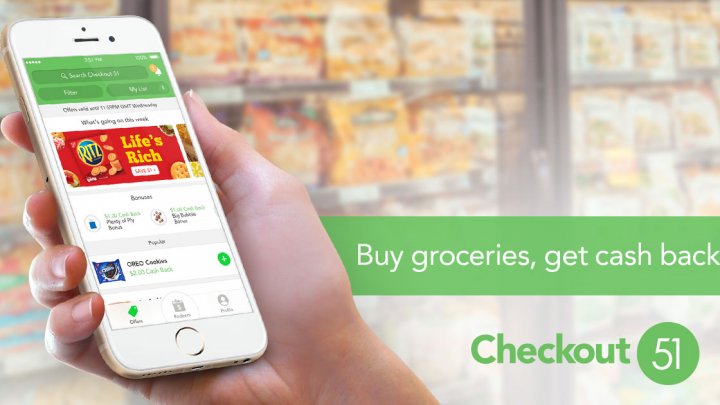

Checkout51: Buy groceries, earn cash back.

Checkout 51 can be used for grocery stores or drugstores. Their offers are valid each week from Thursday-Wednesday. With new offers released each Thursday.

One of my favorite offers is the “Pick your own offer” – it is a selection of 5 fruits of veggies to redeem for extra cents cash back. Once your account balance is over $20, they will mail you a check.

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.